A basic interpretation of words insurance coverage would certainly be “Protection against future loss.”Marine insurance coverage is an additional version of the basic term ‘insurance’ and also as the name recommends is offered to ships, watercrafts as well as most notably, the freight that is lugged in them.

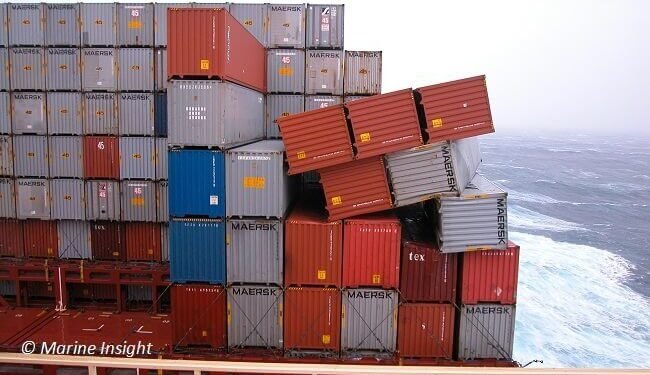

Marine insurance coverage is extremely essential due to the fact that with aquatic insurance coverage, ship proprietors as well as carriers can be certain of suing particularly taking into consideration the setting of transport made use of. Of the 4 settings of transportation– roadway, rail, air as well as water– it is the last most which triggers a great deal of concern to the carriers not just due to the fact that there are all-natural events which have the prospective to damage the freight as well as the vessel however additionally various other events as well as features which can trigger a substantial loss in the monetary coffin of the carrier as well as the delivery company.

Incidents like piracy as well as opportunities like cross-border combats additionally position a significant risk when it pertains to water transport as well as for that reason to avoid any kind of loss due to such occasions as well as happenings, for the company as well as the carrier, it is constantly valuable to have a back-up like an aquatic insurance coverage.

Another essential facet of having aquatic insurance coverage is that a carrier can select the insurance coverage strategy based on the dimension of his ship, the paths that are taken by his ship to carry the freight as well as lots of such technicalities which can go a wonderful size in impacting the carrier majorly.

Also, given that there are numerous strategies as well as plans which suggest regarding covering not simply the freight however additionally the vessel, the carrier can select as well as get the most effective plan that matches his service the most effective.

However, as high as aquatic insurance coverage gives reasonable insurance claim to carriers as well as companies, it needs to be recognized that aquatic insurance coverage is additionally among the trickiest as well as most strict insurance coverage locations right from the moment the principle of aquatic insurance coverage began– i.e. from the 17th century onwards.

While managing the range as well as variety of aquatic insurance coverage, it is extremely essential that a ship’s captain complies with a stiff method in regards to the course taken as well as the moment considered the freight as well as the vessel to get to the desired port of location. Because if there is any kind of disparity or infraction in regards to the course taken, i.e. if the captain differs or swerves in his course from the one initially planned as a component of the ship’s training course, after that also if there is any kind of problem striking the vessel or the freight, the insurance coverage case will certainly be denied totally with no opportunity of the insurance claim being repaid to the plaintiff at some future day after a couple of hard settlements.

Therefore it comes to be extremely essential that a ship’s captain takes due factor to consider regarding the suggested paths so regarding prevent an unsuccessful insurance coverage agreement due to an unexpected loss as a result of the discrepancy in the course. This would certainly produce not simply warn for the captain however would certainly additionally decrease the opportunity of shedding essential insurance coverage cases due to inadvertence as well as oversight.

Marine insurance coverage is a safe house for delivery companies as well as carriers due to the fact that it assists to decrease the facet of monetary loss as a result of loss of essential freight. Also, it assists to produce to the carrying firms as well as to the getting celebrations, the obligation, commitment as well as the straightforwardness of the insurer.

If you liked this short article, you may additionally such as to check out What is ship monitoring?.