BIMCO: The Shipping Market in 2015 and Looking Forward

(BIMCO) — By Peter Sand, Chief Shipping Analyst

Global financial system: menacing clouds within the sky solid a shadow on international financial developments

2015 by no means actually took off, despite the fact that the worldwide financial exercise regarded stronger earlier within the yr. The damaging indicators seen on the finish of 2014 weren’t overcome, and we noticed a considerably decrease degree of development for international GDP in 2015 than within the earlier 5 years. This was primarily as a result of struggling rising markets and creating economies, led by adjustments in China’s financial focus.

As BIMCO’s hope for a bounce-back in 2016 wanes, delivery ought to brace itself for yet one more difficult yr. Despite this, the International Monetary Fund has forecast greater GDP development charges for 2016 throughout the board. As China re-evaluates its future development and route, the delivery business can count on an unsure and decrease degree of help from one of the vital vital drivers of delivery demand development in latest instances.

What may flip this round?

Europe and Japan, particularly, appear like they could present constructive surprises in 2016. The European Central Bank and Bank of Japan are constantly searching for to spice up their economies to deliver on the sustainable restoration that everybody wants.

In the US unemployment charges are low and GDP development is excessive. This implies that greater rates of interest could also be simply across the nook. This may elevate costs however may additionally result in some “cooling off” for investments and consumption throughout the globe.

The unpredictability of China’s market forces is actually inflicting some concern. We can not depend on the standard market forces or circumstances inside some Chinese industries, which is bringing extra volatility in delivery demand. What appears sure is that the rebalancing of its financial system from funding to consumer-driven development may even drag down financial development. This transition is lengthy overdue and – extra positively – its larger sustainability ought to help a steadier degree of development in delivery demand sooner or later.

In quick, a “new normal” has arrived, decreasing the GDP-to-trade multiplier generated by international financial exercise.

Dry bulk: The supply-side was pushed decrease as demand pale

The dry bulk market skilled a difficult 2015 as the continued decline in Chinese coal imports was not countered by any important upswing elsewhere. Whereas iron ore imports have been on a par with 2014, metal export from China reached a brand new excessive, benefitting mid-sized ships. For 2016, a lot is determined by what Chinese metal mills will do. Will they proceed manufacturing above home consumption – or substitute domestically mined ore with imported ore? The jury continues to be out.

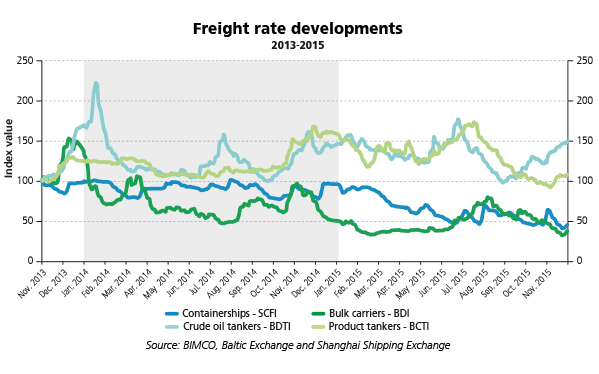

At the top of November, the Baltic Dry Index hit 498, a brand new all-time low. For many of the yr, nearly all of ships have traded beneath OPEX ranges, leading to monetary losses for a lot of firms.

The horrific first half of 2015 introduced round a brand new half-year document for scrapping. Improvements within the freight market throughout Q3 regrettably cooled down demolition market actions. Nevertheless, fleet development recorded a twelve-year low.

In 2016, BIMCO expects the supply-side to develop by round 2% (2.6% in 2015E) – and that this shall be helped by a brand new document degree of scrapping. On the demand-side, development is forecast to stay degree. Challenging market circumstances in China shall be more likely to have an effect on the extent of threat.

Tanker: after the proper storm a steadier yr awaits

Both the crude oil tanker and oil product tanker markets loved an awfully robust freight market all through 2015; ignited by the drop in oil costs that started in mid-2014 and supported by a comparatively low supply-side development in 2015. It was the most effective yr for all oil tankers because the market crashed in late 2008. Strong refinery margins meant that the demand for all oil tankers was excessive all yr – with a momentary pause for much-needed refinery upkeep. Going ahead, the numerous constructing of oil shares in 2015 might sluggish tanker demand development considerably in 2016.

BIMCO expects Iran’s return to the crude oil export market in 2016 to disrupt present commerce patterns. As Iran rebuilds its market share, it should search to take the place of neighbouring and West African rivals in supplying European and Asian markets. Time will inform if this may even deliver greater tanker demand, however BIMCO doesn’t count on that to occur.

The multi-year slide within the crude oil tanker fleet development was reversed in 2015. BIMCO expects the crude oil section to see a fleet development of round 4.5% in 2016 (2.3% in 2015E). As the demand-side development is unlikely to succeed in the identical excessive degree, downward strain on freight charges will comply with.

We count on related market circumstances to develop for oil product tankers, with supply-side development staying excessive whereas the demand-side is more likely to soften after the winter market. For the total yr, freight charges are predicted to be decrease in 2016 in comparison with 2015. BIMCO estimates that provide development for the oil product tanker section in 2016 shall be across the identical degree as in 2015 – which was 5.5%.

Container: development on key commerce lanes is required to revive market dynamics

Disappointing European demand for containerised items versus the robust development of imports into the US slowed the demand for container ships considerably. At the identical time, 900,000 TEU price of extremely giant container ship capability was delivered. Overall, the market imbalance worsened because the supply-side rose to a four-year excessive (8.0% in 2015E) whereas the demand-side development charge hit a three-year low. The lack of head haul quantity development on the Asia to Europe buying and selling lane was significantly worrisome because it accelerated the heavy cascade of ships clogging up different elements of the community.

The revival of time constitution charges within the first a part of the yr was not primarily based on a powerful enchancment within the basic market steadiness, and each spot and time constitution charges dropped because the yr handed. Going ahead, what is required to revive European imports of containerised items is for the Euro to strengthen in opposition to the Renminbi and for retailers to start restocking once more.

Towards the top of 2015, idled container ship capability reaching a excessive not seen since 2010 at over 1 million TEU, as ships of all sizes have been swiftly faraway from over-supplied commerce lanes. But it didn’t show to be sufficient to counter the drop in demand and subsequent income erosion.

What stays essential for the business is to enhance the elemental market steadiness in 2016. As the decrease “new normal” GDP-to-trade multiplier limits the potential upside of the demand-side, cautious administration of deployed capability by the person operators continues to be of utmost significance. Last yr didn’t ease the imbalance as greater than 1.6m TEU was delivered in 2015. After a document for brand spanking new capability getting into the market in final yr, 2016 is about for a a lot decrease inflow at round 3.5%. This isn’t enough and means the difficult market circumstances for container delivery will prolong for an additional yr.

Copyright (c) BIMCO, Republished with Permission