China- UNITED STATE Box Rates Sail Past $20,000

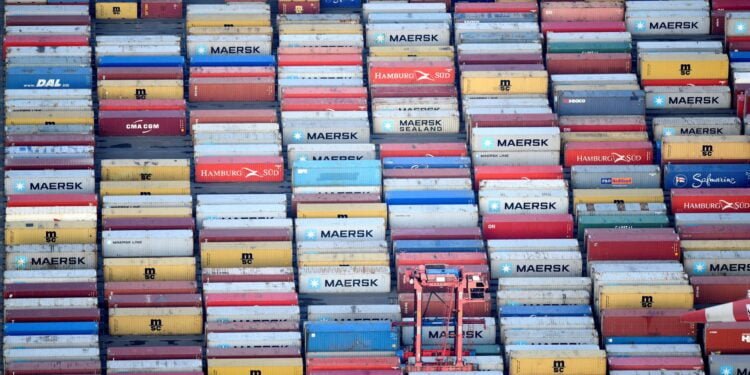

By Roslan Khasawneh and also Muyu Xu (Reuters) Container delivery prices from China to the United States have actually scaled fresh highs over $20,000 per 40-foot box as climbing seller orders in advance of the peak united state purchasing period include stress to international supply chains.

The velocity in Delta- alternative COVID-19 break outs in a number of regions has actually slowed down international container turn-around prices.

Typhoons off China’s active southerly shore in late July and also today have actually likewise added to the dilemma clutching the globe’s crucial approach for relocating whatever from health club tools and also furnishings to vehicle components and also electronic devices.

“These factors have turned global container shipping into a highly disrupted, under-supplied seller’s market, in which shipping companies can charge four to ten times the normal price to move cargoes,” Philip Damas, Managing Director at maritime working as a consultant company Drewry, claimed.

“We have not seen this in shipping for more than 30 years,” he claimed, including he anticipated the “extreme rates” to last till Chinese New Year in 2022.

CONTAINER PRICE WALKS

The area rate per container on the China- UNITED STATE East shore path– among the globe’s busiest container lanes– has actually climbed up over 500% from a year ago to $20,804 today, freight-tracking company Freightos claimed. That contrasts to simply under $11,000 on July 27.

The price from China to the united state west shore is a little listed below $20,000, while the most up to date China-Europe price is almost $14,000, Freightos’ information programs.

Ding Li, head of state of China’s port organization, informed Reuters the spike complied with a rebound in COVID-19 situations in various other nations, which has actually slowed down turn over at some significant international ports to around 7-8 days.

The rising container prices have actually fed via to greater charter prices for container vessels, which has actually compelled delivery companies to focus on solution on one of the most financially rewarding courses.

“Ships can only be profitably operated in the trades where freight rates are higher, and that is why capacity is shifting mostly to the U.S.,” claimed Tan Hua Joo, exec specialist at research study working as a consultant Linerlytica.

Some carriers have actually decreased quantities in much less lucrative courses, such as the transatlantic and also intra-Asia, claimed Damas.

“This means that rates on the latter are now increasing fast.”

NO PRICE BREAK

The price rise is the most up to date representation of disturbances considering that COVID-19 pounded the brakes on the international economic climate in very early 2020 and also caused massive modifications to the circulations of products and also health care tools worldwide.

“Every time you think you’ve come to an equilibrium, something happens that allows shipping lines to increase the price,” claimed Jason Chiang, Director at Ocean Shipping Consultants, keeping in mind the Suez canal obstruction in March had actually played a significant duty in permitting companies to trek prices.

“There are new orders for shipping capacity, equal to almost 20% of existing capacity, but they will only come online in 2023, so we will not see any serious increase in supply for two years,” Chiang included.

(Reporting by Roslan Khasawneh in Singapore and also Muyu Xu inBeijing Editing by Gavin Maguire and also Barbara Lewis, Reuters)

( c) Copyright Thomson Reuters 2021.