Acceleration In Port Capacity Investment Insufficient To Support Cargo Demand Growth

Surging container delivery freight need following the pandemic has actually led to a substantial enhancement in the worldwide incurable capability overview, yet this might not suffice to sustain projection web traffic degrees, according to the most up to date Global Container Terminal Operators Annual Review and also Forecast record released by worldwide delivery working as a consultant Drewry.

Image Credits: DrewryShipping– Twitter

Drewry’s yearly study of the globe’s prominent incurable drivers discloses the strength of the market to exterior shocks. Volumes, generally, were down, yet profits much less so as drivers relocated promptly to manage expenses. Capital expense was controlled throughout 2020, yet the overview is much enhanced.

Eleanor Hadland, writer of the record and also Drewry’s elderly expert for ports and also terminals stated: “The strength of the recovery in demand, aided by high levels of liquidity in the financial market, have enabled operators to bring forward their investment plans, resulting in a stronger capacity outlook post-pandemic.”

Changes to Drewry’s worldwide port capability projection

Source: Drewry’s Global Container Terminal Operators Annual Review and also Forecast 2021/22

Global container port capability is forecasted to enhance by a typical 2.5% each year to get to 1.3 billion teu in 2025. With worldwide need readied to increase by a typical 5% per year over the exact same duration, ordinary exercise prices will certainly enhance from the present 67% to over 75%. While 75% exercise at a port or incurable degree is not completely high to be of significant problem, at a worldwide degree this assumption of tightening up port capability in a market afflicted by blockage because of provide chain discrepancies is a reason for problem.

The bulk of the projection added capability will certainly be supplied at existing terminals, with greenfield tasks still continuing to be a reduced concern for a lot of worldwide drivers. There are less greenfield automation tasks in the pipe, yet retrofitting of existing terminals gets on the increase. The leading drivers are likewise buying digitalisation, identifying that this can enhance the rate of activity of boxes with their centers. Neutral profession systems such as Trade Lens and also GSBN make use of blockchain innovation to improve the governing and also economic circulations related to the freight.

“Improving cargo flow is key,” includedHadland “If via the roll-out of blockchain-based technology GTOs can achieve higher volumes over the same asset base, this will drive improved returns on investment.”

M&A has actually likewise shown resistant, with worldwide incurable drivers (GTOs) and also economic financiers continuing to be energetic out there. A variety of providers have actually remained to unload possessions, choosing to safeguard capability and also efficiency degrees by means of long-lasting incurable solution arrangements. The economic market continues to be an eager financier, brought in by secure long-lasting cashflows, particularly if the supplier offers a quantity warranty.

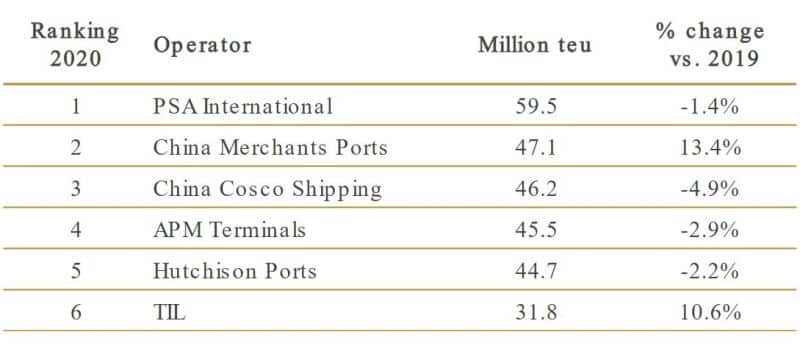

Looking back at 2020, the team of 21 firms identified by Drewry as GTOs, were not immune from the marketplace tests enforced by Covid -19, with mixed equity-adjusted quantities dropping 0.8% contrasted to a worldwide decrease in port handling of 1.2%. These leading drivers currently take care of over 49% of the worldwide port quantities on an equity-adjusted basis, up from 45.6% in 2015.

China Merchants Ports went up to 2nd area in the Drewry positions in 2020, complying with a 13.4% rise in equity-adjusted quantities. Volume development was originated from the business’s shareholdings in various other drivers– Terminal Link, the CMA CGM/ China Merchants JV, obtained 8 terminals at end of 1Q20 from CMA Terminals which gave a significant increase, along with enhanced payment from Liaoning Port Group and also Ningbo Zhoushan Port Company.

TIL likewise reported solid development in 2020, on the back of profile development and also solid efficiency at a variety of significant ports.

Leading global/international incurable drivers, equity-adjusted throughput, 2020

Source: Drewry’s Global Container Terminal Operators Annual Review and also Forecast 2021/22

Reference: drewry.co.uk