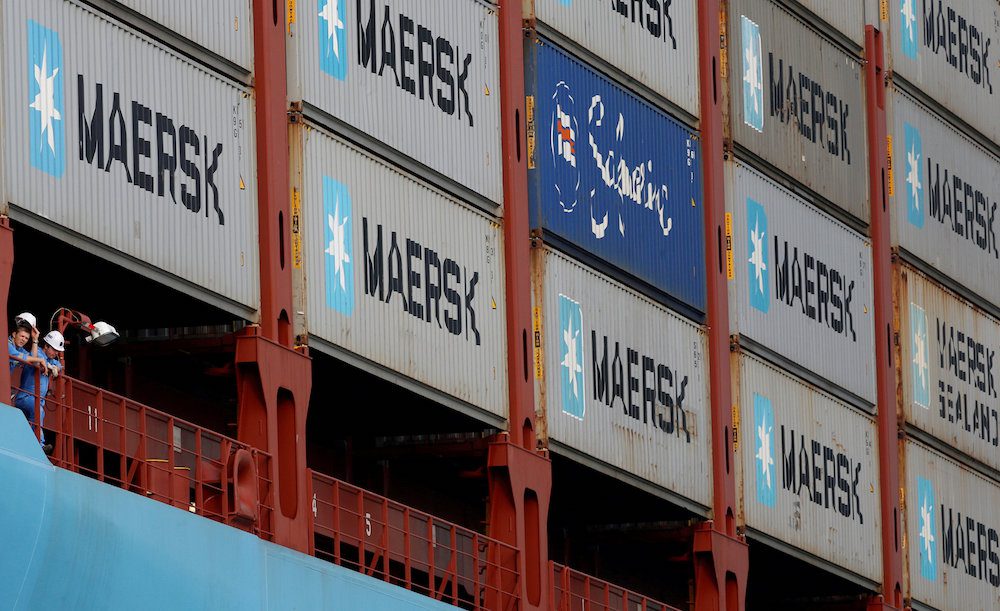

Threat of Price War Clouds Horizon for Maersk Shipping Business

![]() By Jacob Gronholt-Pedersen COPENHAGEN, Aug 22 (Reuters)– A.P. Moller-Maersk has actually been strengthened by the $7.5 billion sale of its oil and also gas company to France’s Total, yet the firm’s major sea products company deals with the danger of a brand-new cost battle in a settling sector.

By Jacob Gronholt-Pedersen COPENHAGEN, Aug 22 (Reuters)– A.P. Moller-Maersk has actually been strengthened by the $7.5 billion sale of its oil and also gas company to France’s Total, yet the firm’s major sea products company deals with the danger of a brand-new cost battle in a settling sector.

Maersk, the globe’s largest container delivery firm, has actually changed its emphasis this year from maintaining market share to greater margins, a technique that was aided by a healing in products prices.

Chief Executive Soren Skou informed Reuters that the firm’s 2nd quarter results recently “were driven by higher freight rates alone” which underlying sector principles were their ideal because 2010.

But rivals consisting of Ocean Alliance– a newly-created collaboration in between France’s CMA CGM, China’s Cosco, Hong Kong’s OOCL and also Taiwan’s Evergreen– will certainly this year launch a string of ultra-large vessels and also will certainly have little option yet to go after a larger piece of the marketplace.

“This could force Maersk to become defensive and defend its market share,” stated Lars Jensen, supervisor at Copenhagen- based working as a consultant SeaIntelligence.

“If you don’t want to enter a price war, you have to accept losing market share.”

The sector in 2014 arised from a strong cost battle over market share that saw products prices go down, injuring container line success as a lot of ships went after inadequate company.

But there are currently indicators of cost altercations on the trans-Pacific course, which might infect various other areas.

Maersk’s concentrate on margins follows sprinkling out $4 billion in December to purchase smaller sized German opponent Hamburg Sud, enhancing its existence in international profession and also Latin America and also boosting international market share to 18.6 percent from 15.7 percent.

Although the sale of the oil and also gas company has actually enabled Maersk to drop any type of conglomerate price cut in the method financiers value its shares, it likewise suggests it can no more make use of oil as a bush versus a slump in the container market.

This method had actually currently motivated score companies to downgrade the firm, although experts still state it will certainly keep its financial investment quality– an essential statistics for the monitoring.

“Overall, (the oil sale) is a credit negative event but we doubt it will have much impact on the short end of the curve due to Maersk’s significant liquidity,” Danske Bank credit rating expert Brian Borsting stated.

Maersk monitoring is extremely crazy about remaining economically durable, suggesting it intends to await an additional cost battle and also for brand-new requisitions.

The firm has actually offered itself an additional year to dilate the staying power possessions, that includes 24 overseas boring gears, 158 oil vessels and also a supply solution procedure.

Nordea approximates an appraisal for the boring fleet around $3.9 billion, while Jefferies anticipate Maersk to bring around $7.5 billion from those possessions. (Reporting by Jacob Gronholt-Pedersen; Editing by Keith Weir)

( c) Copyright Thomson Reuters 2017.