Look Back At 2020: The Headwinds, Tailwinds And Everything In Between

There is no question that 2020 has actually been a stormy year for industrial delivery. The coronavirus pandemic has actually drunk the worldwide maritime transportation. The pandemic waves have actually interfered with supply chains as well as freight moves throughout the globe. Global oil need was drastically struck. Tensions as well as disputes concerning oil manufacturing in between the Organization of the Petroleum Exporting Countries (OPEC) as well as its allies such as Russia (called OPEC+) aggravated the oil supply-demand discrepancy.

All of an abrupt, the globe was swamped with oil as well as was lacking area to place it causing a spike popular for vessels that acted as drifting storage space. While this stimulated some great information for the vessel market, when the drifting storage space boom finished, the products prices dropped. As completion of the year approaches, we assess the warm minutes of the industrial delivery sector, the rainy minutes, as well as all points in between.

How the delivery sector replied to a very unpredictable year

The coronavirus pandemic triggered a significant interruption throughout the worldwide economic climate. The collapse in oil need as well as brand-new lockdowns enforced by nations brought about a tremendously unpredictable year for the delivery market. Here is our market evaluation based upon The Signal Ocean Platform utilizing Signal Maritime’s information. We will certainly have a look precisely at a series of vessel sections as well as areas covering Crude Tankers, Product Tankers along with Dry vessels.

Dirty Tankers– VLCCs

In the filthy vessels section, TCE prices for VLCCs varied from highs to lows within a couple of months. This vessel section had a favorable energy in March as unrefined exports boosted driving VLCC need as well as products prices upwards. Following a remarkable collapse of OPEC+ conversations on March sixth where Russia reacted with “Nyet” to oil manufacturing cuts, Saudi Arabia introduced that it would certainly elevate its unrefined outcome as well as deal market discount rates. In the Arabian Gulf to Asia course, particularly, TCE for VLCCs got to a document high in mid-March at $243K as the need for VLCCs was high inRas Tanura Also, worries over a surplus of oil because of the delayed economic climate brought on by the pandemic forced investors to publication vessels as drifting storage space driving VLCC need additionally.

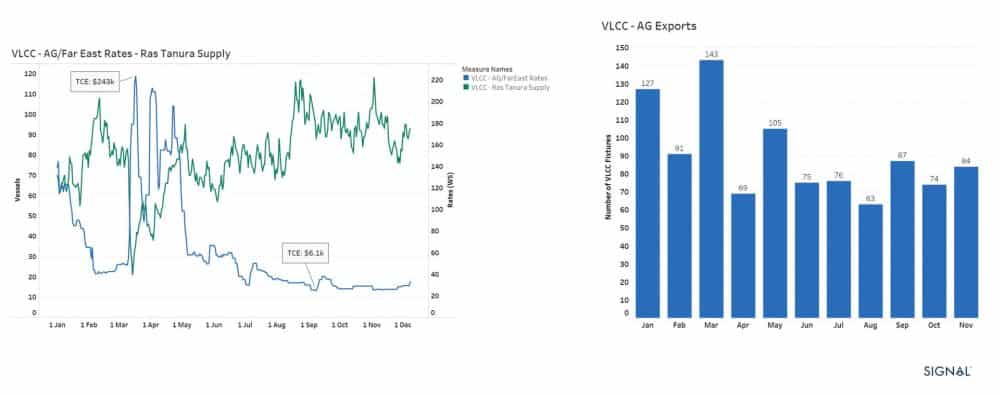

* VLCC supply prices as well as components. Arabian Gulf (AG), Ras Tanura, January-November 2020. TCE estimate for AG/Far East based upon Ras Tanura/Ningbo rounded trip with 2 still days Ras Tanura Supply Trend is based upon 16 days Laycan ahead, Available as well as Spot/Relet vessels|Click To Enlarge

The training course was turned around, nonetheless, throughout the 2nd fifty percent of the year with offered tonnage boosting as vessels were launched to the marketplace, minimizing products prices as well as shipowner profits. After a high of Worldscale 223 in Q1, prices went down as well as have actually stayed listed below Worldscale 60 from June viaNovember Freight prices bottomed at $6.1 K in September much listed below breakeven prices if one thinks about that operating budget alone normally vary in between $8-10K.

