Maersk Group– Full Interim Report for Q3 2016

Editor’s Note: A.P. Møller– Mærsk A/S released its Interim Report for Q3 2016 on Wednesday, 2 November 2016, reporting that its 3rd quarter earnings dropped 44 percent to United States $426 million. Of note, Maersk stated its front runner container system, Maersk Line, sank to a bottom line of $116 million because of dropping products prices. Here’s the complete news release from Maersk Group:

Highlights:

- The Maersk Group provided a hidden earnings of USD 426m in the 3rd quarter of 2016.

- All service devices created totally free capital of an overall of USD 736m and also the Group keeps a solid monetary setting with a liquidity get of USD 11.8 bn.

- The result was favorably affected by proceeded solid functional efficiency and also price decreases in both Maersk Oil and also Maersk Drilling.

- Maersk Oil boosted hidden earnings via proceeded functional effectiveness boosts and also price decreases and also break-even is currently lowered to listed below USD 40 per barrel for 2016.

- Maersk Line obtained market show to a quantity development of 11%, while remaining to boost network exercise and also preserving system sets you back listed below 2,000 USD/FFE.

- APM Terminals raised Q3 efficiency from previous quarters because of more powerful efficiency in vital entrance terminals and also price conserving campaigns.

- The Group still anticipates an outcome substantially listed below in 2014 (USD 3.1 bn) and also defines an anticipated hidden outcome listed below USD 1.0 bn.

The Group remained to be substantially affected by market inequalities, causing continual reduced container products prices and also a reduced oil cost atmosphere.

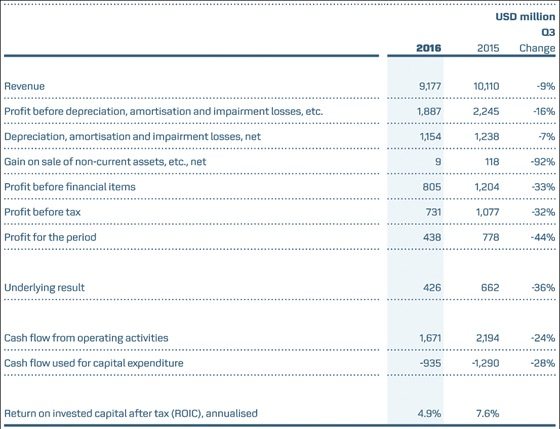

The Group provided a revenue of USD 438m (USD 778m) adversely affected by reduced container products prices partially balanced out by favorable effect of discontinuation charges inMaersk Drilling The return on spent resources (ROIC) was 4.9% (7.6%). The totally free capital was USD 736m (USD 904m).

The hidden earnings for the Group of USD 426m (USD 662m) was substantially less than for exact same duration in 2014, primarily driven by a loss in Maersk Line and also with reduced hidden cause APM Shipping Services and also APMTerminals Maersk Drilling and also Maersk Oil taped boosted underlying revenues.

The Group remains to concentrate on price effectiveness along with increasing harmonies in between our service devices to boost functional efficiency and also continue to be leading rate entertainer.

“The Maersk Group delivered an underlying profit of USD 426m in the third quarter of 2016. The result is unsatisfactory, but driven by low prices. We generally perform strongly on cost and volume across businesses. Maersk Line for the second quarter in a row reported a loss due to continued low freight rates, down 16% y-o-y. Freight rates were however up 5.5% q-o-q, for the first time since Q3 2014. Maersk Line performed strongly on volume and unit cost. APM Terminals delivered a result below last year, as we continued to be challenged by low volume growth on a like–for-like basis. For the second quarter in a row Maersk Oil delivered a positive result driven by strong cost performance and production efficiency. Also Maersk Drilling delivered strong profits, driven by termination fees and good cost performance. The implementation of the new strategic direction and the restructuring of the Group is progressing, and we look forward to sharing further details at the Capital Markets Day on 13th of December,” states Maersk Group Chief Executive Officer Søren Skou.

Group Highlights:

The Group’s earnings reduced by USD 933m or 9.2% contrasted to Q3 2015, primarily pertaining to Maersk Line with a reduction of USD 659m because of 16% reduced typical container products prices, Maersk Oil with a reduction of USD 95m because of 8.0% reduced oil rates and also reduced prices in Damco and alsoMaersk Tankers This was partially balanced out by 11% greater container quantities in Maersk Line and also 7.0% greater quantities in APM Terminals.

Operating expenditures reduced by USD 573m or 7.3% primarily because of reduced shelter rates and also price conserving campaigns.

The Group’s capital from running tasks was USD 1.7 bn (USD 2.2 bn). Net capital made use of for capital investment was USD 935m (USD 1.3 bn) with financial investments primarily pertaining to growths of the Culzean oil area in the UK and also Johan Sverdrup in Norway.

With an equity proportion of 55.5% (57.3% at 31 December 2015) and also a liquidity get of USD 11.8 bn (USD 12.4 bn at 31 December 2015) the Group keeps a solid monetary setting.

