Drewry: History Repeating Itself with Container Shipping’s Continued Addiction to Ships

Despite constructive development momentum, the container delivery trade continues to endure new, massive ship deliveries with no let-up to the ordering frenzy, in accordance with a brand new report revealed by Drewry Maritime Research.

In their report, title Container Forecaster, Drewry forecasts one other 12 months of extra development in relation to demand in 2015, which can make it tougher for carriers to repeat the estimated 92% load elements throughout the primary headhaul East-West commerce lanes achieved in 2014, the report says.

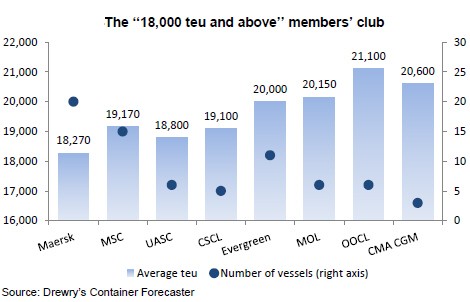

New orders for Ultra Large Container of at the very least 18,000 TEU are pushing again the date when provide and demand might be anticipated to satisfy, and on the particular person commerce route degree that is now seemingly unachievable, Drewry says.

Since January, the trade has ordered round 40 ULCVs, primarily for 2017 supply, not together with any provision for Maersk and Cosco orders but to be finalized.

“The industry paid a heavy price for the huge ordering it undertook in 2006/07 and it seems that four years after Maersk spent $3.8 billion on its Triple Es, history is repeating and many lines are entering or are about to enter this now not so exclusive club. The one difference this time around is that the operational agreements should mean that not all top 20 lines will make this big step”, feedback Neil Dekker, director of container analysis at Drewry.

One constructive for the trade is the latest decision on the US West Coast between the PMA and the ILWU, Drewry notes within the report. However, Drewry estimates are that it price a mixed $150 million over the last three months of 2014, with out considering the related provide chain impression.

The 30% fall in bunker costs has additionally been an surprising boon for the trade, however most carriers nonetheless recorded decrease common freight charges final 12 months, Drewry reviews. Irrespective of decrease bunker adjustment elements, Drewry asks why did the sturdy load elements not align with enhancing freight charges given the fixed month-to-month normal price will increase from the carriers? Drewry says that this reveals there may be nonetheless a disconnect within the trade and the newest indicators in 2015 spotlight that spot freight charges are in critical decline. The commerce route balances stay very fragile. Current spot charges of $1,000 per feu from Asia to North Europe are under break-even ranges for the carriers and constant declines over the past ten weeks will concern quantity shippers which have signed up for increased contract charges this 12 months.

While Chinese New Year interval tends to skew quantity comparisons, the supply of over 60 ULCVs this 12 months with a median nominal capability of over 15,000 teu will trigger a headache for commerce route managers, Drewry says, and the underperformance of the trades to East Coast South America is one other concern for the worldwide cascade of vessels over 8,000 teu.

“The decision by Maersk and MSC to downgrade the average size of ships on one of their European strings to the East Coast of South America from 9,000 teu to 5,500 teu may not seem particularly important in the grand scheme of things. But all ocean carriers have argued that deploying new and big ships across every trade route is strategically critical. This is the first sign that on routes where trade growth is weak, the lower slot cost per unit argument is simply not enough because freight rates dive to well below sub-economic levels”, highlights Dekker.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content material, insider opinions, and vibrant neighborhood discussions.