Tiny Japan Shipping Shares Jump On North Korea Detente Hopes

by Yoshiyuki Osada (Reuters)– Shares of tiny Japanese carriers leapt today after the historical top in between united state President Donald Trump as well as North Korean leader Kim Jong Un triggered hopes of information service connections with the reclusive nation.

Japanese retail financiers are nabbing up shares of the companies that might take advantage of a prospective thaw in between Tokyo as well as Pyongyang, despite the fact that the Japanese federal government has actually been a strong advocate of “maximum pressure” on North Korea.

Shares of Rinko Corp, an aquatic transport business, leapt 17 percent today with the heaviest trading quantity in greater than 2 years.

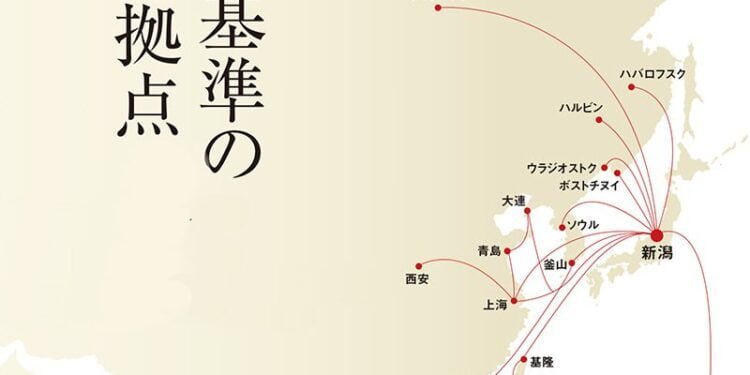

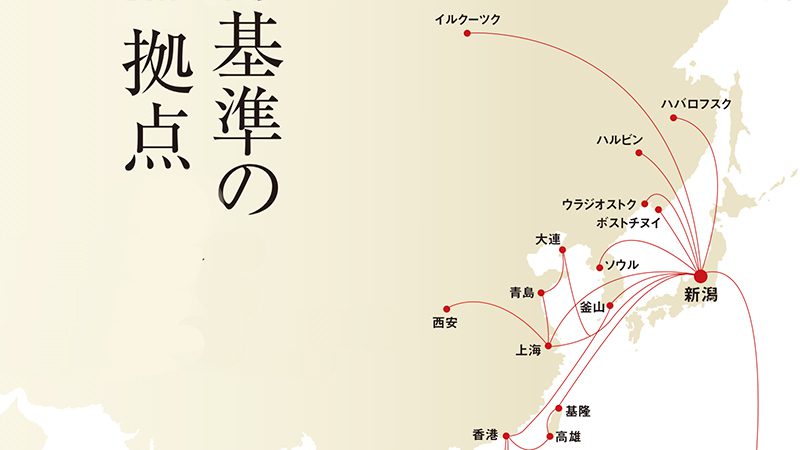

The company is based in the port city of Niigata, a significant center for profession with the locations bordering the Sea of Japan, such as Russian Far East as well as the Korean Peninsula.

Niigata was when offered by Mangyongbong, a North Korean cargo-passenger ship that attached the Japanese port as well as Wonsan inNorth Korea It was just one of an extremely couple of links in between both nations prior to Japan prohibited the ship in 2006, when it enforced permissions adhering to Pyongyang’s rocket as well as nuclear examinations.

Shares of a few other firms with regarded geographical benefits have actually likewise skyrocketed.

Fushiki Kairiku Unso increased 38 percent, its most significant regular gain in practically 20 years. The transport company is based in Toyama prefecture, which likewise deals with the Sea of Japan, as well as has service connections with Russia.

Its trading quantity today surpassed 100,000 shares, bigger than its trading quantity for the entire of in 2014.

Similarly, Hyoki Kaiun, which runs freight delivery solutions to nations consisting of Russia as well as South Korea, leapt 24 percent in large trading quantity.

But market individuals claimed the gains were driven totally by retail capitalist supposition.

“Because there aren’t many sellers, just a small number of bids could lift prices,” claimed Masayuki Otani, Chief Market Analyst at Securities Japan, Inc.

“Retail speculators seem to be trying to make quick money – They have great imagination.”

Tomoichiro Kubota, elderly market expert at Matsui Securities, claimed there was no quality on whether permissions versus North Korea would certainly be raised, not to mention what effect such a growth would certainly carry these firms’ profits.

Indeed, UNITED STATE Secretary of State Mike Pompeo claimed on Friday hard permissions will certainly continue to be on North Korea till its total denuclearisation.

Japan is looking at a conference in between Prime Minister Shinzo Abe as well as North Korean leader Kim Jong Un adhering to the Singapore top in between North Korea as well as the United States.

The concern of Japanese abducted by Pyongyang has actually been a significant road block in any type of rapprochement. The 2 nations still do not have polite connections.

Reporting by Yoshiyuki Osada; Writing by Hideyuki Sano; Editing by Sam Holmes.