Maersk Line remained to supply on critical purposes in Q3, acquiring market show to a quantity development of 11% and also proceeded renovation in network exercise. Sustained stress on container products prices result in a decrease in typical products prices of 16% and also a hidden loss of USD 122m. However, Maersk Line created a favorable totally free capital of USD 192m (USD 159m).

ROIC was unfavorable 2.3% (favorable 5.2%). The result was positively affected by different favorable tax obligation growths.

Revenue of USD 5.4 bn was 11% less than Q3 2015. The advancement was driven by a 16% decrease in typical products prices to 1,811 USD/FFE (2,163 USD/FFE) partly balanced out by an 11% boost in quantities to 2,698 k FFE (2,427 k FFE). A substantial component of the development resulted from a lot more backhaul freight at reduced prices than headhaul. With a boost in fleet capability of 3.8%, the boost in quantities stood for an enhancement of network exercise. The products price decrease was primarily attributable to reducing shelter rates of 25%, however was additionally affected by the boosted backhaul quantities and also proceeded weak market problems.

Maersk Oil remains to supply earnings in a quarter with a typical oil cost of USD 46 per barrel and also with a breakeven degree listed below USD 40 per barrel for 2016. Adjustments to business and also organisation because of reduced oil cost atmosphere and also leave from Qatar by Mid -2017 have actually been started.

Maersk Oil reported a revenue of USD 145m (USD 32m) and also a ROIC of 13.5% (2.1%) in Q3 2016 at an oil cost of USD 46 (USD 50) per barrel. The earnings was favorably affected by greater functional effectiveness and also reduced prices.

In a quarter with the normal scheduled upkeep closures, privilege manufacturing of 295,000 boepd (300,000 boepd) remained in line with Q3 2015. Exploration prices of USD 57m (USD 82m) were 30% less than the exact same duration in 2014.

APM Terminals provided a revenue of USD 131m (USD 175m) and also a ROIC of 6.6% (11.6%). Stronger efficiency in vital entrance terminals raises Q3 efficiency from previous quarters in 2016 while price conserving campaigns are beginning to counter a few of the lowered quantity in readily tested terminals.

The earnings was 17% over Q2 2016. Operating organizations created a revenue of USD 136m (USD 189m) and also a ROIC of 9.5% (13.8%) and also jobs under application in addition to Grup Mar ítim TCB from start of March had a mixed loss of USD 5m (loss of USD 14m), arising from start-up prices. Profits continue to be under stress in readily tested terminals in Latin America, North-West Europe and also Africa consequently of lining network adjustments and also proceeded weak underlying market problems.

Maersk Drilling provided a revenue of USD 340m (USD 184m) and also a ROIC of 17.2% (9.0%). Termination charges, high functional uptime and also cost savings on running prices were partially balanced out by even more still days. Underlying earnings was favorably affected by USD 210m from very early agreement discontinuation of Maersk Valiant.

Maersk Drilling has actually taken advantage of a solid agreement insurance coverage at substantially greater dayrates than supplied in the present market, however the marketplace expectation for the overseas exploration sector continues to be tested, which will certainly additionally impact Maersk Drilling moving forward as present agreements run out and also brand-new reduced dayrates are embraced or gears are still.

APM Shipping Services reported a revenue of USD 25m (USD 154m) and also a ROIC of 2.1% (13.1%) adversely affected by a loss of USD 11m (earnings of USD 45m) in Maersk Supply Service and also a loss in Maersk Tankers of USD 1m (earnings of USD 59m).

Maersk Tankers reported a loss of USD 1m (earnings of USD 59m) and also an adverse ROIC of 0.3% (favorable 14.6%). The result was adversely impacted by wearing away market prices (reduction of 59%), partially balanced out by Maersk Tankers market outperformance, agreement insurance coverage and also price conserving campaigns focused on producing greater performances.

Maersk Supply Service reported a loss of USD 11m (earnings of USD 45m) and also a ROIC of unfavorable 2.5% (favorable 10.4%). Revenue for Q3 reduced to USD 94m (USD 145m) adhering to reduced prices and also exercise along with less vessels offered for trading because of divestments and also lay-ups. Total operating expense boosted to USD 72m (USD 69m), as an outcome of staff redundancies partially balanced out by less operating vessels and also lowered running price. Maersk Supply Service is well en route of lowering everyday running prices by a dual number percent contrasted to 2015 on a like-for-like basis.

Svitzer provided a revenue of USD 22m (USD 30m) and also a ROIC of 6.9% (10.8%). Despite brand-new incurable towage task in Australia and also Americas and also greater harbour towage task, earnings saw just minimal boost of USD 2m. Positive results were balanced out by reduced exercise of the incurable towage place fleet and also GBP currency exchange rate effect. Even with considerable over-capacity and also stagnation in many delivery sections, Svitzer preserved its market share in affordable ports both in Australia and also Europe.

