As Russian soldiers generated at the boundary with Eastern Ukraine last month and also hostilities began on February 26th, the MR Atlantic Basket (approximately products prices on crucial paths in the Atlantic Basin) climbed up continuously from a January 25th low of $5,032 daily to a present year-to-date high of $18,649 daily.

Ship- tracking information from satellite and also land-based resources verifies this results from an action up sought after. Laden ton-miles for MR2 Tankers, one of the most heavily populated sort of ship for the carriage of fine-tuned oil items, sped up from 4% (year-to-date, year-on-year development) in mid-February to 7% today.

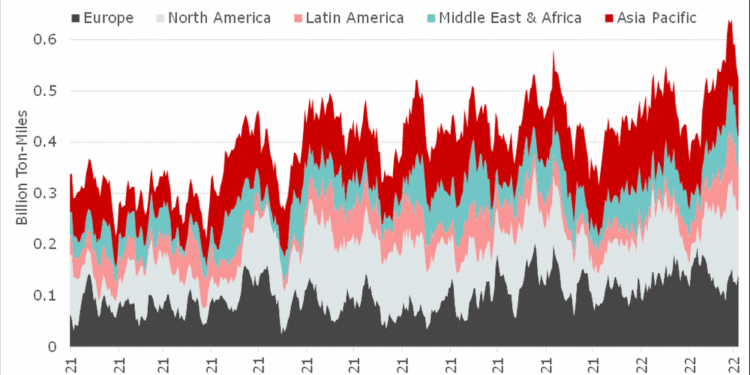

The rise in products prices was driven by imports right intoNorthwest Europe As received Figure 1 listed below, filled ton-miles right into the area were currently on a climbing fad as the economic climate and also oil costs recuperated from clinically depressed degrees a year back. However, as the situation intensified, need increased to degrees much over the top end of its historic variety.

The reasons are twofold. Firstly, Russia, using ports in the Baltic and also Black Seas, is a significant provider of diesel and also center extracts to European oil markets. Although not yet formally approved, oil business and also investors have actually been virtually entirely reluctant to get Russian freights because of increased political, lawful, and also reputational threats, along with useful problems such as getting letter-of-credit funding from Western financial institutions. This, on its own, would certainly leave a huge shortage of diesel inEurope Secondly, regardless of wholesale costs for diesel and also center extracts climbing up a lot more considerably than those for petroleum in Europe, the spiralling price of gas, whereby refineries are powered, has actually implied that European refiners are incapable to capitalize on broadening margins and also have actually rather reduced runs. This has actually worsened the initial result to leave European oil markets except numerous items and also especially except diesel.

