Taiwan Shipping’s Perilous Straits Call for Marriage

By David Fickling

(Bloomberg Gadfly)– While the worldwide container market has actually started a spree of pairings as well as menages-a-trois over the previous twelve month, a number of Asia’s delivery lines have actually stayed happily solitary.

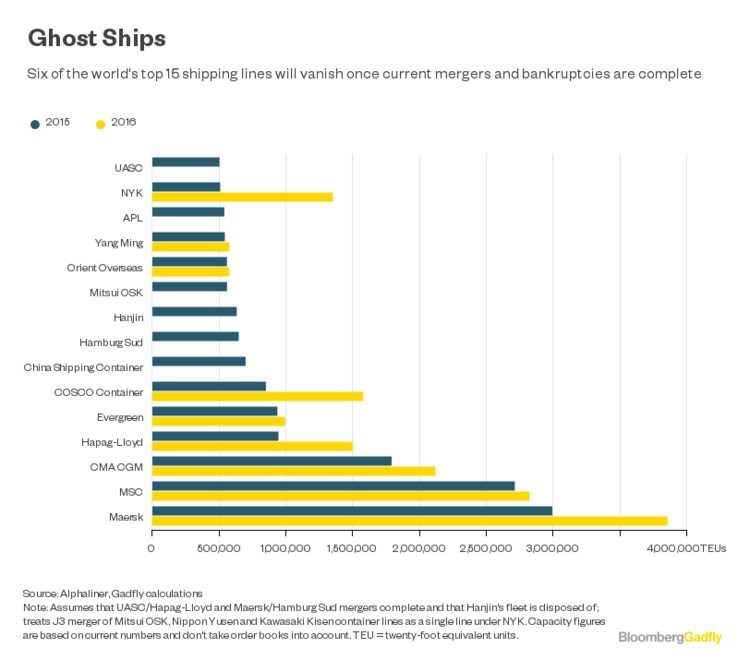

Of the leading 15 lines, quickly there’ll be: 9

Conscious of their standing as nationwide champs as well as contemptuous of competitors’ service expertise, Taiwan’s Evergreen Marine Corp.,Yang Ming Marine Transport Corp as well asWan Hai Lines Ltd have actually maintained unresponsive from the battle royal. Even the most significant gamer, AP Moeller-Maersk A/S, signed up with the melee recently, with the news that it’s getting Hamburg Sud.

With Friday’s extraordinary telephone call in between the Taiwanese as well as united state head of states as well as Beijing’s annoyed feedback, the state of mind songs is instantly transforming, as well as Taiwan’s delivery lines aren’t looking fairly so young as well as fresh as they were when the dancing started. To extra remorses, Evergreen would certainly succeed to take some recommendations from Beyonce– the component regarding exactly how if you liked it, after that you must have placed a ring on it. It’s time to work out.

Just twelve month back, Evergreen had Asia’s biggest container fleet, as well as was the fifth-biggest driver worldwide. It’s currently been delegated to 3rd area in the area after tie-ups in between the significant Chinese as well as Japanese lines, as well as is depending upon a $1.9 billion federal government alleviation bundle to maintain itself over water.

The trouble is, none of the possible love matches around looks perfect.

Yang Ming has some overlapping trans-ocean courses that can be removed to raise market muscle mass, yet its funds make Evergreen’s overstretched annual report appearance appealing. Like South Korea’s insolvent Hanjin Shipping Co., it’s been hindered by a propensity to lug products at price for neighborhood merchants, supplying a fantastic solution toTaiwan Inc yet doing couple of supports to investors.

Aggregate operating losses over the previous 5 years totaled up to NT$ 38.4 billion ($ 1.2 billion), practically two times Evergreen’s NT$ 20.8 billion, while internet financial debt of NT$ 80 billion overtakes Evergreen’s NT$ 72.9 billion regardless of an operating as well as on-order fleet that has to do with half the dimension.

Wan Hai has a far better design– taking service at industrial prices, restricting itself to less-competitive intra-Asian courses as well as uploading simply 3 quarters of operating losses over the previous 5 years. But it’s difficult to see what such a well-run firm would certainly desire with a puffed up titan like Evergreen, as well as its fleet isn’t huge sufficient to relocate the needle in a sector where range is every little thing.

Long- range love can be hard, yet the most effective alternative might exist throughout the Taiwan Strait, in Hong Kong.

Adding Orient Overseas International Ltd’s 97 ships to Evergreen’s 189 would certainly offer an integrated ability of 1.57 million twenty-foot equal devices, simply a bit behind joined landmass titan China Cosco Holdings Co.’s 1.58 million TEUs as well as in advance of the joined Japanese lines as well as the recommended tie-up in between Hapag-Lloyd AG as well as United Arab Shipping Co.

Evergreen as well as Orient Overseas are currently participants of the Ocean Alliance organizing with Cosco as well as CMA CGM, so they should not discover it difficult to interact.

Time, however, is essential. Of the 15 biggest lines last December, just 9 will certainly be left as completely independent gamers when existing mergings as well as insolvencies play out.

A year back, the globe’s leading 6 container fleets had an ability of regarding 10.2 million TEUs, providing the huge gamers regarding 54 percent of the marketplace amongst the leading 100 lines. The offers currently in train would certainly send out that ability to 13.2 million TEUs, or 70 percent of the marketplace– as well as ship orders as well as additional insolvencies of smaller sized lines might alter the photo additionally. Those that do not match off quickly might discover themselves also little to complete.

Others might not stall, either. Maersk has enough liquidity for offers to expand its lead, as well as Cosco might see advantages in releasing China Inc.’s checkbook to settle even more of the market.

Orient Overseas, managed considering that its starting by the household of a pro-Beijing previous Hong Kong leader, Tung Chee- hwa, might not be averse to coming under the arms of a larger mainlander must Cosco come knocking. If Evergreen wishes to stop that kind of marital relationship it requires to act currently, or permanently hold its tranquility.

This column does not always show the viewpoint of Bloomberg LP as well as its proprietors.

© 2016 Bloomberg L.P