IMO’s Low Sulphur Fuel Regs Seen Cutting Demand for Canadian Oil

By Robert Tuttle (Bloomberg)–As if pipe traffic jams weren’t sufficient, Canadian hefty oil manufacturers are dealing with a brand-new obstacle to marketing their crude.

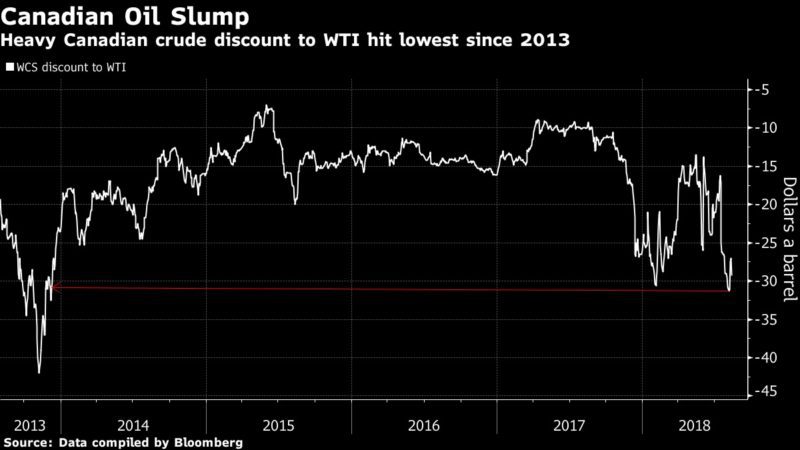

New policies restricting the quantity of sulfur allowed delivery gas is anticipated to reduce need for both high-sulfur gas oil as well as the sour crude that produces it. In Canada, that can expand– or get worse– the most significant cost depression in virtually 5 years.

As rising manufacturing tastes restricted pipe area, Western Canada Select’s price cut to West Texas Intermediate expanded to greater than $31 a barrel this month from approximately concerning $13 a barrel in 2014, information assembled by Bloomberg program. The larger price cut is required to incentivize delivery by rail, which sets you back a lot more, Kevin Birn, a supervisor on the North American petroleum markets group at IHS Markit, claimed in a phone meeting.

While the pipe traffic jam is anticipated to reduce up following year, a brand-new International Maritime Organization policy that enters into impact in 2020 will certainly maintain hefty crude at a discount rate of $31-$ 33 a barrel versus WTI, according to a July record by the Canadian Energy Research Institute, or CERI.

“We think you get a double whammy effect” in 2020, he claimed. “You have prices set by rail and, compounding that, is the IMO” policy.

Under the brand-new policies, ocean-going ships worldwide will certainly either need to set up costly, sulfur-removing scrubbers or make use of a gas that has 86 percent much less sulfur. The resulting boost sought after for lighter crude will certainly press a lot more unrefined towards the complicated North American refineries that presently transform hefty Canadian oil right into higher-value gas such as fuel as well as diesel, placing descending stress on hefty crude rates, according to CERI.

The policy adjustment will certainly come equally as Canadian manufacturers ought to be obtaining some alleviation in the type of better pipe accessibility to united state as well as global markets.

Enbridge Inc’s increased Line 3, is timetable to begin running in late 2019, supplying hefty oil from Alberta toWisconsin The C$ 9.3 billion ($ 7.1 billion) development of the Trans Mountain oil pipe from Alberta to the British Columbia shore is set up to begin concerning a year later on as well as TransCanada Corp.’s Keystone XL pipe waits for a last financial investment choice however can begin running early in the following years.

IMO Opportunity

There’s still factor for positive outlook, nevertheless, as reducing hefty oil manufacturing from strife-torn Venezuela as well as Mexico can assist elevate rates for Canada’s crude, Birn claimed.

The Alberta federal government’s promise previously this year of C$ 1 billion to partial updating tasks likewise might assist Canadian manufacturers get over the obstacles of the IMO policy, Dinara Millington, vice head of state of study at the CERI, claimed by phone.

Unlike huge complete upgraders, a smaller sized as well as less costly partial upgrader would certainly lighten the asphalt simply sufficient to ensure that it can move via pipes with little or no included condensate. Such plants can likewise eliminate contaminations like sulfur, Millington claimed. No such plants have actually been constructed in the oil sands yet as numerous partial updating innovations are still in onset of advancement.

Still, “the industry could take this challenge and turn it into an opportunity,” Millington claimed.

© 2018 Bloomberg L.P