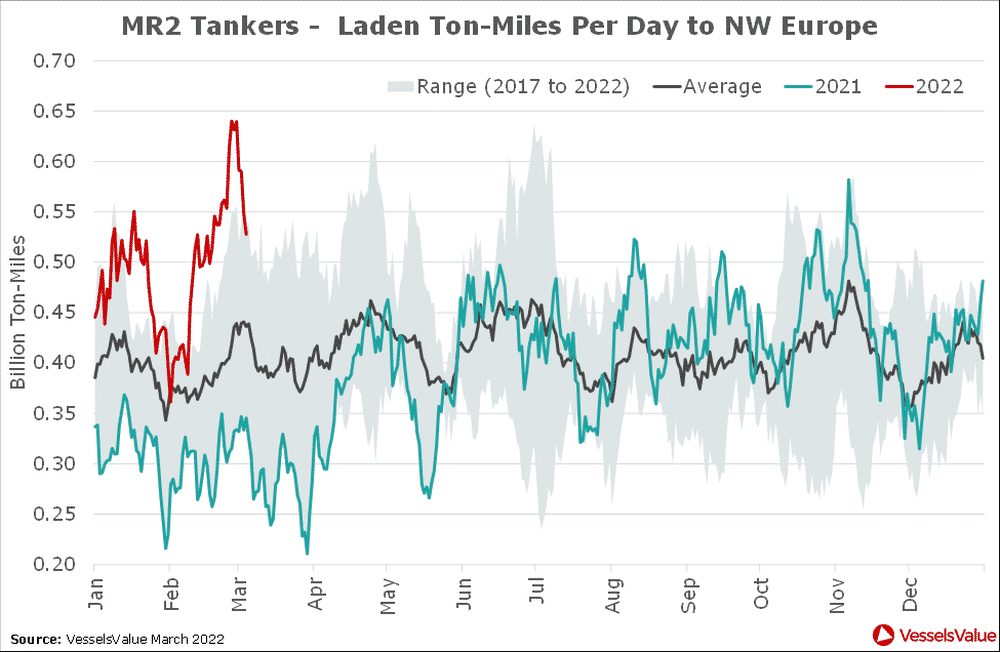

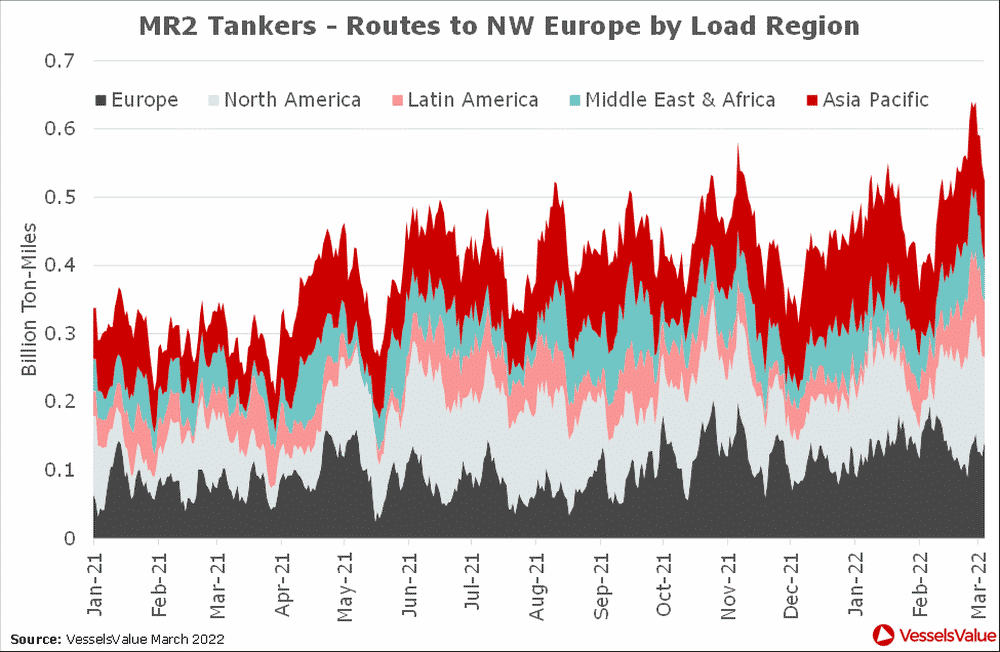

As received Figure 2, ton-mile need has actually sped up on paths right into Northwest Europe from all significant tons areas. Particularly appealing is a 67% surge in ton-miles from North America (year-to-date, year-on-year) and also a 76% surge fromAsia Pacific The previous is driven generally by deliveries from refiners on the United States East Coast, while the last is driven by those from local refining and also storage space center, Singapore.

The result on products prices in the Atlantic is more worsened by a decrease in delivery ability. Due to the long-term “dieselization” of Europe’s car fleet, about the United States, the previous often tends to be brief diesel however lengthy fuel, while the last is the contrary. While markets are operating typically, this develops a countertrade, however as refiners reduce throughputs in Europe, the information reveals filled ton-miles on the reverse leg from Europe to the United States East Coast have actually slowed down. The laden/ballast proportion in the Atlantic has actually dropped and also the Product Tanker fleet has, effectively, end up being much less effective.

While the dispute continues, it is tough to envision a near-term circumstance in which any one of these fads opposite: European oil purchasers return to acquisitions of Russian diesel, gas costs normalise, or European refiners begin performing at complete ability. Hence, it promises that need for delivery fine-tuned oil items will certainly continue at these raised degrees and also delivery ability will certainly be constricted by a reduced laden/ballast proportion. The MR Atlantic Basket ought to a minimum of hold its current gains, otherwise press also greater.