Shipping Giant Maersk May Not Be Sunk But it Sure is Taking on Water

By Chris Bryant

(Bloomberg Gadfly)– It’s difficult to think about 2 even more tested markets than oil and also delivery. AP Moller-Maersk A/S’s tragedy is to be greatly associated with both.

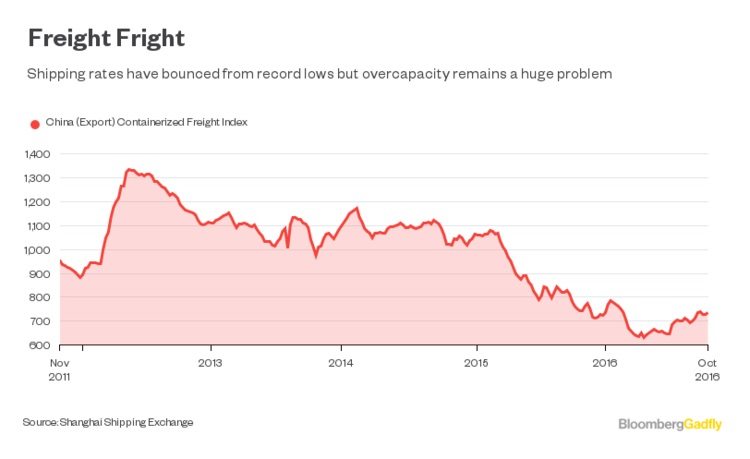

Investors were beginning to really hope the most awful mored than. Oil rates and also container prices have actually increased recently, and also combination in container delivery is lastly underway. But on Wednesday that positive outlook was penetrated when the Danish empire cautioned Maersk Line would certainly make a full-year loss, sending out the shares toppling by 9 percent.

A fact check was probably past due. Under brand-new chief executive officer Soren Skou, Maersk is dividing its power and also transportation tasks so it can concentrate on the last. While his strategy can open even more cost-savings and also get rid of a conglomerate discount rate, it will not deal with the massive overcapacity issue in delivery.

A fact check was probably past due. Under brand-new chief executive officer Soren Skou, Maersk is dividing its power and also transportation tasks so it can concentrate on the last. While his strategy can open even more cost-savings and also get rid of a conglomerate discount rate, it will not deal with the massive overcapacity issue in delivery.

In the wake of Hanjin Shipping Co Ltd’s bankruptcy, Maersk has actually raised its market share– its quantities raised 11 percent in the 3rd quarter, contrasted to require development in the larger sector of around 1.5 percent. But financiers must consider whether winning a larger piece of an unlucrative company is truly such a good idea.

Maersk Line is capital favorable yet loss-making– though others are shedding much more. Its game-plan as a result appears to be this: reduce prices, promote development and also stress much more economically straitened rivals right into surrendering. The problem is, with oil rates slipping greater, Maersk Line dangers shedding something that was propping up its incomes: affordable gas. Its gas expense increased contrasted to the 2nd quarter, which describes why much better products prices really did not result in a go back to revenue.

So while Maersk remains in no risk of a Hanjin- like fatality spiral, it’s still tackling water. Maersk Line’s losses this year complete regarding $229 million until now. In the long-term, combination must– theoretically– result in even more of a healing in products prices yet it’s mosting likely to be a sluggish, grinding procedure.

The delivery sector’s capability raises once again surpassed need development in the 3rd quarter, recommending it still hasn’t found out. While vessel junking prices are up, brand-new vessels are still being supplied and also the sector order publication amounts around 16 percent of the present fleet.

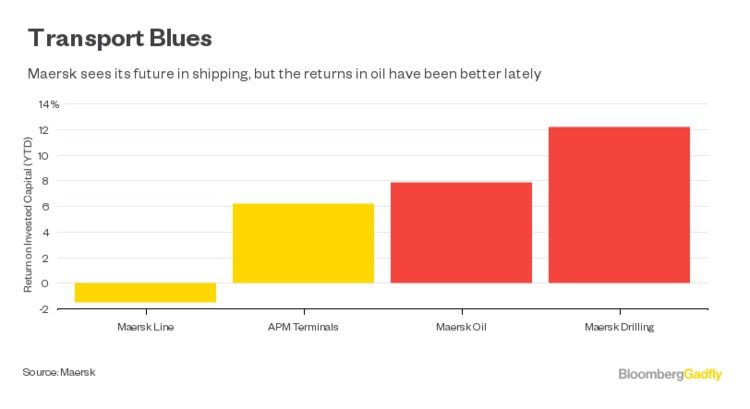

Awkwardly for Skou, Maersk’s power possessions did better than the transportation companies.

That’s helpful, certainly. Finding a residence for oil possessions by means of joint-ventures, mergings or a listing will certainly be that a lot easier if they’re earning money. But it states something when also oil uses much better returns than delivering products by sea.

This column does not always show the viewpoint of Bloomberg LP and also its proprietors. Or gCaptain.

© 2016 Bloomberg L.P