Oil And Gas Sector To Boost Investment In Energy Transition, Despite Weakening Confidence

New research study released by DNV GL exposes that positive outlook for development in the oil as well as gas sector has actually deteriorated for this year. This comes in the middle of unpredictability around the oil cost as well as international financial problems– the leading obstacles to development reported by the sector.

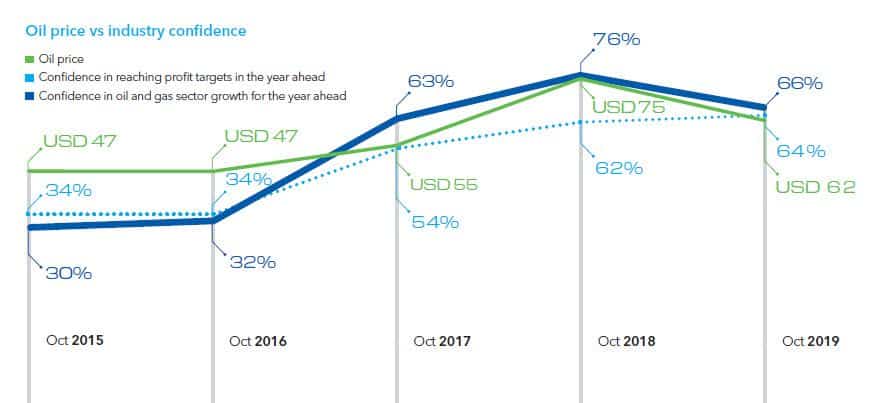

While 2 thirds (66%) of elderly oil as well as gas experts are positive of sector development in 2020, this is down 10 percent factors from the 76% videotaped in 2019– the top of a rise in self-confidence from a reduced of just 32% in 2017.

Under fifty percent (46%) of participants assume that even more big, capital-intensive jobs will certainly be accepted this year contrasted to 2019, below 2 thirds (67%) in 2015.

Image Credits: dnvgl.com

New Directions, Complex Choices: The expectation for the oil as well as gas sector in 2020 is based upon a study of greater than 1,000 elderly oil as well as gas experts as well as comprehensive meetings with sector execs. Now in its 10th year, DNV GL’s research study examines sector belief, self-confidence, as well as top priorities, as well as supplies specialist evaluation of the crucial obstacles as well as possibilities for the year in advance.

Capital might not stream as openly right into big oil as well as gas jobs in 2020, yet business running throughout the sector’s worth chain anticipate to improve financial investment this year in locations that will certainly permit them to build a lasting placement in the power shift. Those reporting that their company is proactively adjusting to a much less carbon-intensive power mix leapt to 60% in 2020 from 44% 2 years back.

While the industry’s development hangs in the equilibrium for 2020, oil as well as gas leaders are positive that they will certainly weather the tornado, making use of hard-earned price effectiveness from the previous 5 years to make a margin.

Image Credits: dnvgl.com

Some 64% anticipate their companies will certainly strike earnings targets this year (mainly constant with 62% in 2019), as well as virtually fifty percent (46%) state their business would certainly still accomplish appropriate revenues if the oil cost were to typical much less than USD50 per barrel. This is a huge percentage, considered that just one of the previous 15 years (2016) saw yearly typical rates under USD50 a barrel.

“While the industry is experiencing persistent uncertainty, growing complexity, and new risks, we also see an industry taking bold decisions, building greater efficiencies and rising to long-term challenges as the world pivots towards a lower carbon energy future,” claimed Liv A. Hovem, Chief Executive Officer, DNV GL– Oil & &Gas “Our research shows that the oil and gas industry has placed decarbonization at the centre of its agenda, and it will remain a priority despite uncertainty from volatile market conditions and stalling expectations for industry growth in 2020.”

DNV GL’s research study reveals that even more oil as well as gas business than ever before are doing something about it to decarbonize, with the percentage anticipating to raise or keep financial investment in decarbonization climbing greatly from 54% to 71% in simply one year. Significantly, they are seeking several paths, consisting of branching out right into renewable resource, decarbonizing oil as well as gas manufacturing, as well as raising financial investment in decarbonized gas such as hydrogen (created from electrolysis as well as renewables, or from gas integrated with carbon capture as well as storage space).

Click To Enlarge|Image Credits: dnvgl.com

Oil as well as gas business’ strategies to raise financial investment in renewable resource resources is up from 34% in 2019 to 44% in 2020. Offshore wind leads this initiative, with 63% of organisations anticipating to raise their financial investment, up from 40% in 2015.

The sector’s purposes to raise financial investment in the hydrogen economic situation has actually greater than increased in a year. 42% of participants claimed they would certainly improve costs around for 2020, up from 20% for 2019.

Oil as well as gas will certainly be required in the power mix for years to find– projection to make up 46% of the globe’s power mix in 2050 compared to 54% today, according to DNV GL’s 2019Energy Transition Outlook This projection overshoots the 1.5 ° C target laid out in the Paris Agreement in 2028.

“More and more people in our sector are realizing that we cannot sit and wait for the perfect solution to jump to a completely decarbonized energy system. The industry will emit too much CO2 in the meantime, so we have to start working on decarbonizing the oil and gas sector with the technologies we have already in order to meet national and international climate goals,” Hovem claimed.

Cost performance will certainly be the leading concern for virtually one third of elderly oil as well as gas experts’ companies (32%), up from 21% a year back. Eight out of 10 (81%) participants think the sector requires to establish brand-new operating designs to accomplish more price effectiveness, identifying the reality that much of the much more apparent cost-cutting has actually currently occurred adhering to the 2014 oil cost collision.

Almost all participants (92%) anticipate their company to raise or keep costs on digitalization in 2020. Senior oil as well as gas experts that think their company is a sector leader in digitalization are much more positive in their company’s potential customers, even more resistant to volatility in the oil cost, as well as are seeking higher financial investment in the power shift.

Download a free duplicate of the sector expectation record

New Directions, Complex Choices: The outlook for the oil and gas industry in 2020