Car Carrier Asset Prices Move Into The Fast Lane: Vessels Worth

Asset Price Inflation: Newbuild invest for Vehicle Carriers (LCTCs/ PCTCs/ PCCs) wrecked past $3.2 billion recently, adhering to large quantity orders from Eastern Pacific and alsoZodiac An unbelievable quantity of cash for a particular niche field, surpassing the previous 6 years overall incorporated. If we consist of alternatives, a massive $4.4 billion has actually been concurred year to day. Japanese shipyards have actually elevated tolls to $100 million for double gas LNG 7000 CEUs, up by an astonishing $10 million contrasted to in 2014.

Chinese lawns have actually complied with however keep a healthy and balanced price cut pricing quote $88 million for a comparable specification. Rapid steel cost rising cost of living incorporated with an article Covid supply vacuum cleaner, have actually escalated newbuild costs adhering to a baron duration of reduced orders extending back to 2016. All 40 Vehicle Carriers validated this year (56 consisting of alternatives) are double gas LNG powered, creating a premier PCTC/LCTC possession course for an energized automobile market.

Secondhand list prices blew up in Q2 as drivers fought to safeguard tonnage. Twenty 2 years of age ASIAN KING (6400 CEU, Dec 1998, Hyundai Heavy) cost an eye sprinkling $23 million inJune An exceptional cost when you take into consideration the PERSEUS FREEDOM (6,400 CEU, Jan 1999, Imabari) of extremely comparable age and also dimension cost $13.8 million simply 2 months previously. Such cost rising cost of living has actually unavoidably brought about broach an incredibly cycle buoyed by a warm charter market. Firmed prices of $30,000 p/day for midsized 5000 CEUs, and also $35,000 p/day for 6500 CEUs are gaining (EBITDA) proprietors 8 to 10 million per year after OPEX. It’s a vendor’s market, caveat emptor.

Image Credits: vesselsvalue.com

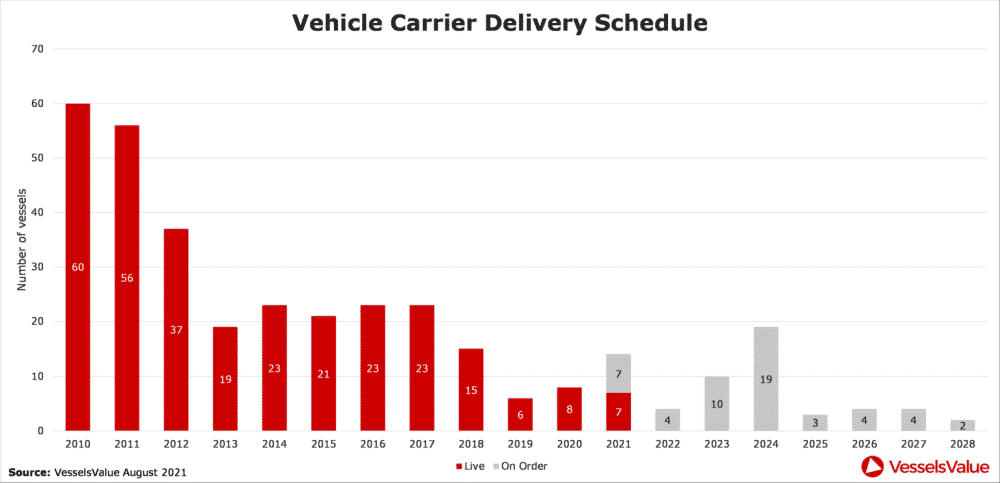

Low Deliveries approximately 2024

Current market problems can last right into 2024 based upon a hidden absence of tonnage. Looking back to 2010, a healthy and balanced variety of distribution struck the water at 8% of the fleet leaving out systems much less than 1000 CEU. However, by 2013 shipments had greater than halved securing around the reduced 20 vessel mark via to 2018. Before decreasing right into solitary numbers from 2019 beforeCovid The existing orderbook at 5% tasks 4 shipments in 2022, 10 in 2023, and also 19 in 2024 (Figure 1).