Let’s currently look at the general supply for VLCCs in theArabian Gulf Once we begin counting offered vessels, we see that for the initial fifty percent of the year, 70 vessels are offered typically each day, while for the 2nd fifty percent, ordinary supply raises to 90 vessels, standing for a boost of 28% in VLCC supply.

On the need side, VLCC components in the Arabian Gulf were solid in January, March as well as May varying in between 105 and143 components monthly however went down listed below 90 in the continuing to be months, with the most affordable variety of components for the year videotaped in August, with 63 taken care of VLCCs. Demand has actually visited concerning 24% for the 2nd fifty percent of the year.

Clean Tankers– LR2s

The tidy vessel section, as well as LR2s particularly, had an unsatisfactory beginning to the year in theArabian Gulf LR2s, nonetheless, saw an enormous boost in profits out of the exact same area in April with TCE increasing to $154k or simply north of Worldscale 500.

* LR2 supply prices as well as components. Arabian Gulf (AG), Jubail, January-November 2020. TCE estimate for AG is based upon Jubail/Yosu rounded trip with 2 still days. The Jubail Supply fad is based upon 10 days Laycan ahead, Available as well as Spot/Relet vessels|Click To Enlarge

The spike did not last lengthy as well as prices decreased however considering the need the variety of components stayed at steadier degrees contrasted to the unrefined market.

Dry Market– Capesizes

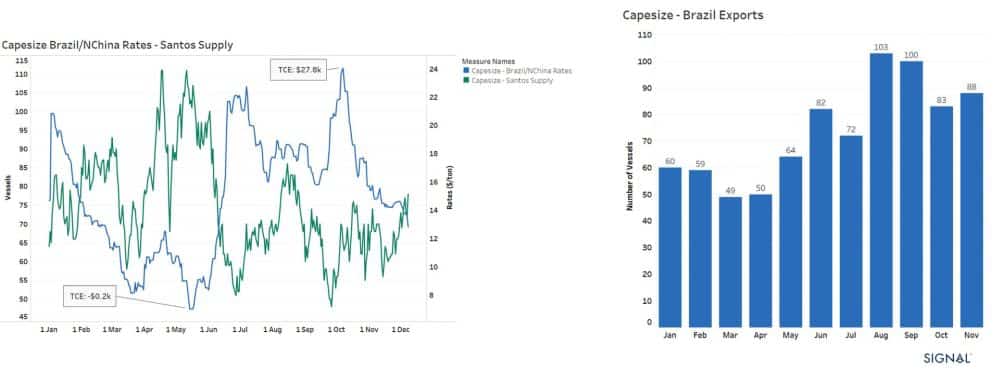

TCE estimate for Brazil/ North China is based upon Santos/ Qingdao rounded trip with 2 still days. The Santos Supply Trend is based upon 1 month Laycan ahead, Available as well as Contract/Program/Spot/Relet vessels.

A rebirth of the Chinese steel sector diminished supplies of iron ore in the area, a crucial active ingredient for steelmaking, as well as restored the requirement for imports fromBrazil After a weak initial fifty percent for the Capesize section, Brazil-China products prices came to a head at first of the 3rd quarter, with tonnage supply running reduced in Santos, as China involved high ton-mile iron ore imports from Brazil.

China cancel worldwide petroleum market

According to oil information analytics solid OilX, throughout 2020, China imported an overall of 11.01 million bpd, a 8.5% boost contrasted to in 2014. While China was the initial nation that was influenced by the covid-19 episode, it appears that it has actually because recuperated solid.

