BIMCO: Update on Dry Bulk’s Road to Recovery

( BIMCO)– Back in May, BIMCO divulged a predicted “road to recovery” for the completely dry mass delivery market. The major message at that time on what the completely dry mass industry have to do to go back to success was, and also still is: “Scrapping ships and no new builds is the fastest road to recovery for the dry bulk market”.

As assured, BIMCO will certainly keep track of and also report back to the completely dry mass delivery market on the development made in the direction of a healing. 2016 have to be the transforming factor in attending to the basic discrepancy of the completely dry mass market. Despite much better need side problems just recently, we can not anticipate favorable need side shocks, coming to rescue permanently. The substantial overcapacity of ships have to be dealt with– beginning currently– and also proceeded over the following 3 years at the very least.

Strong need side development aids as demolition passion has actually cooled down

As shipowners’ passion in demolition has actually cooled down, the supply side is even worse off today than earlier quotes forecasted for 2016. Stronger need side development is the only factor for the enhanced market problems in the completely dry mass delivery industry.

In short, the basic equilibrium of the marketplace has actually boosted, and also products prices can still get to lucrative degrees in 2019. But bringing earnings back continues to be in the hands of shipowners themselves. But remaining on the roadway to recuperation calls for a collection of exceptionally hard and also continual actions to be taken, year on year.

BIMCO Chief Shipping Analyst, Peter Sand, stated:

“The dry bulk market is still in a terrible condition. Regardless of a significant improvement in the BDI from its all-time low back in February 2016, the freight market remains lossmaking and in a very bad state.”

“The market has risen only from ‘catastrophic’ to ‘gloomy’ – so the need for shipowners to take decisive action remains.”

“When you claw your way back from the worst market ever – the road is long, rocky and tough. It requires stamina, adaptation and determination from all shipowners. The market has improved based on growing demand, but the sector cannot rely on this alone – which is out of its own hands.”

“The industry must act decisively to reduce the enormous overcapacity of tonnage by keeping demolition activity high, even as freight rates go up – to make the recovery a sustainable one.”

How are we doing on demolition of excess capability?

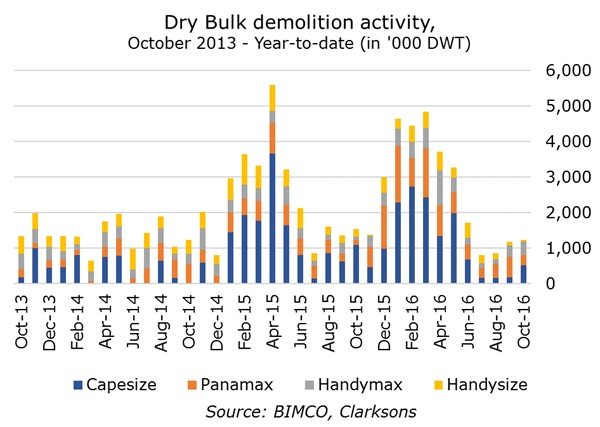

For the initial 5 months of 2016, shipowners were doing simply the best point. They were restricting the influence of brand-new shipments released right into the marketplace by knocking down ships which were producing excess capability.

From January to May, an internet fleet development of simply 4 million DWT indicated that the completely dry mass fleet expanded by 0.5%. This was best on BIMCO’s target to get to an internet supply development of 10 million for the complete year, based upon 50 million DWT of newbuilds fed right into the marketplace and also 40 million DWT gotten of the marketplace for demolition.

Much extra requires to be done

As of very early October, the adjustments to the supply side of the completely dry mass delivery market are no more on target, if evaluated by internet fleet development. This is due to the fact that shipowners have actually stopped demolition of excess delivery capability while taking shipment of newbuilt ships at an unmodified rate. The completely dry mass fleet today is 1.75% bigger than at the beginning of 2016. 38.8 million DWT has actually been provided in the initial 9 months of the year, while just 25.2 million DWT has actually been knocked down.

Whereas our quote for newbuilt shipment continues to be on target for 50 million DWT, BIMCO’s projection for demolition of completely dry mass tonnage for the complete year of 2016 have to be modified downward. We lower our previous quote of 40 million DWT to 35 million DWT. This indicates that the completely dry mass fleet will certainly see an internet development of 15 million DWT or 1.9% for the complete year.

In final thought, the absence of activity on demolition indicates that the growth of the supply side of the products market has actually made the circumstance even worse– if contrasted to our initial “Road to recovery”, where the 2016 internet fleet development was approximated at 10 million DWT.

Surprisingly solid need side development

From the beginning of the year with September, the need side has actually absolutely boosted. Our May 2016 projection for a need side development price of 0.3% on a quantity basis is currently anticipated to get to a development price of 0.8% for the complete year in this upgrade.

Taking the cruising ranges right into account too, the included tonnes of freights originating from long-haul professions even more boosts the photo, as the tonne-miles need development price rises dramatically. Our existing quote recommends the need side will certainly enhance by 1.4% in 2016, up from 0.1% in our initial tonne-mile quote.

In final thought, the need side has actually plainly boosted in contrast to our initial “road to recovery” record in May 2016, where the 2016 need development price was approximated at 0.3% for 2016.

In our forecasts, we have actually established the need side to expand by 2% from 2017 onwards. The advancements in 2016 appear to have actually smoothed the course upwards from the reduced degree in 2015.

The general basic equilibrium has actually boosted

Weighing up the enhancements to the need circumstance and also frustrations of the supply side slides, the general basic equilibrium has actually boosted.

Shipowners did refrain from doing sufficient service the supply side of the marketplace– the enhancements of the marketplace were mostly driven by a more powerful need side development.

Why are products prices still slow-moving, after that?

Because the marketplace is still flooded with excess delivery capability. Improvements like those seen in 2016 until now are required for years to find.

BIMCO Chief Shipping Analyst, Peter Sand, includes:

“The slowdown in demolition activity is alarming. The work needed to be done on the supply side is substantial and the low level of demolition merely postpones the recovery.”

“What is clearly keeping the dream of a profitable market in 2019 alive is the fact that global shipowners and investors have stayed away from the shipyards.”

“Marred only by the 30 VLOCs ordered from Chinese owners confirmed in March and April, we have only seen a handful of new orders for dry bulk ships.”

It continues to be of crucial significance to remain on that track, in order to accomplish the no supply development price in coming years, as demolition task is bound to reduce upon a slowly boosting products market”.

This post is politeness of Bimco.org and also is republished right here with approval.