These are reduced numbers for the following number of years and also 2022 looks specifically threatening with Covid remaining to evaluate on supply. The structures for brief supply can be stemmed back to 2016 when orders balanced simply 5 vessels each year up until 2021. Owners have actually responded this year with a commendable number taking place a significant buying spree, however they are paying a high cost for leaving it late.

Click to Enlarge|Figure 1: Vehicle Carrier Delivery Schedule (online and also on order)

Bev Demand Growth

Battery Electric Vehicle (BEV) need is speeding up throughout the established globe and also is most likely to have a favorable internet influence on international freight miles forVehicle Carriers Biden’s current exec order promoting fifty percent of all United States automobile sales to be battery electrical by 2030 was seen by several as a market specifying minute. Canada went an action better mandating 100% conformity for all light cars and also vehicles by 2035, assuring $1 billion of campaigns to urge use up.

Similar plans have actually been released somewhere else in Europe consisting of right here in the UK where absolutely no exhaust automobile sales have actually raised by 73% this year. BEVs consisting of crossbreeds currently hold a 14% share (7% in 2020) of all light car sales inEurope Back in March, Volkswagen forecasted 70% of its European car sales will certainly be battery electrical by 2030. Latest projections from automobile experts identify a 40% share internationally by 2030 versus 7% today (3% in 2020). Whatever means you take a look at it, BEV need will certainly remain to enhance this years and also right into the following. We must anticipate comparable percent leaps for electrical systems delivered on Vehicle Carriers.

BEV profession development has the possible to considerably influence trip revenues for a significant share of the existing Car Carrying fleet, since electrical vehicles evaluate 20% greater than traditional diesel/petrol comparable designs. This indicates much less vehicles can be packed onboard a common PCTC whenever there is a high quantity of BEV reservations, since the ordinary thickness per automobile system has actually raised, consuming right into deadweight ability. Essentially, PCTCs with reduced deck staminas will certainly be deprived as BEVs begin to control with time, decreasing the gaining chance of the possession. Whilst modern-day PCTCs and also LCTCs geared up with more powerful decks from 0.3 t/m2 upwards, will certainly hold much more worth because of the greater revenues chance stemmed from the much better stowage element.

Vessels trading to utilized automobile markets such as Africa are much less revealed to this headwind. However, this is currently a concern for ships operating significant East West lining courses providing completed brand-new vehicles to European and also North American markets with long-term implications for fleet advancement. Logically, need for more powerful outdoor decked ships will certainly enhance. Cargo miles will certainly additionally obtain a credit report in the brief to midterm, as even more ability is needed to bring the exact same quantity of seaborne vehicles around the globe. This is thinking international need stays reasonably fixed, whilst BEVs remain to take share in sales and also exports.

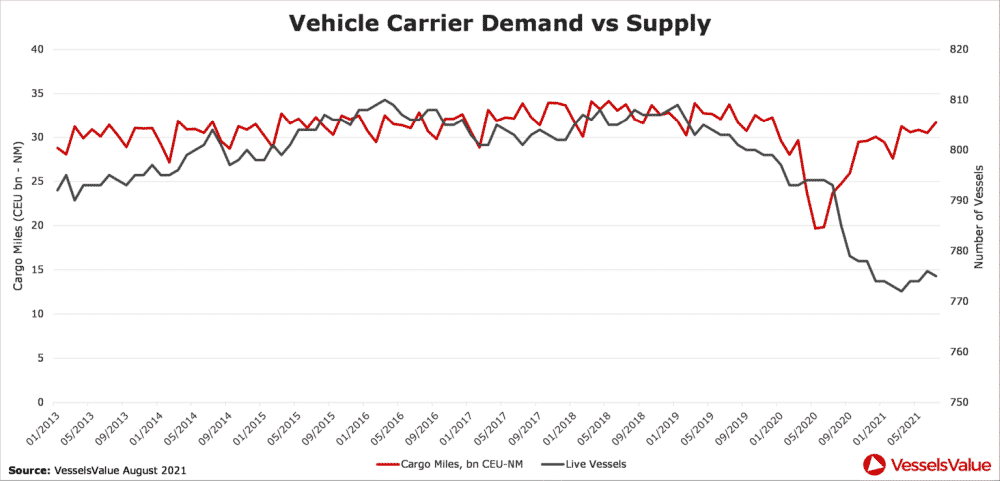

Toyota has actually been required to reduce international manufacturing by 40% for September due to the chip dip dilemma, bring about a depression in their share cost which infected Nissan and alsoHonda United States retail sales numbers additionally transformed unfavorable in July considering on belief. It’s feasible we will certainly see some conditioning in freight mile need in Q4. However, the basic inequality driven by reduced supply versus recuperated need is not likely to alter in the midterm (Figure 2).

