Low-Sulfur Fuel Sale Jumps As 2020 Sulfur Cap Kicks In

In Singapore, the globe’s biggest bunkering center, the shelter sale landscape saw substantial modification as the sale of high-sulfur gas oil went down significantly in an issue of months. In comparison, the sale of low-sulfur gas increased in the last quarter.

The initial wave of IMO2020

Preliminary approximates from The Maritime as well as Port Authority of Singapore show that a total amount of 4,465 thousand tonnes were marketed in December 2019, a 4% rise contrasted to December 2018 as well as the highest possible sale of shelter gas marketed in Singapore because January 2018.

Sales of low-sulfur gas, consisting of LSFO as well as MGO LS, climbed by 51% month-on-month in December to 3,127 thousand tonnes, contrasted to the 1,271 thousand tonnes of HSFO marketed in the very same month.

Image Credits: bimco.org

“The shipping industry has been riddled with market uncertainty in recent months, but the bunker sales in the port of Singapore provide one of the first readings as to how the industry has transitioned into compliance with the IMO2020 regulation. We have now surpassed the first wave of IMO2020 and hopefully, the accompanying market uncertainty will diminish as we proceed into 2020,” states BIMCO’s Chief Shipping Analyst, Peter Sand.

The change in shelter sales

In December, a total amount of 2,630 thousand tonnes of LSFO were marketed, representing 59% of complete sales. This is a huge modification thinking about that it represented approximately 1% of complete sales in the last number of years. However, the complete 2019 shelter sales in Singapore were down 4% year-on-year, the most affordable degree because 2015.

The December numbers supply understanding right into the IMO2020 change as well as just how the forthcoming year could unravel. At the beginning of 2019, low-sulfur gas represented a simple 8% of complete sales compared to a dive to 70% inDecember The substantial uptick on the market share of low-sulfur gas shows the initial wave of IMO2020, however BIMCO does not always anticipate the low-sulfur to high-sulfur sales proportion to stay at these degrees in the coming year.

While low-sulfur gas have actually gotten the biggest market share, it deserves observing just how HSFO still makes up 28% of complete sales, driven by shelters acquired for scrubber-fitted ships. Many of the scrubber-fitted ships are likewise the biggest kinds of ships taking in reasonably extra gas, which will definitely assist in steady need for HSFO.

The bunker market in the port of Rotterdam, roughly one-sixth the dimension of the Singaporean market, displayed the very same pattern inNovember Here, the sale of HSFO decreased considerably while low-sulfur gas climbed to 50% of complete shelter sales.

Transitioning right into the brand-new fact

The change in shelter sales underscores the substantial change that the delivery sector has actually been confronted with at the turn of the years. Whereas shelter vendors started their IMO2020 change in the 3rd quarter of 2019, lots of shipowners waited till the eleventh hour to transportation. The late change has actually relatively enabled shipowners to take advantage of the decreasing HSFO rates in current months, while likewise burning the staying HSFO left in the storage tanks.

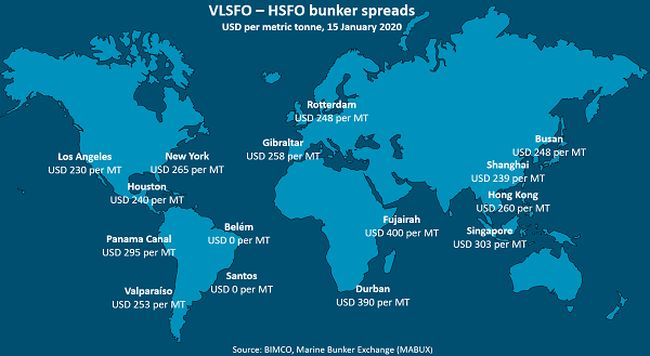

Image Credits: bimco.org

The cost of HSFO began to surge significantly in 2019, driven greatly by geopolitics as well as shelter vendors getting ready for IMO2020.

The low-sulfur to high-sulfur spread broadened in the direction of record-breaking area around the application target date of IMO2020, driven by climbing low-sulfur gas rates. However, 2 weeks right into the brand-new year the spread has actually begun to slim somewhat, which might show that the international fleet has actually bunkered adequately for the initial wave of the change, as likewise confirmed by the shelter sales in Singapore.

A 2nd wave will definitely establish right into movement once the fleet has actually shed via the preliminary supply of low-sulfur gas. Whether the spread will certainly adhere to along the very same lines as well as broaden then continues to be unpredictable, however it promises that the spread could tighten in the coming months, as the haze of IMO2020 unpredictability removes.

VLSFO– the silver bullet for IMO2020?

An selection of various certified extracts has actually arised on the market to assist in conformity. While the IMO2020 lays out a governing structure for the delivery sector, it does not provide compulsory consistent demands for the buildings of extract blends. To some level, this adds to the unpredictability concerning shelter conflict.

Two various gas blends with the very same requirements are not always suitable. Bunkering VLSFO from a shelter distributor in one port is not always suitable with VLSFO bunkered in an additional.

VLSFO has actually been classified as the silver bullet for the IMO2020 market. Yet, up till the 4th quarter of 2019, VLSFO was just readily available in a couple of pick ports, however at an eye-catching cost discount rate to MGO LS. However, In December 2019, the MGO LS as well as VLSFO got to cost parity in Singapore, relatively on the back of greater need for VLSFO.

Image Credits: bimco.org

The climbing expense of low-sulfur gas shows the substantial difficulty that shipowners have actually been confronted with over night. At existing cost spreads, gas oil expenses have actually successfully increased, placing hefty monetary stress on business that should pay problem themselves. The first-mover benefit connected with scrubbers appears to apply for the time being.

“Almost from one day to another, IMO2020 has resulted in a massive increase in bunkering costs for shipowners and operators, costs which for many companies cannot be sustained for a prolonged period. Shipowners are trying to pass on the additional costs of bunkering to customers, but if the underlying supply and demand fundamentals are not balanced, their efforts may prove futile,” states Peter Sand.

While the sector gets used to the brand-new fact of IMO2020, an additional important component of the law is coming close to quickly. On 1 March 2020, the high-sulfur gas oil carriage restriction works, which restricts ships without an exhaust gas cleansing system (scrubber) to also lug shelter gas with sulfur web content over 0.50%.