Airlines Stepping Up Oil Hedges Before 2020 Shipping Rule Bites

By Alex Longley (Bloomberg)– Airlines are beginning to hedge versus the threat that gas costs can be driven greater by policies targeting an additional market’s ecological efficiency.

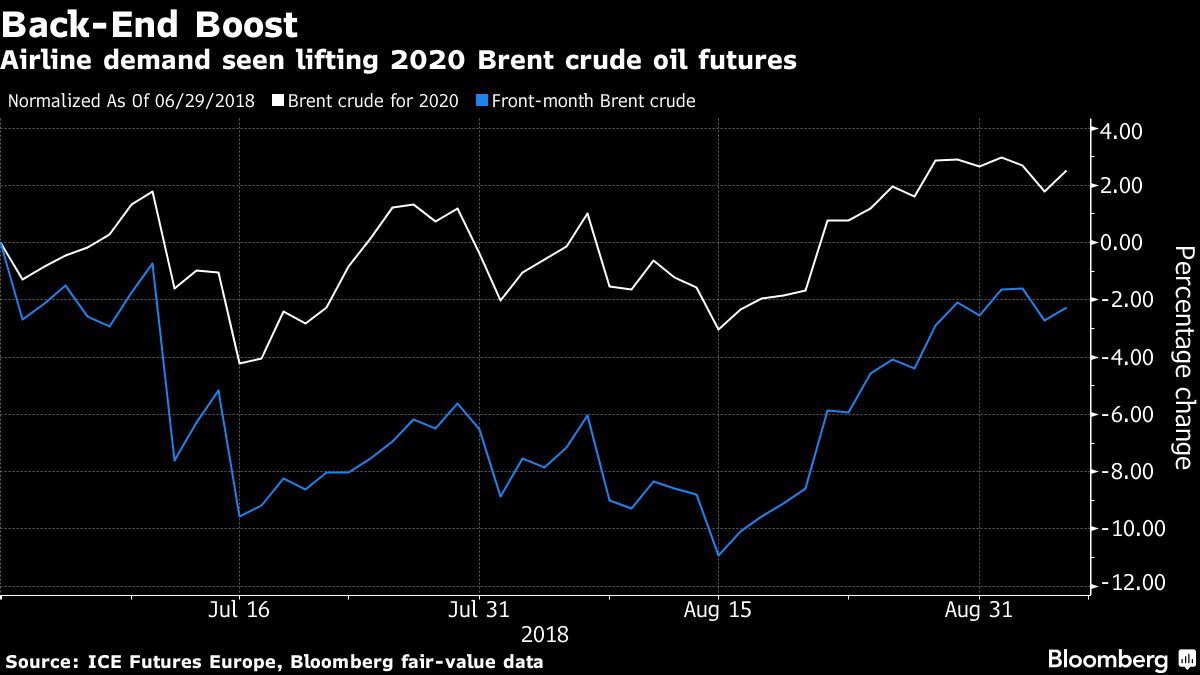

Brent crude for 2020 rallied in the 3rd quarter, a duration in which area costs dropped, as some providers started looking for defense versus greater gas prices triggered by policies to reduce sulfur discharges from ships, according to Thibaut Remoundos, owner ofCommodities Trading Corp inLondon The policies, laid out by the International Maritime Organization, work in January 2020.

“Consumers, and in particular airlines, have been pushing prices in what seems to be a sudden IMO 2020 wakeup call,” stated Remoundos, whose company encourages commercial product customers on hedging techniques. “The back end of the curve has moved significantly higher.”

Crude Lift

Brent for 2020 increased by 2.5 percent to $71.89 a barrel given that completion of the 2nd quarter, according to reasonable worth information put together byBloomberg Front- month agreements, generally one of the most sold the marketplace, went down 2.3 percent.

The 2020 policies will certainly compel the globe’s maritime fleet to utilize gas having much less sulfur, a toxin criticized for human health and wellness problems such as bronchial asthma. The brand-new limitation, besides for ships with scrubbers, will certainly be 0.5 percent, below 3.5 percent in the majority of locations today.

The demand to switch over has actually produced a prevalent assumption that there will certainly be a first need rise for diesel-like items. A vital concern for airline companies is whether oil refineries will certainly reduce outcome of jet gas as they attempt satisfy the rise in purchasing from carriers. No issue what occurs, oil experts anticipate the brand-new ship-fuel policies to improve petroleum costs that are often made use of for the aeronautics market’s hedging programs.

The IMO’s policies are most likely to raise airline company gas prices, experts at UBS Group AG,Macquarie Group Ltd as well asJefferies Financial Group Inc have all stated in current weeks.

Hedging Scrubbers

It’s prematurely to see proof of a rise in hedging in airline companies’ revenues declarations. Of 14 European as well as united state airline company filings put together by Bloomberg, just 2–Southwest Airlines Co as well as Ryanair Holdings Plc– had bushes in location for 2020 or past in one of the most current quarter of coverage. Ryanair’s strategy had not been being affected by IMO, the business’s chief executive officer stated July 23. The mass of airline company coverage for the existing quarter will certainly begin in very early November.

The boost in hedging for the brand-new ship-fuel policies hasn’t simply been limited to unrefined markets, or to airline companies. Shippers have actually likewise been energetic in securing infect aid with the fostering of scrubbers that enable ships to maintain melting even more sulfurous gas. That’s seen some firms purchasing gas oil agreements as well as marketing diesel ones, to secure versus an unforeseen rise in gas oil prices.

The distinction in between gas oil as well as gasoil for January 2020 has actually tightened considerably in current months. High sulfur gas oil has actually gotten 8.9 percent on reduced sulfur gasoil over that duration, according to ICE Futures Europe as well as Bloomberg reasonable worth information.

“We have seen an increase in the interest for doing scrubber hedges,” stated Mads Hemmingsen, an investor at Global Risk Management A/S. “The consolidation above $70 and the subsequent move towards $80 has sparked interest for hedges in general.”

© 2018 Bloomberg L.P

Related:

- Shipping’s 2020 Low Sulphur Fuel Regulation to Hit Airlines

- IMO’s 2020 Fuel Rule to Hit Truckers Where It Hurts: The Diesel