The last 5 years have actually been among the lengthiest as well as most difficult recessions the overseas market has actually ever before experienced. Since the oil cost decline of 2014/2015, the Offshore vessel market has actually been pestered by personal bankruptcies, debt consolidations, requisitions as well as mergings, compelled fleet sales as well as most significantly a substantial decline in possession worths.

Values

VesselsValue has actually constantly been traditional in regards to Offshore possession worths contrasted to their rivals. In January 2019, Solstad Offshore were asked for to revalue their fleet by Norwegian monetary authorityFinanstilsynet At that time VesselsValue approximated the worth of a five-year-old big PSV at USD 13.7 mil, down virtually 22% year to day from USD 17.5 mil. By contrast various other evaluation service providers were pricing estimate evaluations 20% greater.

In the months that adhered to, others thought the worth of a five-year-old big PSV enhanced from c. USD 16 mil to c. USD 19 mil. By contrast, VesselsValue numbers raise from USD 13.5 mil to USD 14.1 mil.

Image for Representation Purpose Only– Credits: Antandrus/ wikipedia

There were extremely couple of purchases within the marketplace throughout this duration to sustain such a hostile rise. However, the marketplace was seeing some positivity, both a steady as well as reasonably high oil cost, vessel prices enhancing, layup numbers lowering, as well as handful of ships cost demolition.

The VV formulas utilize a mix of lengthy as well as temporary rolling standards of the Brent Crude oil cost to design belief in the lack of purchases. This works since the VV belief does not panic to any type of temporary knee-jerk results experienced in the marketplace unless there suffice sustaining sale as well as acquisition deals to validate this.

2019 was not a negative year for the Offshore market, nonetheless VV has actually constantly suggested based upon their information, as well as evaluations that the marketplace was not experiencing the upturn others thought.

2020 has actually seen the Covid 19 worldwide pandemic as well as a substantial decrease in oil cost. Tuesday 21st April saw Brent unrefined decline listed below USD 16/barrel, a 21-year lowest level. To placed this right into viewpoint, the most affordable taped oil cost in last dilemma was USD 23/barrel.

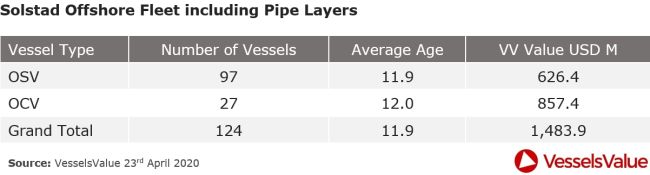

On the 31st March 2020 Solstad Offshore introduced they has actually gone into monetary restructuring, mentioning Covid 19 as well as the ongoing bad Offshore market problems. Such a big Norwegian Offshore proprietor getting in restructuring is a vital landmark for the industry. As of 23rd April 2020 VesselsValue values the Solstad fleet at USD 1,483.9 bil. See listed below table.

Forced eliminations

A problem of Solstad’s restructuring bargain is they need to eliminate 37 vessels. Although the precise vessels to be offered are not yet recognized, it will certainly probably be the injured, older smaller sized devices.

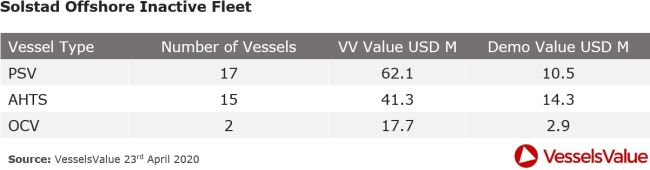

Utilising VesselsValue fleet search as well as recency of AIS feature, VesselsValue are able filter PSVs, AHTs as well as OCVs within the Solstad fleet that have actually not signified in 1 week or even more, i.e. are non-active/ injured. These 34 vessels might stand for a big section of the feasible 37 sales prospects. The listed below table reveals the non-active vessel malfunction:

Please note:

1) Demolition worth is based upon vessels LDT present cost for steelIndian Subcontinent

2) VesselsValue presumes vessels remain in safe problem as well as reasonable study placement.

If Solstad were to eliminate all the 34 detailed vessels from their fleet, the brand-new VesselsValue fleet worth would certainly be USD 1,362.8 bil. See listed below:

The Future

It is unidentified for how long this present financial scenario will certainly last, yet what is recognized is that the Offshore market remains in retraction as well as the overview will certainly be exceptionally examining for everybody from oil majors to little company as well as all those in between. All indications indicate one more duration of restructuring, compelled vessel sales, mergings as well as debt consolidations as well as for that reason decreasing possession worths. As constantly with durations of austerity, information driven evaluations are important to maintain the marketplace progressing as well as avoid it from making the exact same blunders of the past.