275 Cargo Vessels Sold For Scrap In H1 2021; 40% Rise As Compared To 2020: Vessels Worth

The very first fifty percent of 2021 saw 275 Cargo vessels cost scrap, up 40% as well as 33% contrasted to 2020 as well as 2019, specifically. The 275 ditched vessels have a mixed DWT of 11.9 mil as well as a complete scrap worth of over USD 1 bil. 131 vessels were ditched, making up virtually fifty percent of all freight vessels ditched in H1 2021.

The enhancing junking numbers are a straight outcome of incredibly high junking prices, which increased as well as remain to climb throughout 2021. The end of H1 2021 saw Container junking costs get to 600 USD/LT, degrees not seen for virtually 13 years. The rise in junking costs has actually been sustained by the ever-growing surge in steel rate as well as need. A need catalysed by lockdown limitations creating logistical problems for building and construction websites throughout the globe.

The extraordinary revenues seen in H1 2021 for the Bulker as well as Container fields saw proprietors capitalise in both the charter as well as S&P market, transforming their back on the demolition market regardless of the rewarding junking costs. Tanker proprietors, nonetheless, were much more attracted by the high junking costs, however still, the bulk are picking to stick onto older possessions in the hope of a complete market recuperation.

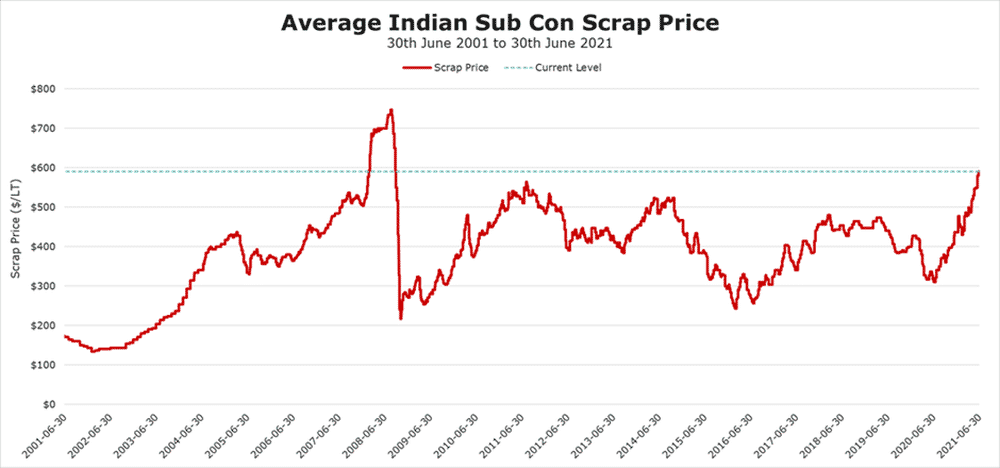

Figure 1: Average Indian Sub Con scrap rate of Bulkers, Tankers as well as Containers, last two decades.

|Click Image to Enlarge|Image Credits: vesselsvalue.com

Financial stress required upon the Offshore field because of Covid -19 has actually seen several proprietors junking their non-core possessions. This is an outcome of pre concurred personal bankruptcy contracts which needs full fleet testimonials.

Cargo

Figure 1 reveals the typical scrap rate in theIndian Sub Con The Indian Sub Con stands for the highest possible scrap rate readily available in between Bangladesh, India as well as Pakistan reusing backyards.

The previous 10 years high of 560 USD/LT was rapidly gone beyond at the beginning of June 2021 as well as present costs are surrounding a 13 year high. In the very first fifty percent of the year, the scrap rate boosted about USD 0.86 each day. If this development price proceeds after that the 2008 perpetuity high of 754 USD/LT will certainly be gotten to by the end of the year.

The end of H1 2021 scrap rate is 86% greater contrasted to the scrap rate end of H1 2020.

Below are some instances of vessels attaining high scrap costs on the demolition market.

- 18th June 2021 MR1 TNKR (Chem/ Product): Dubra (35,900 DWT, Jul 1999, Daedong) cost 592 USD/ LT– Pakistan

- 18th June 2021 MR2 TNKR (Chem/ Product): Elka Angelique (44,900 DWT, Jun 2001, Brodosplit) cost 590 USD/ LT– Pakistan

- 11th June 2021 FEEDERMAX (Gantry): Dole Costa Rica (890 TEU, Oct 1991, Fincantieri Ancona) cost 585 USD/ LT– India

- 10th June 2021 CAPESIZE BC: Win Win (170,100 DWT, Nov 2001, IHI) cost 580 USD/ LT– Bangladesh

