New Service For Ship Investors Provides Snapshot 5-Year View Of The Financial Prospects Of Dry Bulk Carriers

Leading author of maritime market criteria, the Baltic Exchange, has actually introduced a brand-new solution for delivering capitalists which gives a photo five-year sight of the economic potential customers of completely dry mass providers.

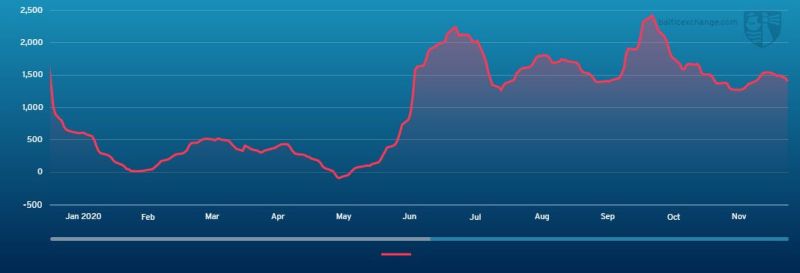

The Baltic Exchange Investor Indices are a simple to utilize on-line control panel presenting information appropriate to vessel financial investment choices, recurring worth, health and wellness of revenues, place as well as five-year timecharter revenues; acquisition & & reusing worths; as well as running expenses. It supplies a high degree of quality as well as openness for capitalists in capesize, panamax, supramax, as well as handysize vessel kinds. Tanker as well as gas provider possessions will certainly be included at a later day.

Subscribers to the Baltic Exchange Investor Indices are used a wellness of revenues index which contrasts place revenue with day-to-day running expenses; a financial investment index which gives a write-down worth of the vessel over 5 years; as well as an indicated recurring danger analysis which provides the reusing steel worth of the vessel as a proportion of its suggested recurring worth.

Image Credits: balticexchange.com

Commenting on the brand-new solution, Baltic Exchange Chief Executive Mark Jackson claimed:

“The Baltic Exchange is a credible, established and regulated provider of data for the shipping industry. The recent addition of operating cost assessments to our portfolio of spot, forward market, Sale & Purchase and recycling indices means that we now cover the financial lifecycle of the vessel. By splicing and dicing our data we are able to deliver an innovative new product which provides shipowners, banks, family offices and funds with an independent, easy to use benchmark which shows them the current and expected performance of key asset classes.”