Slowing Demand Growth to Push Big Oil From Cars to Chemicals

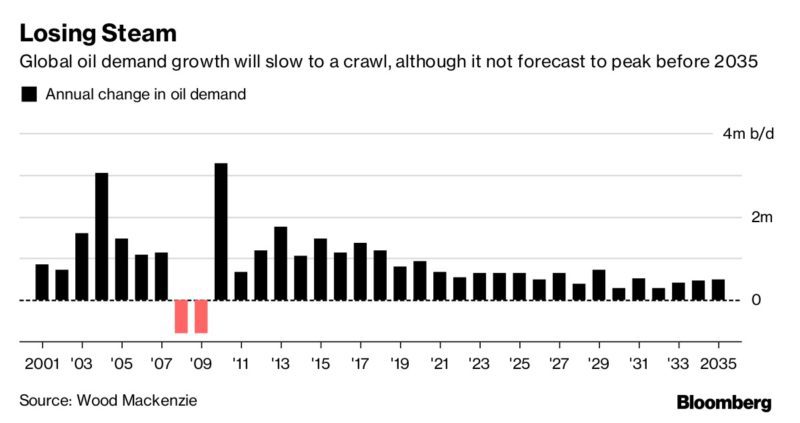

By Javier Blas (Bloomberg)–Global oil need development will certainly reduce to a crawl as well as fuel usage will certainly come to a head within the following years, triggering the globe’s largest power firms to speed up the change to gas as well as chemicals, according to professional Wood Mackenzie Ltd.

Major unrefined manufacturers will certainly need to adjust to substantial modifications in the coming years, however their organizations can expand. Oil intake will certainly maintain broadening up until at the very least 2035 as the petrochemical market, which supplies the foundation to produce whatever from plastics to chemicals, offsets the tightening in some transportation gas, Wood Mackenzie claimed in a record on Monday.

There’s likewise gas, made use of in nuclear power plant as well as progressively vehicles as well as ships. In an indication of the expanding relevance of this much less carbon-intensive gas, the Oil & & Money meeting, an event of numerous market execs that commemorates its 38th year on Tuesday in London, will certainly open up with a complete day dedicated solely to gas.

“The issue for Big Oil is how companies position themselves in a fairly quickly moving landscape,” Ed Rawle, Houston- based primary financial expert at Wood Mackenzie, claimed in a meeting. Oil is not likely to drive lasting development however “gas supply remains relatively robust through 2035, and is a growing focus.”

The possibility of peak oil need is fiercely opposed in the power market. Some firms, consisting of Royal Dutch Shell Plc as well as BP Plc, expect it occurring in between 2025 as well as 2040. Others, such asExxon Mobil Corp as well as Chevron Corp, still anticipated years of undisturbed development.

No Peak

By 2035, the growth in oil need will not have actually peaked however will certainly be “minimal compared with what we have seen over the past 20 years,” Wood Mackenzie claimed in the record. Consumption will certainly have gotten to a plateau in areas consisting of Europe, the UNITED STATE, China as well asJapan Only India as well as a few other components of Asia, Latin America, Africa as well as the Middle East will certainly still be expanding, the professional claimed.

Wood Mackenzie claimed the possibility of an ultimate top in intake is “very real,” however provided a nuanced sight of what will certainly end up being a multi-speed market. Fuel oil as well as fuel intake will certainly be reducing– the last partially because of the expanding appeal of electrical automobiles. Demand for naphtha– made use of as a feedstock in the petrochemical market– will certainly be expanding. Diesel intake will certainly climb also, albeit at a slower rate.

“The petrochemical sector is one of the few bright spots for oil demand,” Wood Mackenzie claimed, projecting that this market will certainly enhance its intake of oil feedstock by half from 2017 to 2035.

Despite their distinctions concerning when oil need will certainly come to a head, the globe’s biggest incorporated power firms are however getting ready for the future, greatly via a press to spend much more in gas. They see this gas playing a better duty in arising markets consisting of China as well as India, which are fighting air contamination from coal-fired power plant.

The oil market’s largest sell current years was Shell’s acquisition of BG Group Plc for $54 billion in 2016, which settled its setting as the globe’s largest manufacturer as well as investor of dissolved gas. The offer transformed Europe’s biggest power manufacturer from “an oil-and-gas company to a gas-and-oil company,” claimed Chief Executive Officer Ben Van Beurden.

© 2017 Bloomberg L.P