Low Sulphur Fuel Sales Skyrocket at World’s Leading Bunkering Hub

Photo: joyfull/ Shutterstock

The sale of reduced sulphur gas escalated at the globe’s biggest bunkering center of Singapore in advance of the IMO 2020 Sulphur Cap due date, BIMCO claimed in its initial analysis of the button.

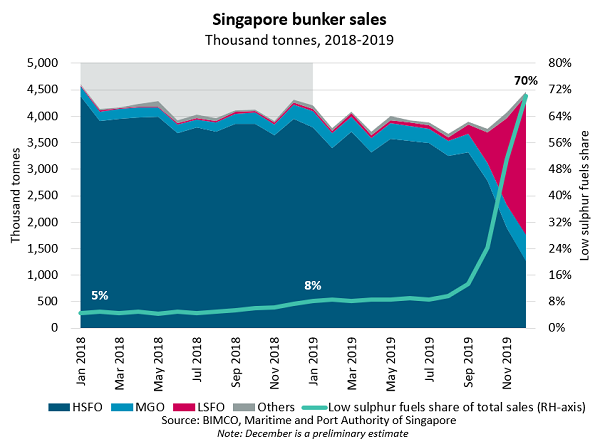

According to BIMCO, initial price quotes put together by the Maritime and also Port Authority of Singapore show that an overall of 4.4 million tonnes of shelter gas were marketed in December 2019, with IMO-compliant reduced sulphur gas, such as LSFO and also MGO LS, comprising the bulk sales with 3.1 million tonnes marketed, standing for around 70%.

This contrasts to the begin of 2019 when reduced sulphur gas represented simply 8% of Singapore’s complete shelter gas sales. The number additionally stands for 51 percent month-on-month boost in December, revealing shipowners’ “last minute” shift to utilizing the brand-new gas, according to BIMCO.

LFSO composed the mass of reduced sulphur gas sales, amounting to 2.6 million tonnes standing for 59% of complete reduced sulphur gas sales in December.

Meanwhile, the sale of high-sulphur gas oil went down enormously in an issue of months as the sector transitioned to the brand-new laws, being up to simply 1.27 million tonnes in December for 28% market share. BIMCO kept in mind that ongoing need for HFSO is being driven mostly by ships fitted with exhaust gas cleansing systems, also known as scrubbers.

“The shipping industry has been riddled with market uncertainty in recent months, but the bunker sales in the port of Singapore provide one of the first readings as to how the industry has transitioned into compliance with the IMO2020 regulation. We have now surpassed the first wave of IMO2020 and hopefully the accompanying market uncertainty will diminish as we proceed into 2020,” claims BIMCO’s Chief Shipping Analyst, Peter Sand.

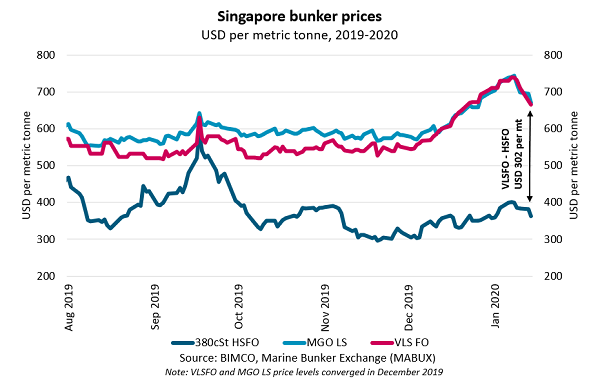

Looking at the low-sulphur to high-sulphur gas spread, BIMCO claimed the close to document damaging spread in between the gas seen around the IMO due date has actually tightened a little in the initial 2 weeks of the year potentially suggesting that the worldwide fleet has “bunkered sufficiently” for the first stage of the shift.

Nevertheless, the increasing expense of reduced sulphur gas will certainly be an obstacle for shipowners that did not go the scrubber course, thinking about gas oil expenses efficiently increased over night.

“Almost from one day to another, IMO2020 has resulted in a massive increase in bunkering costs for shipowners and operators, costs which for many companies cannot be sustained for a prolonged period. Shipowners are trying to pass on the additional costs of bunkering to customers, but if the underlying supply and demand fundamentals are not balanced, their efforts may prove futile,” claims Peter Sand.