Equinor Acquires a 40% Stake in Undeveloped Rosebank Project in UK Waters

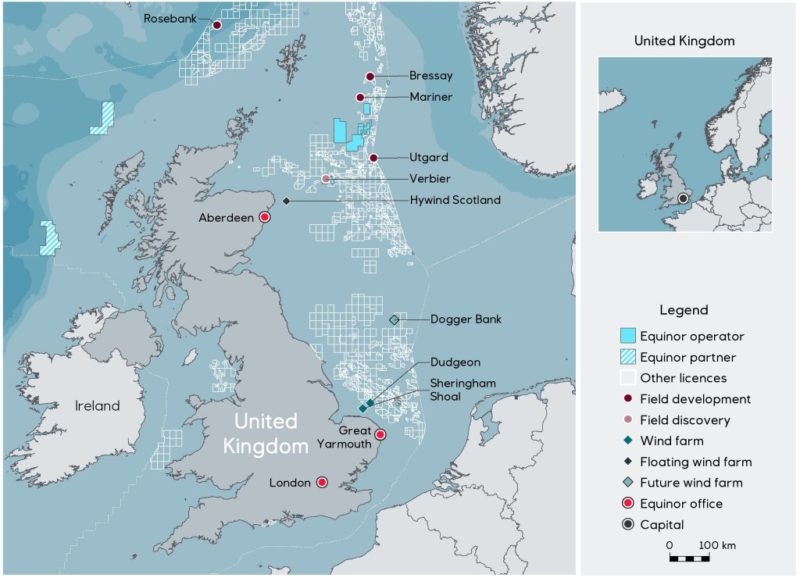

Norwegian power titan Equinor has actually authorized an arrangement to get Chevron’s 40% ran passion in the Rosebank task, among the biggest primitive areas on the UK Continental Shelf (UKCS).

The Rosebank area was found in 2004 as well as lies concerning 130 kilometres northwest of the Shetland Islands in water midsts of around 1,110 m. The various other companions in the area are Suncor Energy (40%) as well as Siccar Point Energy (20%).

“We look forward to becoming the operator of the Rosebank project. We have a proven track record of high value field developments across the North Sea and will now be able to deploy this experience on a new project in the UK. Today’s agreement allows us to buy back into an asset in which we previously had a participating interest, demonstrating our strategy of creating value through oil price cycles. The acquisition of Rosebank complements our portfolio of oil, gas and wind assets in this country, in line with our strategy as a broad energy company. This new investment underlines Equinor’s commitment to be a reliable, secure energy partner for the UK,” states Al Cook, Equinor’s exec vice head of state for worldwide technique & & company growth as well as UK nation supervisor.

Equinor transformed its name from Statoil ASA previously this year to show the diversity of its power profile in the direction of eco-friendly resources.

Once ended, the deal will certainly even more reinforce Equinor’s profile jobs in the UK, where it is amongst the biggest vendors of petroleum as well as gas. Its profile consists of the Mariner growth, eye-catching expedition chances as well as 3 creating overseas wind ranches.

“With Rosebank, a standalone development in the underexplored West of Shetland region, we strengthen our upstream portfolio, which also includes Mariner, one of the largest investments on the UKCS in over a decade. As we have done with other projects in our portfolio, such as Johan Castberg and Bay du Nord, we intend to leverage our experience and competence to create further value in Rosebank, in alignment with the UK Government’s priority of maximising the economic recovery of the UKCS,” states Hedda Felin, Equinor’s elderly vice head of state for UK & & Ireland offshore.

The deal is still based on popular closing problems.

The industrial regards to the arrangement have actually not been divulged.