OSV Companies Still Face Serious Difficulty, Study Shows

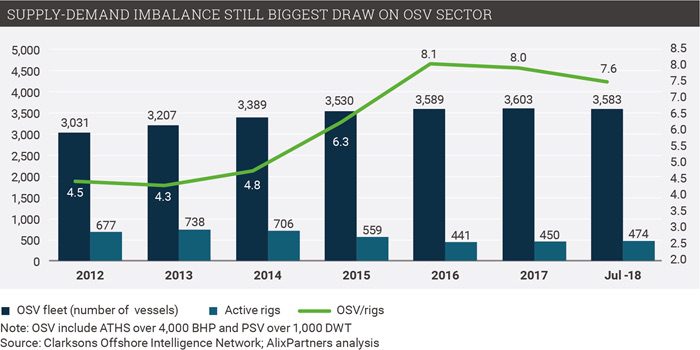

The overseas supply vessel (OSV) industry remains to remain in severe difficulty in spite of a rebound in oil rates as way too many vessels complete for minimal organization possibilities, according to a new study from the international consulting company AlixPartners.

As an outcome, OSV firms have to take fast and also definitive activity in order to endure in what need to be thought about the “new normal,” AlixPartners stated. In truth, virtually 90% of the OSV firms examined by the company were viewed to be at high threat of bankrupcty.

“Despite the recovery in oil prices, the OSV industry remains in trouble. Charter rates across most asset classes and regions are still running at or close to operating cost levels. There is a continued glut of vessels, caused by over-ordering during the boom in oil prices and easily accessible bank credit, hampering the industry. Companies hoping for a dramatic rebound in OSV vessel demand are playing a dangerous waiting game, as their existing financial resources are likely not enough to sustain them through the current environment,” AlixPartners stated in its record on the research study.

According to the evaluation, 34 of 38 firms had Altman- Z ratings of much less than 1.8, showing a high possibility of insolvency in the following year.

“It is abundantly clear that OSV operators need to face the music on the current state of the market and the real probability that we won’t be heading back to sustainable industry dynamics without a structural change to the sector,” stated Jeff Drake, Managing Director at AlixPartners. “Companies need to be disciplined about capacity management and do everything they can to reduce costs and increase operational efficiency.”

According to AlixPartners, overseas gear application and also day prices, the 2 aspects that drive profits for OSV firms, are still even more than 30% listed below 2014 degrees. Other aspects such as a bundant shale oil materials and also the influence of power change on oil need in the medium-to-long term will certainly are likewise viewed as constricting brand-new overseas wells. &&(* )on these aspects,

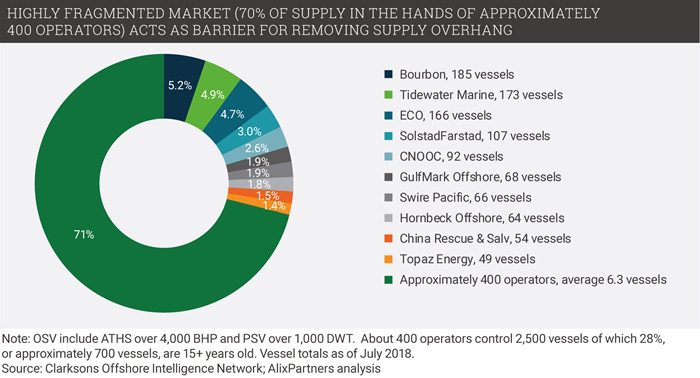

Based AlixPartners price quotes that the international OSV market is presently oversupplied by regarding 1,150 vessels, consisting of a spell 900 vessels that are 15 years or older, which will likely make it challenging for them to locate job. are concerns protecting against a decrease in the general supply of vessels too.

There,

Chiefly AlixPartners states, the industry is fragmented, with the biggest drivers managing 30% of the fleet and also the continuing to be 70% managed by 400 smaller sized drivers with fleets of 6 or less vessels. it stated. “Small operators have little incentive to retire any of their own fleets and are loathe to take action that would benefit the larger companies or the sector overall,”, AlixPartners did make some suggestions on what firms can do to endure the extended decline.

Recommendations

Luckily”

, drivers are cost takers out there at prices at or near to operating budget. Presently will certainly require to be extra enthusiastic regarding their cost-cutting strategies, by improving both running and also offering, basic and also management (SG&A) costs. Companies of which to be driven by utilizing modern innovation.Some”

will likely play a raising function to attend to a few of the obvious supply overhang while recognizing expense harmonies and also subsequently boosting the industry’s worth suggestion. Consolidation the various other hand, financial obligation restructurings appear still out-of-bounds for some financial institutions. On truth continues to be, however, that with a debt/EBITDA proportion of 23.9 x, the industry is overleveraged, the majority of that financial obligation is not likely to be paid back.The extra info, see AlixPartners’ paper,

“The difficult and painful actions that are required now to become more cost-competitive and restructure balance sheets could create stronger world-class companies that can not only survive this crisis, but even thrive if the sector recovers.”

For.