Supertankers Sailing from UNITED STATE to Cut Time, Money as well as Traders

By Serene Cheong (Bloomberg)– Big oil vessels cruising from the united state are readied to bring along some advantages for refiners in Asia while permitting them to avoid investors offering the globe’s leading crude-buying area.

The brand-new alternative to lots oil right into large unrefined service providers at the united state Gulf Coast incurable run by the Louisiana Offshore Oil Port, or loophole, will certainly lower prices as well as waiting time for Asian customers of American products, according to shipbroking company Braemar ACM. It likewise lowers the requirement to count on investors to handle difficult vessel logistics that often entail several smaller sized vessels moving crude right into a larger watercraft.

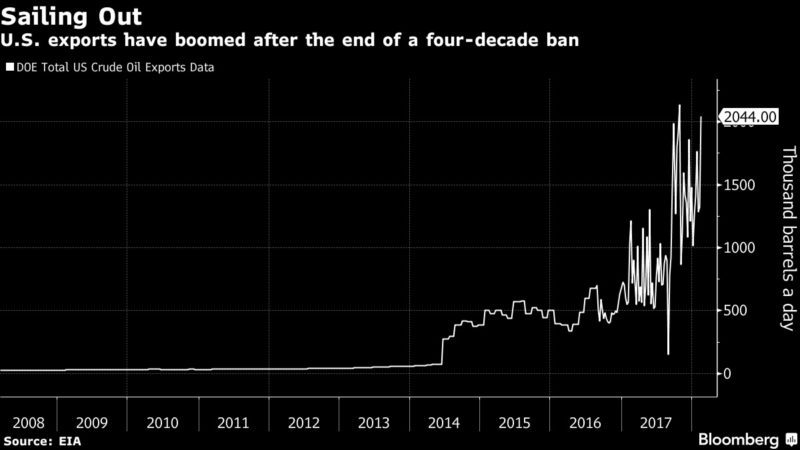

The initially totally stuffed supertanker cruised from America previously this month, leaving for China from loophole’s deep-water center– the just one in the united state with the ability of filling up a few of the sector’s most significant vessels. In the wake of an end to a 4 decade-ban on exports and also as OPEC suppressed result to remove an excess, a stream of deliveries from the Gulf Coast headed eastern as significant customers such as India as well as South Korea looked further for products.

Looking to Export, America’s Busiest Oil Terminal Tests Loading of First Supertanker

The capability to export by means of the huge ships might confirm a strike to investors as well as their function as intermediaries each time of enhancing effectiveness as well as enhanced market openness. Until currently, Asian refiners have actually primarily bought united state oil that’s marketed to them on a supplied basis by investors, that would certainly resource the freights, fill them onto smaller sized vessels as well as schedule out-at-sea transfers to supertankers that can not get in the superficial berths of a lot of American terminals.

While it uses expense as well as time benefits, “the bigger win for Asian buyers, however, may be the ability for buyers to cut out the trader’s margin by using LOOP,” Anoop Singh, an expert at Braemar ACM, created in a tanker-market record. “This is because most buyers of U.S. crude in Asia take delivered barrels from traders, which have traditionally been better at managing” the delivery logistics, he stated.

To make certain, investors are not likely to shed all their company. Braemar ACM anticipates loophole deliveries to typical just 1 to 2 VLCCs a month, still leaving lots of various other chances for crude to be exported from smaller sized terminals.

Cost financial savings

Loading concerning 2 million barrels of oil right into a VLCC at loophole might reduce around $300,000 in straight prices– or 20 cents per barrel– compared to the present procedure of hiring a number of Aframax vessels to fill barrels from inland berths as well as ship-to-ship transfers to bigger vessels, according to Braemar ACM. Additionally, packing at the terminal likewise lowers the timeline to someday from the 4 days that’s presently required.

The loophole’s About-Face on Oil Imports Cues UNITED STATE Drive Into Global Market

To sweeten the bargain, loophole is likewise going to supply storage area in its containers at affordable prices to allow merchants to collect sufficient quantities to fill up a complete VLCC. It has storage space ability of 71 million barrels, almost as big as the 78 million barrels at united state oil center in Cushing, Oklahoma, Singh stated in the record.

Based on the shipbroker’s quotes, united state exports have actually balanced 1.4 million barrels a day this year, increasing from 2017 when 1 million barrels a day were delivered from its ports. About 9 VLCCs a month left throughout the 4th quarter of in 2014, with even more crude bound for the eastern of Suez market. Those big ships were packed utilizing supply at first transported by smaller sized vessels.

Oil Quality

The products exported by means of loophole might be concentrated on crude of supposed medium-sour top quality, Singh created in theFeb 23 note. That’s because of route pipes connecting one of the most plentiful Gulf of Mexico areas such as Mars, Poseidon as well as Thunderhorse to loophole’s storage space terminal, generating greater than 500,000 barrels a day of manufacturing. These are various in features to light-sweet oil from shale areas, products where have actually pressed American result to a document.

UNITED STATE Oil Export Boom Putting Infrastructure to the Test

“LOOP’s pipeline capacity has limited ability to bring in light-sweet crudes,” Singh stated. “Production of these crudes from Permian, Eagle Ford and Bakken regions is growing fast. But these grades are primarily being exported from ports in Texas because of better pipeline connectivity.”

West Texas Intermediate crude, the united state standard, traded at $63.54 a barrel at 5:22 a.m. inNew York Prices are up around 5 percent this year.

© 2018 Bloomberg L.P