China’s Gas Tariffs Are a Permian-Size Problem: Opinion

By Liam Denning (Bloomberg Opinion)–Energy supremacy sure does appear ahead with a significant dosage of self-flagellation.

The most recent little bit of America’s power market to really feel the over-the-shoulder lash is the melted all-natural gas-export organization. On Friday, LNG signed up with the checklist of items that China will certainly strike with tolls punitive for united state ones. This is bothersome when you think about China has actually taken 13 percent of united state LNG exports (as well as even more like a quarter last winter season), according to Bloomberg New Energy Finance.

As I composed right here regarding united state oil, a toll enforced by among the globe’s biggest importers of gas will certainly work as a reliable tax obligation on merchants. China gets united state LNG instantly market, so its need is really conscious the spread in between benchmark united state gas costs as well as Asian costs. That spread needs to soak up the expense of transforming united state gas right into a fluid (normally a 15 percent costs) as well as delivering it throughout the globe (regarding $2 per million BTU through the Panama Canal, according to BNEF’s LNG Shipping Calculator).

Using futures costs for Henry Hub gas as well as the Japan-Korea Marker (JKM) as proxies, right here’s what takes place to the academic netback, or margin, of a merchant on the united state Gulf Coast offering LNG to Shanghai if a 25 percent toll is enforced:

The truly enjoyable aspect of the LNG profession, however, is that, like with a lot of various other professions, whatever is attached. So in addition to the LNG market, these tolls can truly trigger troubles for a larger organization up the pipeline: the Permian container’s oil manufacturers.

How so? A side-effect of the rise in Permian oil outcome is a comparable rise in linked gas that shows up together with it. As long as oil costs urge even more fracking for oil, the gas basically comes absolutely free. This is an issue in west Texas because, except thinking of a resourceful approach enabling regional homeowners to take a breath right stuff, there isn’t sufficient need there to take it all. Hence, gas valued in Waha, Texas, trades at a discount rate of virtually 80 cents per million BTU, or 28 percent, to the Henry Hub standard.

Read Also: Chinese Tariffs on LNG, Oil May Hit UNITED STATE Bid for Energy Dominance

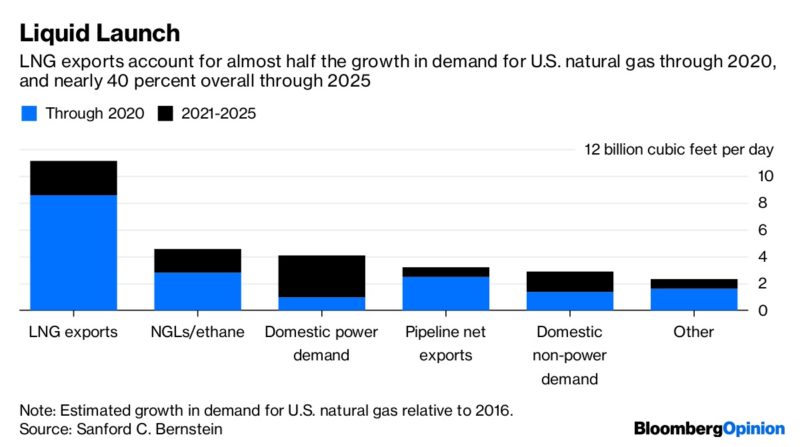

Just as raising the crude-oil export restriction assisted ease a comparable trouble in oil a number of years back, so the capability to obtain gas to the Gulf Coast as well as deliver it globally is an important getaway shutoff right here. In an evaluation released in May, Sanford C. Bernstein approximated that increasing linked gas manufacturing– the large bulk of it from the Permian container– would certainly suffice to satisfy the majority of the rise in residential united state need as well as exports with 2025. And considered that united state gas need is hardly expanding– partially due to the fact that it remains in a blade battle with renewable resource in markets such as Texas as well as California– exports are essential:

Notice that the development in LNG exports hands over after 2020. That’s because, after the first wave of brand-new export capability has actually opened, there’s a void due to the fact that brand-new jobs have not yet obtained a last financial investment choice. Given that it takes 3 to 4 years to construct a brand-new incurable, those choices require to be made quickly if exports are to expand significantly in the very early 2020s.

Guess what could truly trouble a power exec considering starting on a multi-billion-dollar financial investment in a center developed for the single objective of global profession? And presume what could truly trouble a prospective profession companion considering perhaps authorizing a 20-year agreement with stated center?

Tariffs aren’t most likely to hinder united state LNG exports in the close to term, as freights can be changed in other places somewhat. But if this profession battle is prolonged, after that the mix of reduced margins, likely reduced use of terminals as well as the darkness hanging over profession plan generally is a solid deterrent to anybody thinking about funding or having with brand-new united state capability. China is, besides, anticipated to represent virtually half the development in worldwide LNG need over the following 5 years, as well as a fifth with 2030.

In considering on united state competition, tolls would certainly additionally urge competing manufacturers to purchase brand-new capability. “If Qatar had any doubts about expanding, they won’t now,” states Marianne Kah, a previous principal financial expert of ConocoPhillips, currently on the board of advisers of the Columbia Center on Global Energy Policy.

We are presently seeing a short-term downturn in oil-production development from the Permian container because of poor oil pipe capability. But that can drag out much longer if there’s no area for excess gas to go. The old choice of flaring it as well as supplying a Texan light program for astronauts is no more tenable.

Tariffs, birthed of a plan of supremacy, might eventually put on hold that for America’s gas manufacturers. Just bear in mind a lot of them additionally take place to drain an additional item for which, likewise, desire for supremacy can backfire.

Liam Denning is a Bloomberg Opinion reporter covering power, mining as well as products. He formerly was editor of the Wall Street Journal’s Heard on the Street column as well as composed for the Financial Times’ Lex column. He was additionally a financial investment lender.

© 2018 Bloomberg L.P