Damco provided a revenue of USD 15m (USD 20m) and also a ROIC of 29.7% (30.0%). Revenue was USD 635m (USD 719m), down 12%, affected by reduced products prices and also currency exchange rate motions. Margins in supply chain monitoring enhanced, while products forwarding margins continued to be under stress.

The Group’s support for 2016

In line with previous assumptions the Group still anticipates an outcome substantially listed below in 2014 (USD 3.1 bn) and also defines an anticipated hidden outcome listed below USD 1.0 bn. Gross capital made use of for capital investment is still anticipated to be around USD 6bn in 2016 (USD 7.1 bn).

Maersk Line still anticipates a hidden outcome substantially listed below in 2014 (USD 1.3 bn) and also defines an anticipated unfavorable hidden outcome for 2016. Maersk Line anticipates worldwide need for seaborne container transport to boost by about 2% according to previous assumption of 1-3%.

Maersk Oil still anticipates a favorable hidden outcome. A breakeven outcome is currently anticipated to be gotten to with an oil cost listed below USD 40 per barrel versus formerly in the variety of USD 40– 45 per barrel.

Maersk Oil keeps an anticipated privilege manufacturing of 320,000-330,000 boepd (312,000 boepd), and also expedition prices substantially listed below in 2014 (USD 423m).

APM Terminals still anticipates a hidden outcome substantially listed below 2015 (USD 626m), because of lowered need in oil creating arising economic climates and also network modifications by clients.

Maersk Drilling currently anticipates a hidden lead to line with in 2014 (USD 732m), with a break-even outcome anticipated in Q4, versus formerly a hidden outcome listed below in 2014.

APM Shipping Services restates the assumption of a hidden outcome substantially listed below the 2015 outcome (USD 404m) primarily because of substantially reduced prices and also task in Maersk Supply Service and also weak prices in Maersk Tankers.

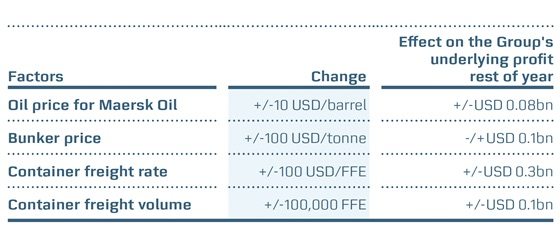

The Group’s support for 2016 goes through significant unpredictability, not the very least because of growths in the worldwide economic situation, the container products prices and also the oil cost. The Group’s anticipated underlying outcome relies on a variety of elements. Based on the anticipated revenues degree and also all various other points being equivalent, the level of sensitivities for the fiscal year 2016 for 4 vital worth motorists are noted in the table listed below:

Group method upgrade

The Group started a tactical evaluation on 23 June to assess the critical and also architectural choices with the goal to create development, boost dexterities, unlock harmonies, and also increase investor worth. The Group introduced a development upgrade on the critical evaluation on 22 September.

The future Maersk Group will certainly be an incorporated transport and also logistics business, while the goal is to discover architectural services for every of the oil and also oil associated business. The Maersk Group will certainly moving forward supply finest in course transportation and also logistics solutions as an incorporated business based upon mixed capacities, sustained by sector leading electronic services.

As an effect the Group’s profile will certainly be reorganised right into 2 different departments: Transport & & Logistics and also Energy.The Transport &Logistics department includes Maersk Line, APM Terminals, Damco, Svitzer and alsoMaersk Container Industry The Energy department includes Maersk Oil,Maersk Drilling &,(* )and alsoMaersk Supply Service Maersk Tankers &

The Transport department will certainly concentrate on producing development and also harmonies based upon a one business framework with numerous brand names, by handling and also running the tasks in an extra incorporated fashion. Logistics method of The & &(* )hinges on 3 columns to supply long-term successful development: Transport offering and also client experience will certainly be enhanced based upon the mixed capacities of Logistics, APM

- Product and also Maersk Line in mix with sector leading electronic services.Terminals operating as one entity, Damco & &

- By will certainly have the ability to collect harmonies and also optimize procedures to protect the sector’s most reliable and also dependable network.Transport resources technique and also much better exercise of properties will certainly be guaranteed. Logistics making financial investments, purchases will certainly be the recommended alternative.

- Strong approximated harmonies are anticipated to create as much as 2 percent factors ROIC renovation over a duration of 3 years. When product harmonies are anticipated in 2016.

The is anticipated that the oil and also oil associated organizations within the No department will certainly call for various services for future advancement consisting of splitting up of entities independently or in mix from A.P. Møller– Mærsk A/S in the type of joint-ventures, mergings or listings. It on market advancement and also architectural chances, the goal is to discover services for the oil and also oil associated organizations within 24 months.Energy of Depending remains to concentrate on making sure a solid resources framework and also specified vital monetary proportion targets according to a financial investment quality ranking.

The Board reporting for the brand-new framework will certainly work since Q1 2017.Directors, 2

Financial 2016

Copenhagen