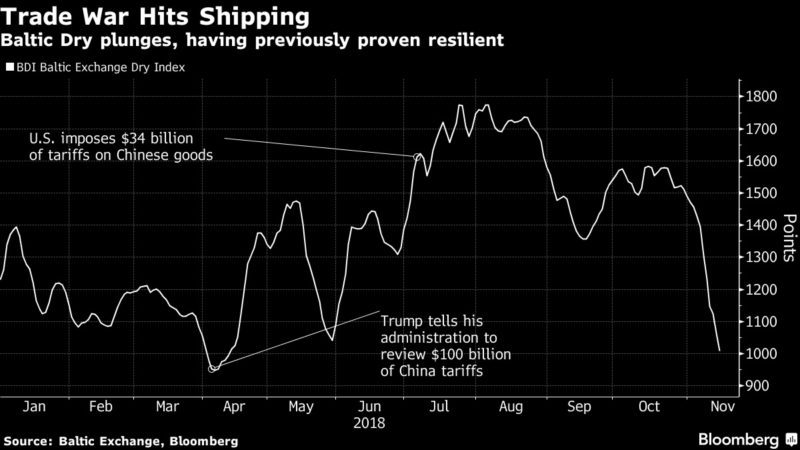

Trade War Finally Hits Commodity Shipping, Confounding Optimists

By Prejula Prem and also Firat Kayakiran (Bloomberg)– The asset delivery market was anticipated to cruise via the profession battle unharmed.

Tariffs were being added thousands of items and also yet delivery prices for completely dry mass– the sector that transports billions of lots of coal, iron ore and also plants around the world– maintained increasing. No extra.

The Baltic Dry Index is within a hair of collapsing via 1,000 factors for the very first time considering that April, regardless of just small growth in fleet capability, the typical perpetrator when prices collapse. This time, it has to do with subsiding development in Chinese need.

“Expect a fragile recovery going into 2019,” claimed Peter Sand, primary delivery expert at BIMCO, a 113-year-old delivery organization standing for vessel proprietors and also drivers. “At best, sideways rates improvement is seen.”

The everyday price for a titan Capesize transporting iron ore to China stands at $7,987, from $27,283 inAugust Forward products contracts, made use of to hedge future expenses, have actually additionally broken down.

China gets greater than a billion lots of iron ore and also coal every year. While imports broadened 1.8 percent this year, development in 2017 was 5.5 percent. At the exact same time, the federal government might limit imports of coal made use of in nuclear power plant as it looks for to suppress contamination. The country is additionally getting less united state farming items, injuring smaller sized ships.

The products market has actually additionally been buffeted by arbitrary occasions. BHP Group, the largest mining business, was compelled previously this month to hinder a runaway train in Western Australia, interrupting iron-ore deliveries. That triggered a liquidation of excessively hopeful fourth-quarter settings in the Capesize market, Macquarie Wealth Management claimed.

© 2018 Bloomberg L.P