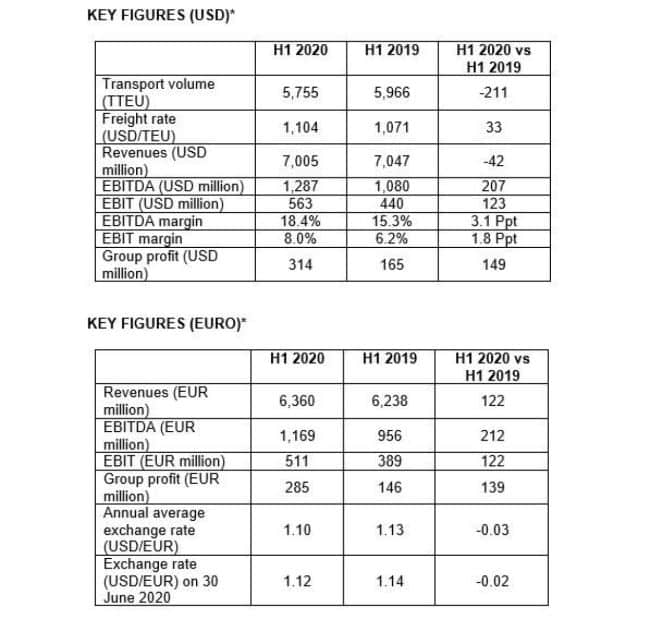

Hapag-Lloyd has actually ended the initial fifty percent of the year 2020 with incomes prior to passion as well as tax obligations (EBIT) of USD 563 million (EUR 511 million), consequently going beyond the prior-year number of USD 440 million (EUR 389 million). The Group revenue boosted to USD 314 million (EUR 285 million). At the very same time, incomes prior to passion, tax obligations, devaluation as well as amortisation (EBITDA) increased to USD 1.29 billion (EUR 1.17 billion).

“After the year got off to a decent start, transport volumes significantly declined in the second quarter as a result of the COVID-19 pandemic. We benefitted from the sudden drop in bunker prices, adjusted capacity to lower demand and took additional cost-cutting measures as part of our Performance Safeguarding Program. On the whole, we have a good first half year behind us despite the coronavirus crisis,” stated Rolf Habben Jansen, Chief Executive Officer of Hapag-Lloyd AG.

Revenues in the initial half year of 2020 stood at around USD 7.0 billion (EUR 6.4 billion), much less than 1 percent listed below the prior-year degree. This can largely be credited to the reality that transportation quantities reduced by around 4 percent, to approximately 5.8 million TEU.

Image Credits: hapag-lloyd. com

While transportation quantities were still a little raised in the initial quarter, the 2nd quarter saw a decrease of approximately 11% contrasted to the prior-year duration as an outcome of the pandemic. The typical products price in H1 2020 a little boosted to USD 1,104 USD/TEU.

Transport costs were about 4 percent listed below the equivalent number for the previous year. An typical shelter rate of USD 448 per tonne, which is around 4 percent greater than it remained in the prior-year duration owing to the intro of the IMO 2020 gas law, was balanced out by favorable results from a volume-related decrease in transportation costs as well as energetic price administration arising from the PSP actions. In enhancement, the dramatically decreasing shelter rates in the 2nd quarter had a favorable effect on Hapag-Lloyd’s incomes.

The cost-free capital was once more extremely favorable, at USD 1.2 billion (EUR 1.1 billion). The liquidity book was substantially raised in the initial fifty percent of the year as energetic actions were required to additional enhance the liquidity placement as component of the Performance Safeguarding Program, as well as it stood at around USD 1.9 billion (EUR 1.7 billion) at the end of June.

Image Credits: hapag-lloyd. com

Rolf Habben Jansen: “Thanks to the wide range of measures we have introduced in recent months, we are still on track. Our focus will remain on the safety and health of our employees, but naturally also on safeguarding the supply chains of our customers worldwide. We will continue to advance our Performance Safeguarding Program and to implement our Strategy 2023. While doing so, we will keep a close eye on the future course of the COVID-19 pandemic and flexibly react to market changes. On the whole, the pandemic is and will remain a major source of uncertainty for the entire logistics industry.”

Looking in advance, the outcomes projection stays unmodified. For the present fiscal year, Hapag-Lloyd anticipates an EBITDA of EUR 1.7 to 2.2 billion as well as an EBIT of EUR 0.5 to 1.0 billion. Given the COVID-19 pandemic as well as the financial consequences it has actually had in numerous components of the globe, the projection will certainly continue to be based on substantial unpredictability. In enhancement to the advancement of transportation quantities, the advancement of products prices as well as a more possible rise in shelter rates, particularly, ought to have a substantial effect on Hapag-Lloyd’s lead to the 2nd fifty percent of the 2020 fiscal year.

Reference: hapag-lloyd. com