Container Equipment Prices Have Peaked And Are Expected To Moderate: Drewry

Prices of completely dry products delivery containers have actually folded the previous year to get to historical highs however will certainly regulate over the following couple of years, according Drewry’s lately released Container Census & & Leasing Annual Review as well asForecast 2021/22 record.

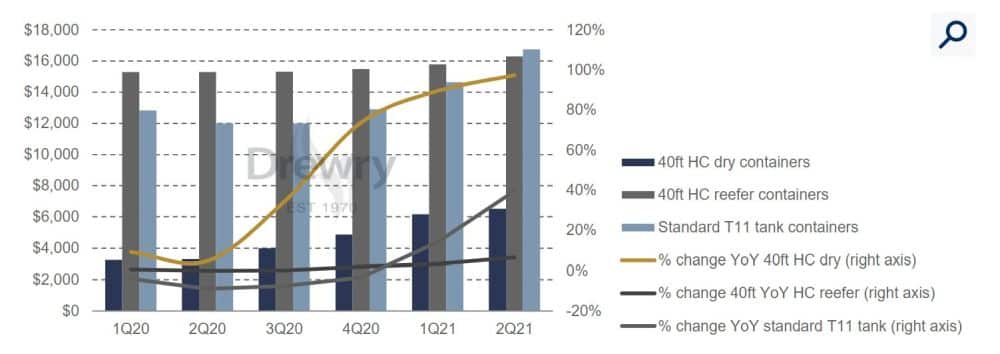

Dry box newbuild costs rallied highly in 2020 from the lows of the previous year to reach their highest degree considering that 2011 by the 4th quarter, with a YoY gain of 75%. Then by 2Q21 40ft high dice containers breached the $6,500 limit, greater than folding the year, to reach their greatest worth considering that Drewry began keeping an eye on container tools costs back as for 1998.

“Pricing has been driven by soaring demand for newbuild containers as shipping lines and lessors have been seeking to rebuild fleets in the face of chronic equipment availability due to widening disruption across the container supply chain,” claimed John Fossey, Head of Container Equipment & & Leasing Research atDrewry “But also increased input costs, particularly for Corten steel and flooring materials have also played a part. We expect dry box prices to peak in the third quarter and to soften thereafter, easing further over subsequent years as trade normalises.”

Image Credits: DrewryShipping–Twitter

In sharp comparison, reefer as well as storage tank container costs transformed little bit over 2020, however rallied in the initial 6 months of 2021, up 6.5% as well as 40% YoY, specifically, in 2Q21. Prices of these professional container kinds have various expense chauffeurs to completely dry containers as well as are anticipated to proceed increasing although at a modest speed over the following couple of years.

Annualised newbuild completely dry, reefer as well as storage tank container costs

Click Image To Enlarge|Source: Drewry’s Container Census & & Leasing Annual Review as well as Forecast 2021/22; Drewry’s Container Equipment Forecaster 2Q21

Newbuild container outcome has actually risen with the initial 6 months of 2021, with China completely dry box outcome climbing up 235% YoY to 3 million teu as well as reefer manufacturing greater than increasing to 260,000. Drewry anticipates full-year manufacturing to get to 5.2 million teu, standing for a 67% YoY increase. The primary customers of this tools have actually been owners, making up 68% of newbuild acquisitions. But Drewry anticipates service providers to spend much more in their very own container swimming pools over the close to term offered their much enhanced degrees of earnings.

Despite document newbuild outcome, pressing need for tools increased exercise of the rented fleet throughout all tools kinds to over 99% by the 2nd quarter of 2021, its highest degree on document. This drove completely dry box LTL daily prices to their highest degree in ten years, folding the year, bringing financial investment money returns (ICRs) back to pre-pandemic degrees.

“Looking ahead, dry box per diems are forecast to rally 65% in 2021, the steepest rise since Drewry started recording lease rates in 1990,” includedFossey “This acceleration will outpace that of newbuild prices as the lagging effect means that lease rates will stay higher for longer, lifting ICRs further. But thereafter we expect some softening of returns.”

Reference: drewry.co.uk

Marine Insight does not have the civil liberties of the video clip.