BIMCO: 2018 Has Been ‘Historically Bad’ for Crude Oil Tankers

The initial fifty percent of 2018 has actually been a traditionally poor year for petroleum vessels as incomes struck their least expensive degree on document in hefty loss-making region, according to delivering sector organization BIMCO.

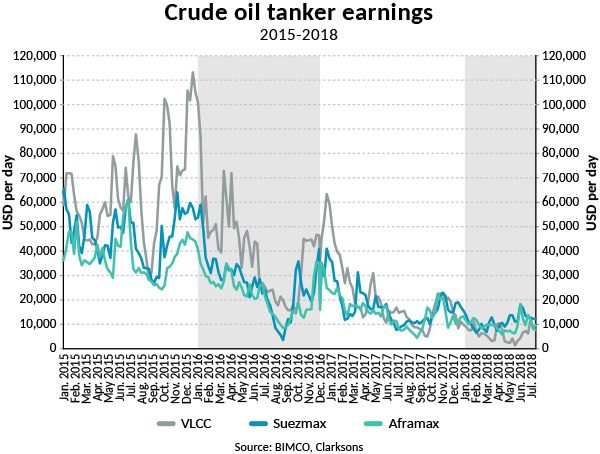

Earnings for Very Large Crude Carriers (VLCCs) in the initial fifty percent of 2018 were as reduced at USD 6,001 daily typically, with a Suezmax vessel making USD 10,908 daily as well as an Aframax making USD 9,614 daily, BIMCO reported Tuesday.

After an extremely solid 2015 that saw the greatest products prices for petroleum vessels in 7 years, 2016 was an action down, however still earnings production, according to BIMCO. In 2017, nonetheless, sheds gone back to the field for the very first time in 3 years.

“2018 has been absolutely horrible for the crude oil tankers with freight rates and the fleet utilization rate falling to a record low level,” remarks BIMCO’s primary delivery expert Peter Sand.

“The complete petroleum vessel fleet hasn’t expanded whatsoever in 2018. In reality, the VLCC as well as Aframax fleets especially have not been expanding over the previous one year. The products market is severally influenced by extremely weak need development.

“Overall, the freight market is oversupplied. The key to higher earnings lies within a very low fleet growth and a return to normalized demand level. The sooner the better – but patience is required,” stated Sand.

According to BIMCO, it might take up until the 2nd fifty percent of 2019 for the field to end up being successful once more, however raised demolition as well as an “oil price contango” can cause a much faster recuperation, it stated.