Seadrill Files for Bankruptcy in Bid to Shrink Debt Burden

By Steven Church, Mikael Holter, Angelina Rascouet and also Luca Casiraghi (Bloomberg)–Seadrill Ltd, the overseas driller managed by billionaire John Fredriksen, declared insolvency defense after cutting a deal with nearly all its elderly loan providers to infuse $1 billion of brand-new cash right into the firm.

Under the proposition, loan providers will certainly prolong the maturation on $5.7 billion in the red, without any amortization settlements due till 2020. Should lower-ranking lenders sign up with the proposition, $2.3 billion in unprotected bonds would certainly be exchanged a 15 percent risk in the firm, Seadrill claimed in a declaration.

“The deal gives us a great liquidity cushion,” enabling Seadrill to make it through the “mother of all downturns,” Chief Executive Officer Anton Dibowitz claimed by phone. The brand-new funding is “underpinned” by leading investorHemen Holding Ltd and also greater than 40 percent of shareholders sustain the strategy together with 97 percent of Seadrill’s safeguarded financial institution loan providers, he claimed. Dibowitz anticipates even more shareholders to register to the offer.

Fredriksen invested greater than 18 months looking for an arrangement with lenders to reorganize $12.8 billion of obligations– consisting of the offshore-drilling market’s most significant debt-load– after crude’s collapse suppressed need for oil solutions. Earlier this year the firm provided itself a due date ofSept 12 to submit a Chapter 11 reconstruction situation in united state Bankruptcy Court, simply 3 days prior to $843 numerous bonds grow.

Deal Structure

The brand-new $1 billion financial investment will certainly make up $860 million in safeguarded notes and also $200 million in equity, and also investors will certainly get concerning 2 percent of the post-restructured equity, according to the declaration. Seadrill anticipates to arise from Chapter 11 in 6 to 9 months, Dibowitz claimed.

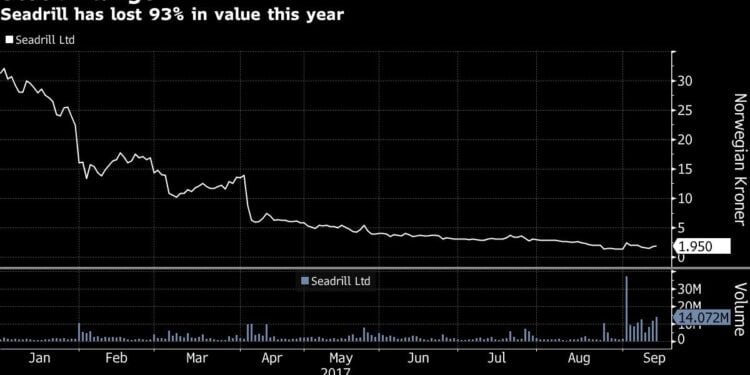

The shares whipsawed in Oslo on Wednesday, turning in between a 14 percent gain and also a 20 percent loss prior to trading up 8.9 percent at 2:14 p.m. regional time. More supply sold the initial 15 mins than on a whole ordinary day throughout the previous 3 months. Seadrill’s 1.8 billion-kroner ($ 229 million) bonds due March 2018 went down 14 ore on the krone to a record-low 9 ore.

The firm claimed hedge fund Centerbridge Partners is purchasing the restructuring offer, validating a Bloomberg News record recently that Fredriksen and also Centerbridge remained in talks. Aristeia Capital and also Man Group Plc’s GLG system along with Saba Capital LP, Whitebox Advisors, ARCM and also Fintech are likewise purchasing the brand-new safeguarded notes and also equity, Dibowitz claimed.

Under the strategy, Fredriksen’s Hemen Holding and also Centerbridge will certainly offer most of the brand-new safeguarded notes and also equity, enabling them to take the biggest risks. Hemen, presently holding a 23 percent passion, will certainly stay the “anchor” financier and also have “the same or slightly greater position” in the reorganized firm, Dibowitz claimed.

“We are excited to invest alongside Hemen,” Jed Hart, elderly handling supervisor of Centerbridge Partners Europe, claimed by e-mail. “We view Seadrill as a high-quality, global business with a top-tier employee base that will be well positioned when the industry recovers.”

Current investors might wind up with just 3 to 4 cents a share, while unprotected shareholders might see a straight healing for unprotected cases of around 6 percent if they do not join brand-new safeguarded financial debt, experts at Clarksons Platou Securities AS composed in a note.

“We see significant risk of the final words not being said yet and the Chapter 11 process might be a long and painful process,” the experts claimed.

Two Deals

The firm’s Chapter 11 application Tuesday claimed that Seadrill had actually struck 2 offers to assist it restructure under court defense: a restructuring assistance arrangement and also a financial investment arrangement. The preliminary court declaring really did not consist of information concerning either offer. Seadrill does not visualize property sales as component of the restructuring strategy, Dibowitz claimed.

The firm has to obtain court approval to authorize the lending institution proposition, which will certainly after that be integrated right into a reconstruction strategy that will certainly most likely to lenders for a ballot. The court will certainly take that ballot right into factor to consider prior to choosing whether to accept the strategy.

The firm detailed a variety of $10 billion to $50 billion in the red and also properties in its application, which was submitted in government court in Victoria,Texas Deutsche Bank Trust Co. was detailed as the firm’s most significant unprotected financial institution with bond financial debt amounting to $1.74 billion.

Samsung Heavy Industries Co claimed Wednesday it has actually remained in conversations with Seadrill on postponing shipments of 2 vessels. Daewoo Shipbuilding & &Marine Engineering Co claimed it currently reserved stipulations for feasible losses on its order of 2 drillships and also isn’t worried concerning added losses occurring from the current advancement.Hyundai Heavy Industries Co claimed it does not have any type of superior orders with Seadrill.

“Should the plan be implemented successfully, we consider it to be good for Seadrill as an operating company,” experts at DNB ASA composed in a note. “The plan seems to give Seadrill a solid liquidity runway and improved visibility, which we believe could help it win more contracts going forward.”

Seadrill has actually worked with Kirkland & &(* )LLP as its insolvency law office,Ellis as economic consultant, and also Houlihan Lokey Inc & & Alvarez as reorganizing consultant.Marsal situation is

The re: In, Seadrill Americas., 17-60077, UNITED STATE Inc, Bankruptcy Court of Southern District (Texas).Victoria © 2017

L.PBloomberg