163 Cargo Vessels Sold For Demolition In H1 2021; 4.5% Increase On The Same Period In 2020

Since completion of H1, there have actually been 163 freight vessels cost demolition, a 4.5% boost on the exact same duration in 2020 when 145 vessels were junked, as well as a 63% boost from 2019 when just 100 vessels were junked. These vessels had a consolidated DWT of 6.3 mil as well as a minimal consolidated scrap worth of over USD 825 mil.

57 of these vessels were obtained by purchasers in Bangladesh, comprising over a 3rd (35%) of all vessels offered. A total amount of 49 vessels were sent out for demolition in India, comprising 30% of the sales. Both nations harbour solid purchasing cravings as their building and construction sectors recover from Covid -19 lockdowns.

Pakistan tracked behind bookkeeping for just 14% of demolition manage a total amount of 23 vessels sent out for scrap. This was most likely as a result of the Pakistani rupee getting to perpetuity lows versus the buck, reducing the getting power of Pakistani shipbreaking lawns.

Image Credits: vesselsvalue.com

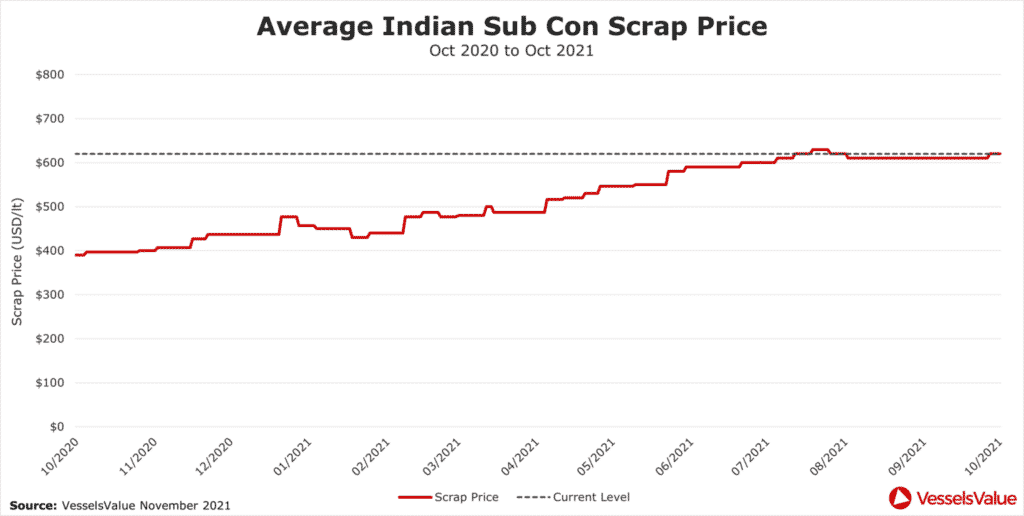

Between completion of June as well as completion of October 2021, the standard Indian Subcontinent scrap rate throughout Bulkers, Tankers as well as Containers increased by around 5% from 590 USD/lt to 620 USD/lt. Scrap rates came to a head around completion of August as well as have actually because secured, noting completion of a duration of solid as well as substantial development.

At completion of October 2021 the scrap rate for a Tanker was 620 USD/lt. By comparison, rates in October 2019 were 390 USD/lt. Applying these scrap rates to a common VLCC of 44,000 lt creates 2 extremely various recurring property worths. Today the recurring rate of a VLCC is USD 27.7 mil, contrasted to October 2019 when the exact same vessel would certainly accomplish a rate of USD 19.8 mil. Although the distinction is substantial, at regarding USD 8 mil, degrees have not fairly got to the perpetuity highs seen back in 2008, when scrap rates virtually got to 760 USD/lt.

Recent fads in Subcontinent scrap rate can be seen in Figure 1.

Click To Enlarge|Figure 1: Average Indian Subcontinent scrap steel rate of Bulkers, Tankers as well as Containers.

Bulkers

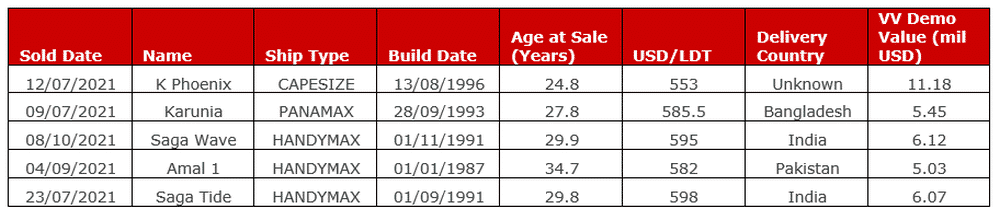

Throughout 2021, Bulker products prices have actually raised considerably. For instance, the Capesize 54 TCA raised from 32,604 USD/day on the 30th June to a top of 86,953 USD/day on the 7th October, a rise of 167%. Rates have actually because decreased to 47,950 USD/day on the 25thOctober Unsurprisingly, this has actually reduced the variety of Bulkers being sent out for demolition.

31% of the vessels junked in between completion of June 2020 as well as completion of October 2020 were Bulkers, bookkeeping for a total amount of 48 ships. Today, as a result of the thriving charter market, this number has actually been up to just 8 Bulkers, a decrease of 83%.

Example demolition sales are revealed listed below:

Click To Enlarge|Figure 2: Bulker demolition sales for 30th June– 25thOctober Sales with concealed rate left out.

Containers

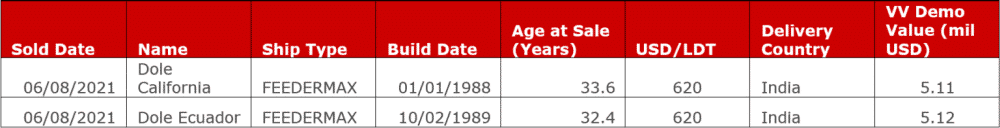

As is commonly reported, 2021 has actually been a document splitting year for Containerships, with port blockage as well as boosting need creating products prices to get to unbelievable highs.

Just just like Bulkers, the percent of Containerships junked in between June as well as October 2021 has actually gone down significantly because in 2015 as shipowners have actually been keeping their tonnage. There were just 2 Containerships junked in between June 30th as well as October 25th 2021, standing for a 94% reduction from 2020, where 34 Container vessels were sent out for demolition.

The vessels junked were 2 32 as well as 34 years of age Feedermaxes, sent out for HKC “Green Recycling” at Alang, India.

Click To Enlarge|Figure 3: Container demolition sales for 30th June– 25th October.

Tankers

112 Tankers have actually been junked in between completion of H1 2021 as well as today, comprising 69% of all freight vessels junked in the exact same duration. For contrast, in 2020 just 26 vessels were junked. Following a year of stationary products prices in 2021, proprietors are not surprisingly capitalising on the thriving scrap rates as well as ditching tonnage.

With the upcoming winter months as well as nations gradually raising traveling limitations, we might see a Tanker rally as well as as a result a foot on the breaks for Tanker demolition sales.

Click To Enlarge|Figure 4: Tanker demonstration sales for 30th June– 25thJuly The 2 sales with the greatest scrap rates for every ship kind are revealed.

Conclusion

Overall, ditching for Bulkers as well as Containers is not likely to boost whilst both take advantage of a thriving charter as well as S&P market, in spite of the increasing scrap steel rates. Those exact same high scrap rates, combined with inactive products prices, will certainly make sure that Tanker scrap numbers continue to be stable till prices can damage devoid of their existing placement.

Data since end October 2021.

|Vessels Worth