Energy firms have actually been lowering expedition and also manufacturing budget plans considering that the Covid -19 pandemic held and also sent out oil costs toppling, however, with couple of successful financial investment choices, drivers are currently most likely to enhance costs in deactivating job. Rystad Energy approximates the overall worth of the worldwide swimming pool of deactivating jobs that will certainly collect with 2024 can get to $42 billion.

With a typical property age of 25 years, the Northwest European deactivating market can expand 20% in yearly dedications with 2022 if the present reduced oil costs do not reveal indications of considerable healing quickly. In enhancement to a quickly developing property base and also reduced oil costs that deteriorate industrial practicality and also possible life expansions, the North Sea deactivating market will certainly additionally be assisted by beneficial solution agreement costs.

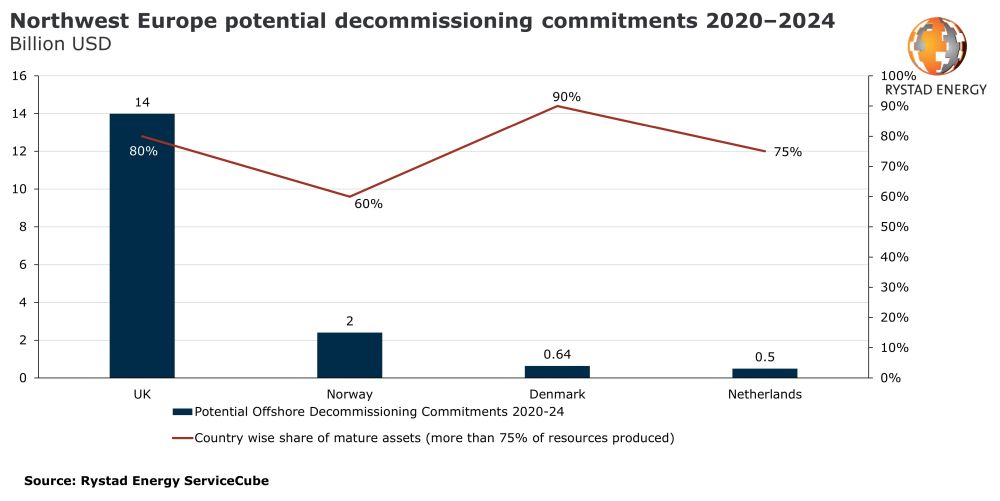

Only concerning 15% of North Sea possessions have actually been deactivated to day, however in the coming 5 years we anticipate approximately 23 possessions to stop manufacturing each year. The UK is positioned to blaze a trail with virtually 80% of overall approximated expense on Northwest European deactivating in the following 5 years, complied with by Norway with 14% and also Denmark with 4%. The swimming pool of elimination jobs in the area for that duration is approximated at concerning $17 billion. By contrast, deactivating expenses in the United States for the exact same duration are approximated at $5.7 billion.

Click To Enlarge

Stay as much as day and also obtain prompt e-mail alert when we release COVID-19 associated records and also s. Sign up right here

“A protracted low price environment can potentially motivate operators to leverage low contract prices and commit to their asset retirement obligations, thus spurring decommissioning activity in the Northwest Europe region. This will also provide welcome opportunities for contractors in an otherwise gloomy oilfield services market,” states Sumit Yadev, power solution expert at Rystad Energy.

Learn much more in Rystad Energy’s ServiceCube.

The high market share of the UK can be mainly credited to its quickly developing manufacturing degrees, as virtually 80% of the nation’s oil and also gas possessions have actually generated greater than 75% of their readily available sources. Additionally, uninspired expedition outcomes, expanding governing stringency and also an extended reduced oil rate atmosphere might lead drivers to satisfy their property retired life commitments in the lack of any kind of financially rewarding completing financial investments.

Some of the leading possessions that will certainly drive the deactivating market in the area consist of the Brent, Ninian and also Thistle areas in the UK and also Gyda inNorway Shell’s Brent job would certainly become the solitary biggest property ever before deactivated around the world, standing for an investment of virtually $3 billion alone over the coming years. Ninian and also Gyda would jointly offer having chances worth virtually $2 billion.

The boosted costs on deactivating might restrict the space for drivers to buy various other sectors such as expedition, advancement and also improved oil healing jobs. Leading gamers such as Shell, Total, Repsol and also Premier Oil are anticipated to appoint 10% or even more of their North Sea costs in the following 5 years to deactivating tasks.

Plugging and also desertion (P&A) of wells is anticipated to comprise concerning 45% of deactivating expenses through, complied with by system eliminations, which make up virtually 20% of the overall expenses. Platform wells are readied to be the leading sector for well P&A task, comprising concerning 65% of the overall wells to be deserted, while the remainder are subsea wells. However, in regards to expenses, subsea wells will certainly take the lead as they set you back typically $11 million each to desert, compared to $5 million for a typical system well.

The reduced oil costs can play a crucial duty in improving deactivating costs in the UK if they continue past completion of this year. Nearly 10% of all UK overseas possessions have raising expenses over $25 per barrel, which will certainly obstruct their life expansion potential customers and also make deactivating a far better monetary alternative if low cost continue.

Operators carried out solid price optimization steps after the oil rate accident of 2014 and also consequently have little space for more price and also effectiveness gains currently, which might additionally quicken deactivating costs.

Overall, greater than 2,500 oil and also gas wells are anticipated to be deactivated throughout the North Sea in the coming years, of which 1,500 remain in the UK. The UKCS will certainly additionally witness the elimination of virtually 300,000 tonnes of topsides in the following 5 years, with virtually 50 topsides readied to be deactivated, standing for a typical topside elimination price of $5,300 per tonne. Additionally, virtually 100,000 tonnes of bases are anticipated to be gotten rid of in UK waters. In line with the wider North Sea patterns, system wells are anticipated to make up the mass of the well P&A task with virtually 70%.

“While decommissioning is becoming a pressing concern for North Sea operators, the prevailing low-price environment presents an opportunity for driving down costs. For instance, after the oil price slump of 2014, rig and vessel rates declined by 30% to 40%. We expect rig and vessel rates to exhibit a downward trend this time as well, with declines likely lasting until 2022,” Yadev ends.

For much more evaluation, understandings and also records, customers and also non-clients can obtain accessibility to Rystad Energy’s Free Solutions and also obtain a preference of our information and also analytics cosmos.

Reference: rystadenergy.com