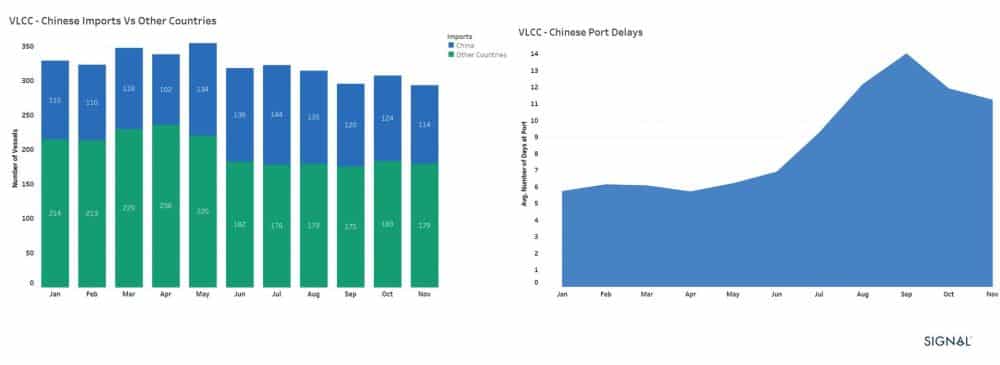

* VLCC section: Chinese imports vs. various other nations as well as Port Congestion in China in between January as well as November 2020|Click To Enlarge

In truth, OilX says that the globe’s biggest importer of petroleum gets on track to be the only significant nation to elevate its oil need year-on-year. In 2020, the high need for petroleum in China was in charge of canceling the shed need from various other areas offering assistance for the worldwide petroleum market.