Supply chains will certainly remain to be choked by the quit beginning nature of the pandemic, limited by sluggish incurable procedures and also continuous vessel hold-ups at busy ports as the brand-new typical, minimizing lining regularity and also as a result the general provided ability readily available for sea merchants. China’s stringent plan on Covid by closure as seen at Yantian and also Ningbo ports this year, educated us that durable goods stay extremely conscious functional quits. Until the globe is immunized, more disturbance is to be anticipated.

Looking a little more right into 2022, the supply need inequality can broaden if the integrated circuit scarcity reduces whilst Covid sticks around, allowing even more BEVs to be completed and also exported throughout seas. Which is possible keeping in mind Hyundai appearing last month stating the most awful lags us. A firming of pent up freight need from automobile car dealerships wanting to renew diminished supplies unfinished in addition to their normal regular monthly seaborne import orders, would certainly produce a compounding impact of development on development. That would truly inflate prices and also possession worths.

Click to Enlarge|Figure 2: Vehicle Carrier Demand vs Supply vessel matter (Cargo Miles CEU bn– NM)

Values Spiking, Final Thoughts

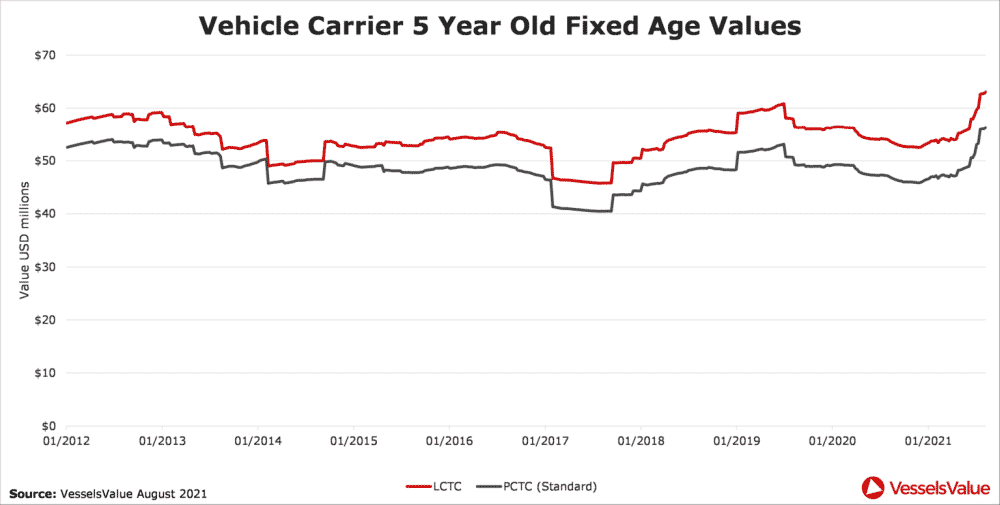

Values for a conventional 5YO 6500 PCTC have actually increased by 19% given that April, tipping previous $56 million from July based on Vessels Worth’s Fixed Aged Values information (Figure 3). The VIKING OCCUPATION (6700 CEU, Jan 2017, Jinling) cost USD 45 mil on April 23rd (VV at $47.2 million day prior to sale, SS due Jan 2022). This appeared a high cost at the time, not currently.

Figure 3: Vehicle Carrier 5 Year Old Fixed Age Values (USD Millions)

An ordinary variety of sales have actually finished this year since proprietors hesitate to allow go of tonnage in a supply deprived market, expecting greater worths. Some drivers have actually hired out their possessed PCTCs lured by rewarding, much better revenues from a thriving price setting. Values for 10YO and also 20YO PCTCs have actually soared adhering to some remarkably high marketed costs paid by customers with couple of options. Car Carrying properties are valuable, however following year can obtain hotter.

Vessels Worth information since end August 2021.