Gulf of Oman Tanker Attacks Threaten LNG Shipments Too

By Liam Denning (Bloomberg Opinion)–News of even more strange vessel strikes, this time around in the Gulf of Oman, had their foreseeable result on (or else drab) oil costs Thursday early morning. But there’s one more gas that layers those struggling waters: melted gas, or LNG. What might contrast, or the danger of it, imply for among the fastest expanding littles the power organization?

The Middle East represent 29% of international LNG exports, fixated Qatar (the globe’s biggest merchant in 2018), Oman and also theUnited Arab Emirates Exports from Qatar and also the U.A.E. needs to transportation the Strait of Hormuz, the chokepoint near where both vessels were struck.

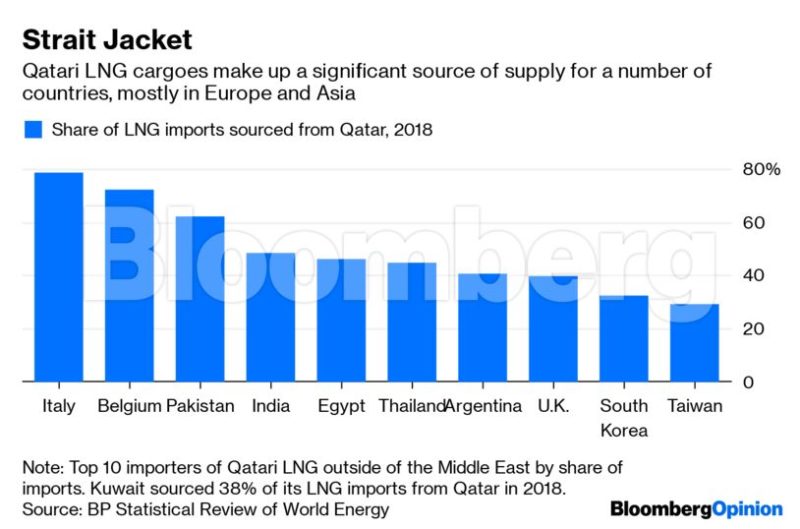

In concept, an extensive problem along the lines of the supposed vessel battle of the 1980s can have a significant influence on the LNG profession. Just over 26% of all LNG freights went through the Strait of Hormuz in 2018, according to information from BP Plc, near to the approximately 30% of oil moves approximated by theEnergy Information Administration Qatar represent the large bulk of those– and also a big percentage of the imports taken by a variety of nations outside the area:

Besides interdicted freights of LNG, the most likely comparable influence on oil vessels would certainly additionally increase LNG costs, as several supply agreements are indexed to oil.

As my coworker Julian Lee composes here, beyond a wider battle, Iran has little to obtain from introducing a full-blown vessel battle that would certainly interrupt what remains of its very own sanctions-hit power profession and also would certainly welcome the devastating focus of the united stateNavy Even so, the danger of problem or erratic strikes similar to this can still have an influence on the LNG market.

LNG is the engine driving bullishness in the international gas profession. Roughly 40% of the development in international gas manufacturing with 2040 will certainly include circulations relocating in between various areas, according to BP’s most current forecasts. Of that profession, LNG is anticipated to make up greater than 2 thirds– and also China, India et cetera of Asia control.

For China, climbing LNG imports provide a means to suppress dependence on coal and also its affiliated air pollution. From a tactical perspective, nevertheless, they stand for one more leg of climbing energy-import reliance– for a nation that wasn’t exactly thrilled concerning that also prior to it got involved in a profession battle with the united state China currently depends on imports to satisfy greater than 70% of its oil need– a greater percentage than the united state also at its height reliance in 2005– and also the nation completely satisfied concerning 44% of its gas need using imports in 2018. The last appearances particular to climb on present fads.

As Stephen O’Sullivan composes in a current report for the Oxford Institute of Energy Studies, China’s import reliance for oil is alleviated by the reality that oil is extra fungible which Beijing has actually currently equipped a big calculated book of it. The greatest comparison with gas, nevertheless, is timing:

The distinction in between climbing oil import reliance and also climbing gas import reliance might connect, most of all, to a comparison in between the international political setting when China’s oil imports were originally climbing highly one decade back and also the present political setting when the very same quantity development has actually held true of gas. Clearly the circumstance is extra laden than a years back.

LNG has actually currently been captured up in the profession altercation, with China having actually enforced a toll on united state LNG freights. This successfully shuts off a crucial method for China to expand its LNG imports, the key methods of handling boosting import reliance.

This altering setting can cool China’s cravings for even more LNG freights– which can improve the power expectation in several measurements.

Most undoubtedly, if Qatari and also united state freights are much less preferable, then that aids various other possible distributors. Apart from those in the area, such as Australia and also Malaysia, advancement tasks in eastern Africa can profit, as would certainly long-stalled intend on Canada’s Pacific shore. Argentina, with its very own shale-gas field, can additionally profit, with Wood Mackenzie explaining the nation’s peak possible LNG manufacturing in the summer season would certainly accompany solid winter months need from energies in Asia.

Equally, however, even more piped gas from Russia and also main Asia, in addition to Russian LNG, would possibly look extra appealing. The Power of Siberia pipe results from begin shipments to China quickly, and also calculated factors to consider can understandably tip the ranges on a 2nd line. Notably, Chinese customers have actually consented to take a 20% risk in Novatek PJSC’s LNG task on Russia’s Arctic shore– a bargain revealed just a number of months back, after the toll fight with the united state started.

More significantly, however, China can well determine to take care of its direct exposure to possibly undependable LNG freights by calling back dependence on gas generally. That can reduce a number of means. Renewable power, generated locally and also reinforcing China’s very own commercial base, is one apparent possible recipient. Tempering such hopes, nevertheless, is the reality that, in spite of an enter renewable-energy manufacturing in China in 2014, the nation additionally made up 30% of the development in international intake of one more residential gas resource it has in wealth: coal. The very same tale holds for India, one more fast-growing market reliant on Qatar for a great deal of LNG.

Either method, this accesses one of the most destructive facet of also a simmering, instead of warm, problem. Geopolitics may create spikes in traded-energy costs in the close to term, yet has a tendency to dispirit intake over the longer term. A BP circumstance launched previously this year speculated a roll-back in globalization would in fact strike gas-demand development more challenging than one entailing an extra fast shift to reduced carbon power resources.

Yet that circumstance is beginning to play out currently. Besides possible disturbance in the Middle East, the profession battle and also America’s change towards an extra honestly mercantile position under the rubric of “energy dominance” stand for a basic break with the past. Only on Wednesday, President Donald Trump endangered assents versus Germany over the long-delayed Nord Stream 2 pipe, which he and also a large set in Congress think would certainly leave this small ally excessively based on Russian gas. The European Union should question just how much of this is driven by genuine worry for its power protection and also just how much owes to a need to export even more “molecules of U.S. freedom” throughout the Atlantic– specifically as Washington’s standoff with Tehran endangers a crucial LNG resource that minimizes Moscow’s power in the continent’s power market.

Oil’s standard, and also differing, geopolitical threat costs is the last point those LNG vessels ought to take onboard.

<< em>> © 2019 Bloomberg L.P.<