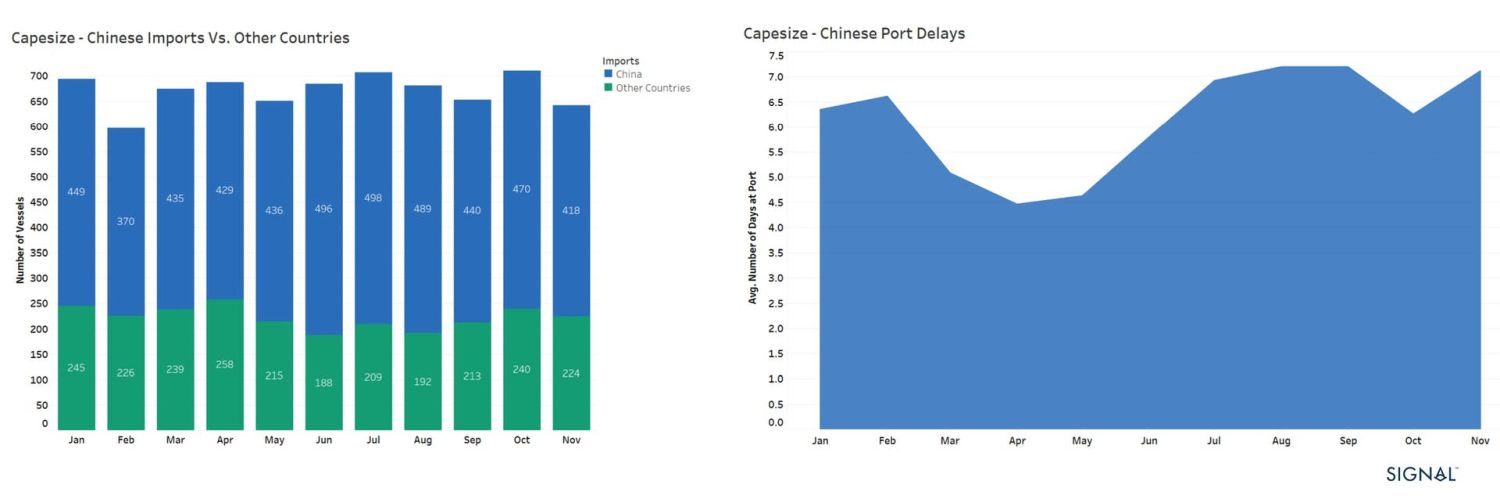

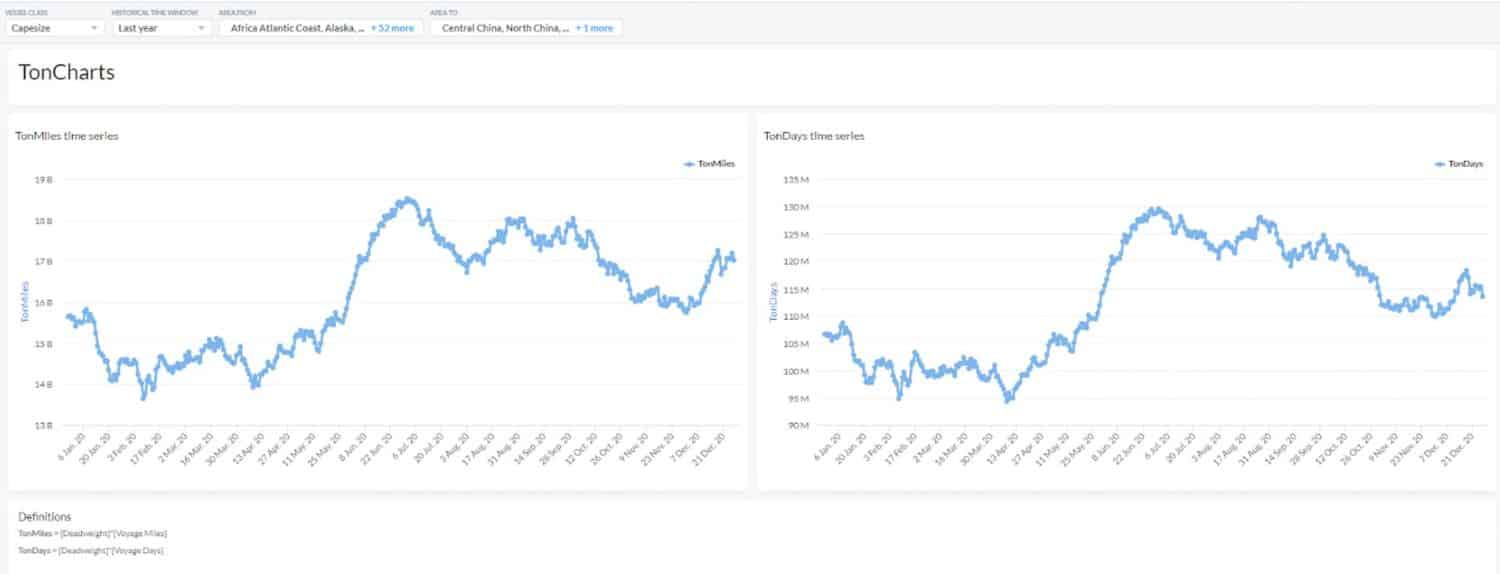

* Capesize section: Chinese imports vs. various other nations as well as Port Congestion in China in between January as well as November 2020|Click To Enlarge

The Chinese imports boost of both petroleum as well as completely dry freight, brought about substantial port blockage as well as troubles in suiting the high variety of VLCCs as well as Capesize vessels. The ordinary waiting time for vessels that were waiting to release beyond Chinese ports varied from numerous days to 2 weeks, leading, because of this, to a boost in Ton Days as shown in the charts listed below.

