Drewry: Light at the End of the Tunnel for the Multipurpose Shipping Market

(Drewry)– Following one more bad year for multi-purpose delivery with additional disintegration of prices making it the most awful market in over one decade, indicators of healing are currently noticeable with energy anticipated to construct over the following couple of years, according to the current Multipurpose Shipping Market Annual Review and Forecast 2017 record released by international delivery working as a consultant Drewry.

Dry freight need is anticipated to expand by around 3% in 2018, however within that number it is the marketplace share offered to multi-purpose vessels which is extra intriguing. Drewry approximates that the multi-purpose (MPV) share of mass sell the height year of 2007 had to do with 17%, while the share of basic freight professions was nearer 20%. Over the interfering duration, both these shares have actually worn down and also we approximate the mass freight share for 2016 to be nearer 14% and also 12% for basic freight. However, Drewry thinks that this is all-time low of this specific cycle which the MPV market share in both locations must boost, albeit partially, over the following 5 years. Although MPV need dropped somewhat over 2016 contrasted to 2015, it is anticipated to expand at a typical yearly price of 3.4% to 2021.

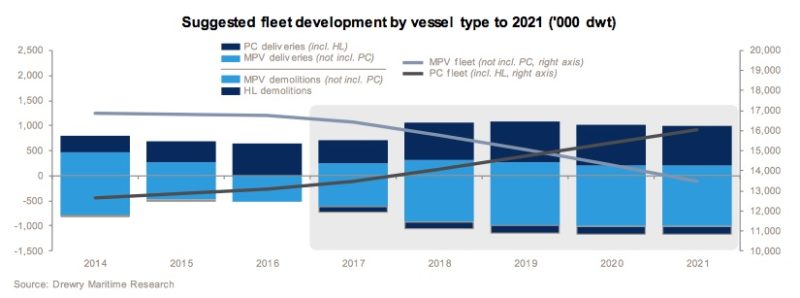

On the opposite of the formula vessel supply is anticipated to agreement over the exact same duration, albeit by just 0.1%. However, for both newbuilding orders and also demolition task there is a huge distinction in between easy MPV and also job service providers. Over the last 5 years the portion of job service providers being supplied to the fleet has actually climbed to a typical 58%. However, in 2016 a shocking 93% of all newbuildings had heavylift capacity, seeming a fatality knell for the easy MPV fleet.

With concerning 63% of the orderbook proclaiming heavylift capacity, the future decrease of the easy MPV area of the fleet is practically ensured. There is really little, if any kind of, brand-new financial investment in this field with those brand-new orders without lift ability viewed as easy substitutes for an aging fleet. Owners are taking considerable choices to construct greater spec vessels with larger lift ability, in order to provide a benefit in the terrible market.

“Drewry expects to see a decline of almost 4% in the ‘simple’ MPV fleet to 2018, balanced against growth of 4% in the project carrier fleet,” remarks Susan Oatway, lead expert for multi-purpose delivery at Drewry.

“Add these two together and you get an improving supply and demand balance. We expect to see only a slight improvement in the market over 2017 with rate rises gathering momentum after 2018. For the larger sectors, which have a bigger correlation to Handysize rates, there could be a more significant uptick in 2017 before rates settle over 2018,” included Oatway.