As UNITED STATE Oil Grows, So Does Its Influence on Global Prices

By Alex Longley and also Sheela Tobben (Bloomberg)–For a look right into what the international oil rate could appear like someday, an excellent area to look is the Dutch port of Rotterdam.

There, at a crucial center for Europe’s oil trading and also refining, unrefined imported from the united state is establishing the rate for an ambitious standard for North Sea oil one-third of the moment, according to Argus Media.

That a united state quality is also taken into consideration for addition in a referral rate for majority the globe’s unrefined emphasizes the revolutionary change in international oil markets over the previous years.

America’s shale boom has actually driven the country’s manufacturing up by concerning a 3rd because 2016, with exports rising to Europe along withAsia At the very same time, North Sea outcome has actually plateaued, requiring rates companies such as S&P Global Platts, which establishes the area’s major standard, and also Argus to expand the variety of qualities underpinning their standards.

“The U.S. is an important new competitor” in regards to establishing rates, stated Olivier Jakob, the handling supervisor of Petromatrix GmbH, a Zug, Switzerland- based scientist. “It is something that is pretty new, so for now you stay with the same way that you were pricing the North Sea, but there’s going to be increased competition.”

Traders and also experts have lengthy suggested that the international oil market’s major recommendation rate, which is based upon freights filled in the North Sea, requires an overhaul to show weak local manufacturing. But there are no indications that Platts’ Dated Brent will deliver its leading setting as a benchmark whenever quickly. Multiple oil-producing nations all over the world web link the rate of their barrels to Platts’ analysis, while unrefined futures are inevitably connected to it also.

Platts stated late in 2014 that it would certainly think about consisting of brand-new qualities, consisting of WTI, in its Dated Brent analysis. Last month, after an examination, it stated that there were no instant strategies to do so, rather taking into consideration the worth of North Sea unrefined provided to Rotterdam.

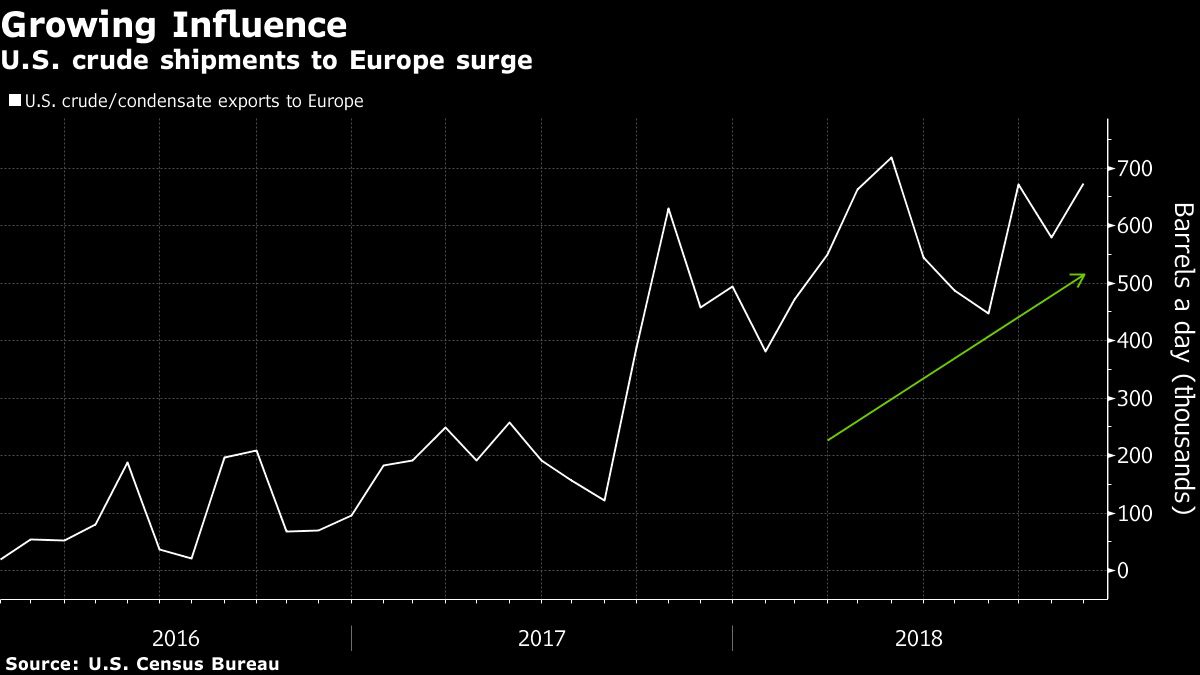

There’s little uncertainty the impact of American crude is expanding in the area. Shipments to Europe balanced 560,000 barrels a day in 2014, up from concerning 100,000 in 2016, according to united state Census Bureau information. The 5 North Sea qualities that compose the Dated Brent standard created 960,000 barrels a day usually in 2018.

Global Benchmark

Some investors– specifically those with united state barrels– formerly stated they would certainly prefer an international standard that integrated both WTI and alsoBrent Others, conscious that the 660,000 barrel-a-day Johan Sverdrup area in the North Sea is because of create its very first oil later on this year, oppose such a widening.

European manufacturers will certainly need to encounter enhanced competitors from the united state in any case. Occidental Petroleum Corp., among the biggest drillers in the Permian, is currently exporting 10 percent of its manufacturing, its chief executive officer stated recently. With united state’s manufacturing projection at 12.3 million barrels a day this year, it will certainly much overshadow supply from the similarity the U.K. and also Norway.

In an additional indicator of just how united state barrels are influencing just how oil obtains valued, Enterprise Products Partners LP will certainly organize its 2nd united state crude export public auction in April utilizing a system run by CMEGroup Inc The initially was held early this month, offering light pleasant crude to Glencore Plc from Enterprise’s Houston oil terminal.

The U.K. manufacturing sank from concerning 3 million barrels a day of oil in the late 1990s to 1.1 million in 2014, according to the U.K. Oil and alsoGas Authority Norway pumped 1.5 million barrels a day in 2014, compared to 1.7 million in 2011. That dynamic will just make united state crude more crucial– as a resource of supply and also as a method to establish rates.

“WTI is already being factored into the price of North Sea and West African crudes,” claims Sandy Fielden, expert at Morningstar Inc., based in Austin,Texas “As long as there is too much WTI in the U.S., it will get demand from overseas.”

© 2019 Bloomberg L.P