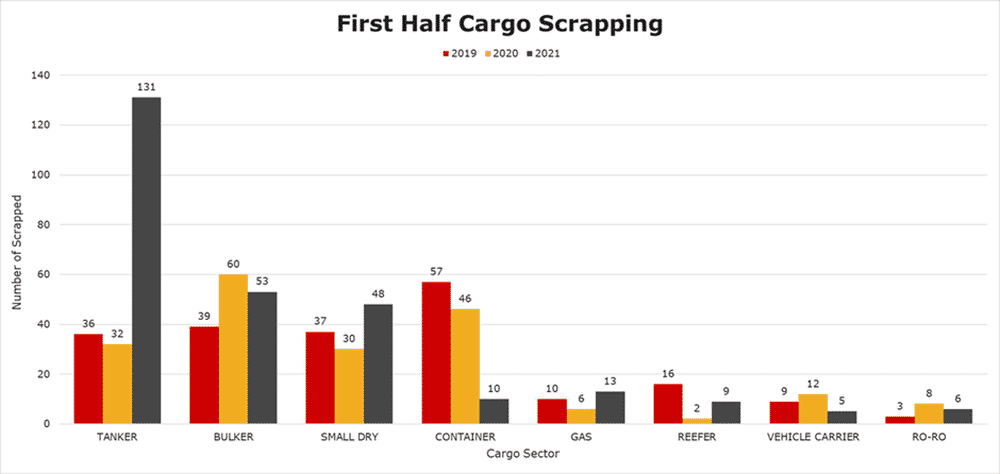

Figure 2 reveals the variety of vessels ditched in the very first fifty percent of 2019, 2020 as well as 2021 by field.

Figure 2: Number of vessels ditched by field, for H1 2019, H1 2020 as well as H1 2021.|Click Image to Enlarge|Image Credits: vesselsvalue.com

The variety of Tankers ditched in H1 2021 is up four-fold contrasted to 2020 as well as 2019. For recommendation, the complete variety of Tankers ditched throughout 2020 as well as 2019 was 92 as well as 91 specifically. It would certainly not be a shock if Tanker junking remains to expand as revenues remain to continue to be at incredibly reduced degrees.

Despite the high scrap costs, Bulker proprietors are tentative to junk any type of older tonnage because of the incredibly high revenues. Scrapping numbers have actually continued to be relatively reduced for H1 2021, down 13% from H1 2020.

Expectedly, Container junking numbers are down 78% from 2020 as the field delights in the severe revenues. 7 of the 10 Containers ditched this year, were little Feedermaxes, all 25 years or older. Even if scrap costs remain to rally upwards it is not likely that we will certainly see a lot more Containers ditched in the 2nd fifty percent of the year.

The Small Dry field experienced a charitable uptick in junking numbers (up 60% from 2020), as a number of proprietors chose to take advantage of the high junking prices as well as junking their older tonnage. The typical junking age for H1 2021 was 34 years.

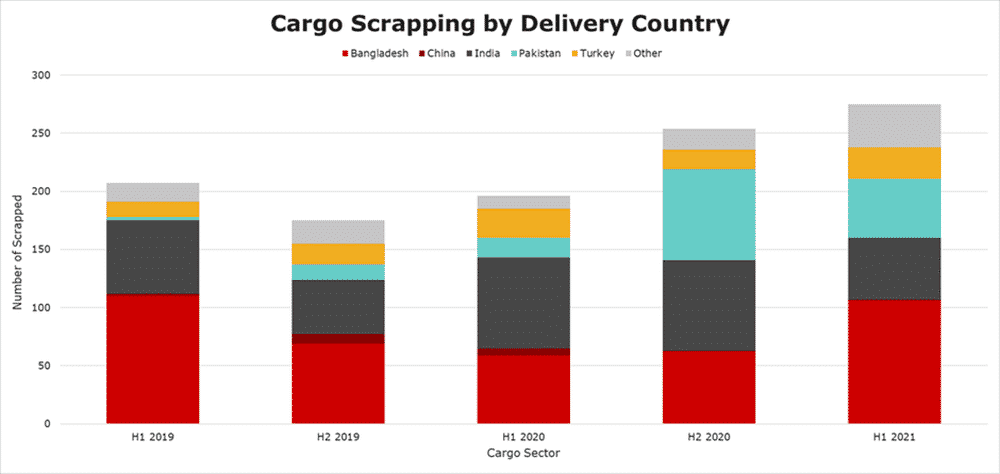

Figure 3 break down by fifty percent years the variety of vessels ditched in each place for 2019, 2020 as well as 2021.

Figure 3: Number of vessels ditched by place, for H1 2019, H2 2019, H1 2020, H2 2020 as well as H1 2021.|Click Image to Enlarge|Image Credits: vesselsvalue.com

Since the 2nd fifty percent of 2019, the variety of vessels ditched every year has actually expanded year on year.

The fight for the leading area for 2020 as well as 2021 drew countless untried components right into play such as increasing Covid -19 instances, backyard lockdowns as well as absence of oxygen supply which were all unchartered waters for reusing backyards.

Bangladesh was quickly ripped off its leading area in March as Pakistan supplied much more affordable scrap rates. During April, all 3 nations, Bangladesh, India as well as Pakistan endured because of increasing Covid -19 instances. India was specifically influenced as it saw one more collection of lockdown limitations enforced.

