A dredge constructing increase that has been underway within the United States for a number of years remains to be going sturdy because the market stays extremely completive for strong undertaking workloads in each the private and non-private sectors.

According The Mike Hooks Report, an evaluation of the FY22 U.S. federal dredging market compiled in September 2023 by Michael Gerhardt, senior director of presidency affairs at Mike Hooks, LLC, 52 Jones Act dredging corporations had been awarded federal dredging contracts in FY2022. On common there have been three bidders per undertaking, with 20 tasks receiving 5 or extra bidders.

Seventy-two % of the time, the non-public sector business profitable bid was decrease than the Independent Government Estimate (IGE); and 95% of the time, the non-public sector business profitable bid was decrease than the Government Estimated Awardable Range (GEAR), which is IGE + 25%. When in comparison with the IGE, 59 tasks had been decrease by greater than 10%, 27 tasks had been decrease by greater than 25% and 15 tasks had been decrease by greater than 40%.

“What does this mean? It means that the U.S. dredging industry (private sector dredging companies) is fiercely competitive and is delivering a service that saves the federal government, and therefore the taxpayer, hundreds of millions—$670 million in FY22 alone (when compared to the GEAR), and this trend happens year over year,” Gerhardt stated.

The U.S. federal dredging market bid out to U.S.-flag Jones Act non-public sector dredging contractors has grown 408% in worth since 1993. In these 30 years the subset of hopper dredging contract awards has elevated 620%, Gerhardt added.

“While there have been peaks and valleys over this time period due to funding and level of need, there has been a steady climb,” Gerhardt stated. “On average the hopper dredging market, which has fluctuated between $300 million and $700 million over the past seven years, annually accounts for approximately 30% of the total market.”

Gerhardt famous that his report solely particulars federal dredging tasks, and that work within the non-public sector has additionally been strong.

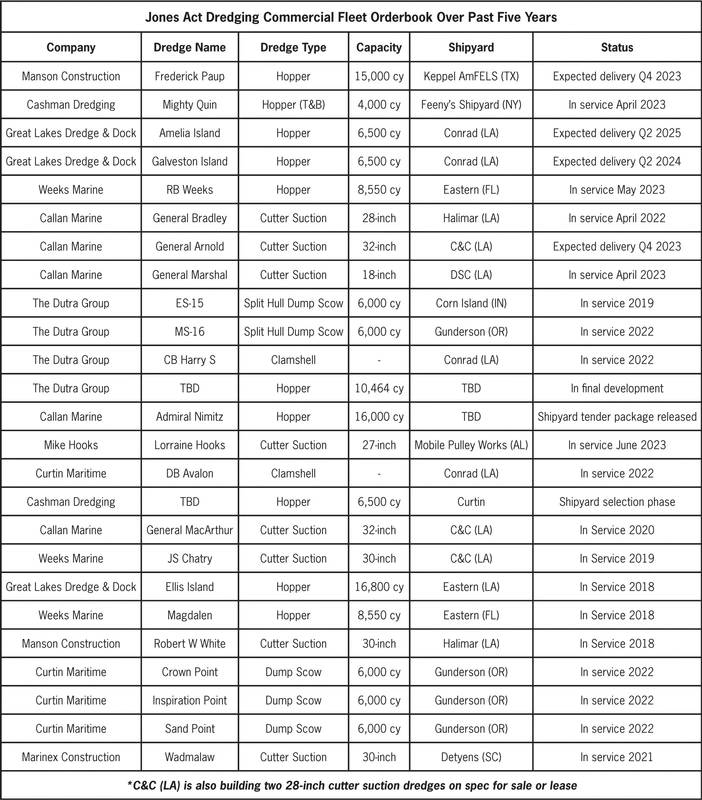

To assist meet the regular demand, the business has invested closely in new building of U.S. owned, constructed and crewed Jones Act dredges: over $2.5 billion over the previous 5 years. Newbuild dredges have been “rolling off the blocks”, stated William P. Doyle, CEO, Dredging Contractors of America. Doyle stated he expects this pattern will proceed into the foreseeable future, noting dredging corporations have additionally been investing in different tools to assist their actions, akin to cranes, barges, tugs, scows, tender boats, survey vessels, boosters, pipelines, pontoons, and many others.

“The U.S. Jones Act dredging industry is not just highly competitive and in the midst of the largest fleet capitalization ever, but it is reliable. The foreign entities have a tendency to overpromise and underperform— then walk away when times get tough,” Doyle stated.