Liner Carriers Firing Few Blanks As Trade Capacity Remains Tight In Q1 2021

Data from eeSea’s Blank Sailings Tracker is revealing that 1.7% as well as 0.6% of head haul cruisings on the 3 major East/West lining professions have actually been terminated in February as well as March 2021 specifically, contrasted to the 19.9% as well as 9.4% cruisings terminated in the very same months in 2014.

Very couple of cruisings have actually until now been terminated for the Q2 2021 duration, whereas in 2020, Q2 terminations totaled up to 14.7% of anticipated cruisings.

Simon Sundboell, Chief Executive Officer of maritime as well as supply chain knowledge firm eeSea, claimed: “In the first half of last year, blank sailings were widely considered as a way of managing capacity during the COVID-19 crisis. However, this is now being blamed for the unanticipated increase in freight rates and significant delays across the supply chain.”

Click To Enlarge

Commenting on the scenario, Sundboell claimed: “It is understandable that cargo owners are frustrated by the tight ocean capacity. The impact on their businesses is huge. But there seems to be an impression that carriers are deliberately holding back capacity to push up freight rates. We don’t see that.”

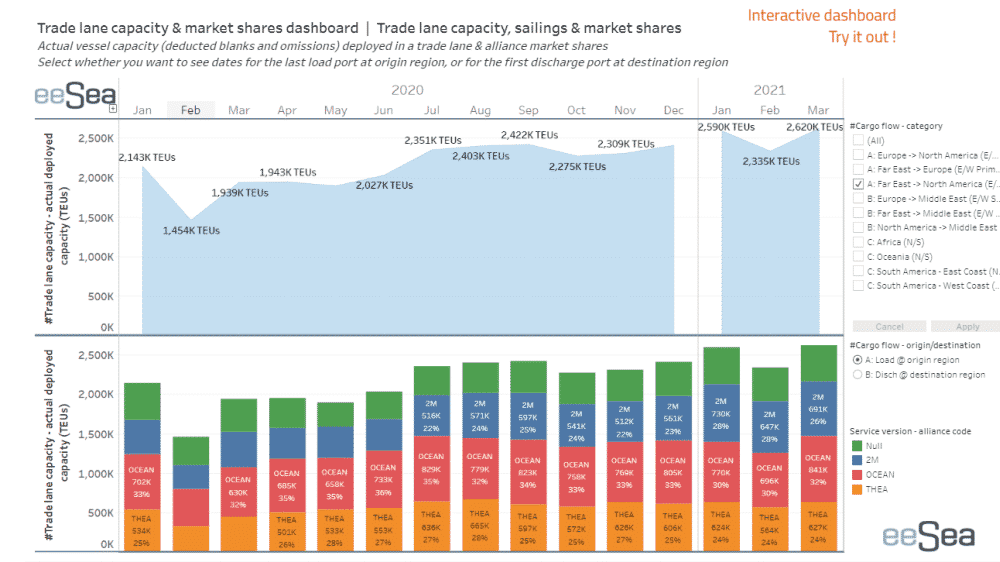

Analysis of eeSea’s Trade Capacity Index, which connects very closely to the Blank Sailings Tracker, performs in truth suggest a boost in profession capability contrasted to 2020 numbers.

On the 3 major East/West head transports, January’s reliable capability is up by 7.6% over the equivalent duration in 2020, with virtually the very same portion of empty cruisings. The information additionally reveals February as well as March are up by an incredible 34% as well as 17% specifically, partially owing to the reduced variety of terminations.

“We see that carriers are snapping up any available charter tonnage,” claimedSundboell “There is no idle capacity left, carriers are delaying scrapping, and the first new tonnage orders have even been placed.”

As profession capability as well as empty cruisings look readied to stay a vital emphasis this year, eeSea is making a variation of its real-time Trade Capacity Index as well as Blank Sailings Tracker openly readily available. Visitors to its site control panels will certainly have the ability to analyze different profession lanes, such as Far East-Europe, Transpacific or professions to/from the South American East Coast.

“At a granular trade and port-focused level, our Blank Sailings and Trade Capacity data can help cargo owners, ports, service providers and even the carriers themselves better anticipate any deviations from week to week.”