* Capesize section: Ton Miles as well as TonDays gradually for Capes heading right into China|Click To Enlarge|Image Credits: Signal Ocean Platform

Impact on shelter gas rates

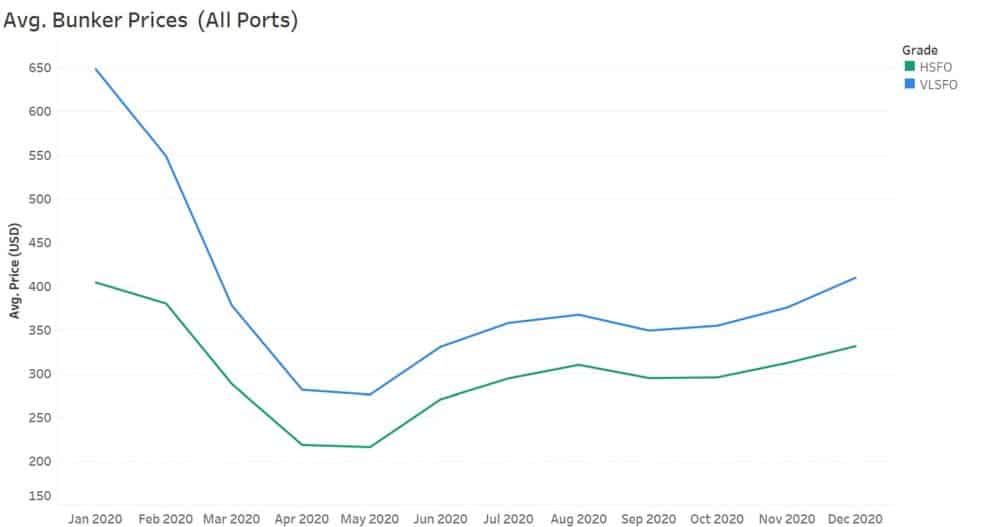

* In the above chart we see exactly how the shelter rates varied from January till completion of November|Click To Enlarge|Image Credits: Signal Ocean Platform

The year began with the IMO 2020 law starting, among one of the most substantial adjustments in the vessel sector in the last few years. Beginning January 2020 vessels are called for to either make use of reduced sulfur aquatic shelter gas such as VLSFO or utilize the less costly shelter gas choice, HSFO, just if they are furnished with scrubbers. As an outcome, VLSFO rates were anticipated to skyrocket as well as scrubber fitted vessels to gain from shelter financial savings. And after that coronavirus occurred.

As the initial wave of the pandemic began its causal sequence early in 2020, the sector experienced a significant autumn in shelter rates. Compared to the beginning of the year, gas rates went down throughout the initial 5 months of the year going from $400/mt to $276/mt for HSFO as well as from $648/mt to $216/mt for VLSFO. At the start of the year, the ordinary spread in between VLSFO as well as HSFO went to $248. At completion of November, the spread in between both gas kinds had actually been minimized to $60.

The decrease in aquatic gas rates profited some as well as harmed others. For some sector gamers consisting of shipowners as well as charterers, the decrease in VLSFO rates has actually definitely been calming. For others, nonetheless, such as shelter providers, the decline in gas cost boosted stress. The cost decline did not furthermore prefer the shipowners that purchased scrubbers in order to adhere to the IMO 2020 law as this advancement will likely postpone their return on their financial investment. Things began relocating northwards throughout the 2nd fifty percent of the year, where shelter gas rates saw an uptick via completion of November however have actually stayed reduced contrasted to the beginning of the year.

Treading in undiscovered waters

As there is some peek of hope that originates from the information of an efficient coronavirus vaccination, the delivery sector is trying to find an international healing that will unquestionably take a while prior to the sector gets to pre-pandemic degrees. At the moment that this write-up is created, all vital firms, IEA, EIA as well as OPEC, have actually reduced their oil need projections for 2021 providing a rather enhanced yet still dismal expectation in months in advance. As the globe adapts to this brand-new normality as well as nations slowly open economic climates, we anticipate calmer seas which the lengthy trip to healing will at some point start with the item vessels section. Commercial delivery is a market seasoned to volatility as well as with delivery analytics devices such as The Signal Ocean Platform, shipowners, brokers as well as charterers can walk with confidence in undiscovered waters by feeding their designs with maritime information to examine market problems in real-time as well as make their very own data-driven industrial choices.