The well-documented trough in Dry Bulk incomes in 2020 is anticipated to turn around. Vessel sValue’s brand-new Forecast Earnings component in collaboration with ViaMar AS reveals a hopeful overview from mid-2020 throughout the Dry Bulk field. Capesize incomes, particularly, are anticipated to enhance sixfold in the following 6 months, from USD 5,000 each day to USD 30,000 pd by October 2020.

Where are we currently?

The previous year have actually seen weak Dry Bulk, as well as particularly Capesize, principles.

On the need side, the Brazilian dam collapse of April 2019 integrated with a decrease in facilities as well as power usage because of Chinese New Year as well as COVID-19, has actually caused a continual depression.

Image Credits: Vessel sValue.com

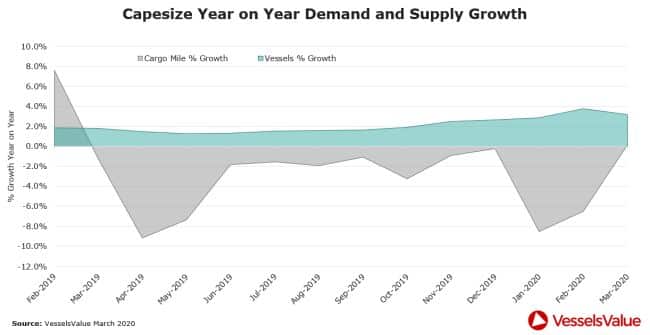

The listed below graph reveals the previous year of Capesize supply as well as need development. As can be seen, in 2019 as well as 2020 up until now, fleet development surpassed need development, causing an unwanted of vessel supply as well as the current bad markets.

Some excellent information is that eliminations from the Capesize fleet came to a head in very early 2020.

Year to day, 25 Capesize vessels were cost demolition contrasted to just 10 systems in YTD 2019 as well as 7 systems in YTD 2018. High degrees of recycling has actually lowered tonnage supply yet present closures of damaging backyards in the Indian subcontinent because of COVID-19 will briefly ice up additional eliminations. We anticipate to see a considerable rise of eliminations on resuming of damaging backyards in June– July 2020.

What do we anticipate?

Vessel sValue currently uses Forecast Earnings, along with Forecast Values, for the Bulker, Tanker, Container as well as LPG industries.

In the Capesize field we anticipate incomes of USD 30,000 pd in Q3 of this year as well as incomes in a variety of USD 20,000– 35,000 pd over the following 3 years. These forecasts are based upon modelled evaluation of Vessel sValue AIS Trade, Fleet as well as Vessel application information.

Image Credits: Vessel sValue.com

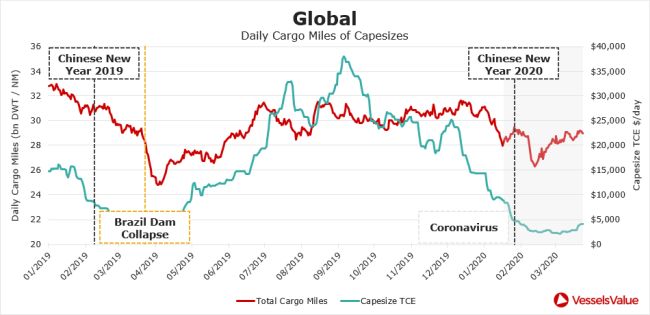

In regards to present need fads, the graph listed below programs the freight miles of Capesize in red, plainly revealing the current healing in Capesize freight miles to close to degrees seen in the previous year as well as proceeded upwards trajectory (for recommendation the Capesize TCE is likewise received environment-friendly).

We anticipate an extension of this international need development. At completion of February the Chinese rural federal governments presented financial investment jobs worth 24.7 tr yuan, approximately 25% of their 2019 GDP. This stimulation bundle will certainly bring about significantly solid need for steel as well as power as well as a tightening up completely dry mass supply need equilibrium. The stimulation bundle will certainly remain to sustain completely dry bulk need development completely to surpass supply development over the following 3 years, as well as the completely dry mass market as well as products prices will certainly remain to increase throughout 2021 as well as 2022.

Additionally, unpredictabilities bordering the COVID-19 pandemic, the profession battle as well as volatility in oil rates are regulating service choices being made in the very first fifty percent of 2020 as well as care will certainly be taken. Shipyard need, currently dealing with obstacles from upcoming policies as well as geopolitics, will likely run into a more impact provided the large present disturbances to financial development as well as profession internationally. As an outcome, the international orderbook has actually relocated also lower, as well as we predict an extension of that advancement.