Notwithstanding the unrelenting pandemic, junking costs as well as numbers remained to climb. Bangladesh took the lion’s share in H1 2021, junking 106 vessels, up 80% from H1 2020. India as well as Pakistan ditched 53 as well as 51 vessels specifically, below their remarkable efficiency in the last fifty percent of 2020.

Offshore

As an outcome of the Covid -19 pandemic, the Mobile Offshore Drilling market is experiencing among the hardest durations given that the oil rate accident of 2014/2015. Large United States noted gears proprietors such as Noble Drilling, Pacific Drilling, Diamond Offshore as well as, John Fredriksen possessed Seadrill, have actually just recently been required to experience Chapter 11 (some for the 2nd time in 5 years). Many of these gear proprietors as component of the pre bundle personal bankruptcy contract have actually been required to assess their fleet as well as eliminate non-core tonnage.

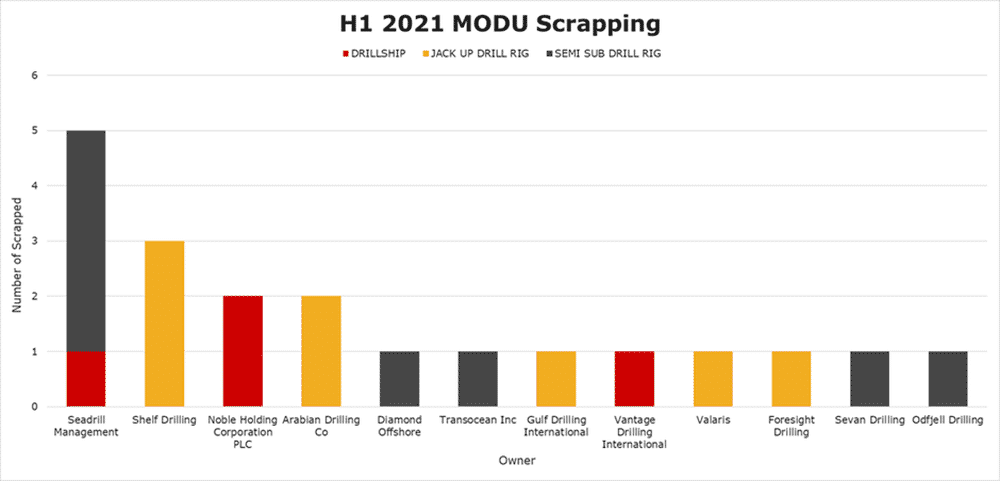

Figure 4 reveals the complete variety of Methods ditched by proprietor as well as kind from January 2021 to June 30, 2021.

Figure 4: Number of Methods ditched in between Jan 2021 as well as Jun 2021, by proprietor as well as kind.|Click Image to Enlarge|Image Credits: vesselsvalue.com

Seadrill has actually been one of the most energetic throughout the very first fifty percent of 2021, as discussed this has actually been driven by their current Chapter 11Bankruptcy The Seadrill gears cost demolition are described listed below.

- West Pegasus 10,000 feet blt 2011 Jurong cost USD 7.6 mil. Rig chilly piled given that June 2016 Norway.

- West Eminence 7,800 feet blt 2009 Samsung cost USD 7.6 mil. Rig chilly piled given that 2015 Canary Islands.

- West Navigator 8,200 feet blt 1998 Samsung cost USD 11.9 mil. Rig chilly piled given that 2014 Norway.

- West Venture 5,905 blt 1999 Hitachi cost USD 6.5 mil. Rig chilly piled given that 2016 Norway.

- West Alpha 2,000 feet blt 1986 NKK cost USD 4.2 mil. Rig chilly piled given that 2016 Norway.

All were offered ‘as is’ to a Turkish demolition money customer Rota Shipping for a complete rate of USD c. 38 mil.

We additionally saw the adhering to gear offered to Indonesia for demolition, Sevan Driller 10,000 feet blt 2009Nantong Cosco Reported offered to Indonesian trial customer on ‘as is’ basis for an unrevealed rate. Rig chilly piled given that 2016.

Conclusion

Extreme scrap costs, expensive brand-new ecological policies (sulphur cap, BWMS and so on) as well as an ever before aging fleet was the ideal mix to see junking numbers blown out of the water as well as some remarkable documents to be established.

However, with Containers as well as Bulkers making a lot cash, as well as Tankers having actually done so formerly, proprietors are hanging onto their vessels regardless of the substantial lure from junking costs.

If the steel need remains to rally the demolition scrap rate for delivery, after that it is most likely that junking numbers will certainly boost throughout the year, specifically if Bulker as well as Container prices start to soften.

The high steel rate declares for market basics in oversupplied fields as it motivates junking however poor for undersupplied fields as it increases brand-new structure costs.

Vessels Worth information since July 2021

Disclaimer: The function of this blog site is to supply basic info as well as not to supply recommendations or assistance in regard to specific conditions. Readers need to not choose in dependence on any type of declaration or viewpoint included in this blog site.