VesselsValue.com: Dry Bulk Values within the Pits

By William Bennett,

(VesselsValues.com) – Both the BDI and the BCI have been hitting successive file lows. Capesize charges fell beneath $2000pd in January 2016 and with the present OPEX for the standard capsize sitting at round $6000pd, the vast majority of vessels are working at a loss. Industry sources counsel that charges might sit someplace between $6000pd and $8000pd for the rest of 2016 however that is hardly a worthwhile enchancment. Suggested interval for restoration receives combined estimates starting from 12 months to 5 years with the bulk suggesting 18-24 months.

Downturns in worth have been lower than passable for present Capesize house owners with some capes shedding as much as 60% of their worth over the past 12 months. However, regardless of additional anticipated downturns in worth circa 10-15% in keeping with dealer sources, 2016 will probably be a superb yr for dry bulk acquisition; significantly low-cost, high-risk capes.

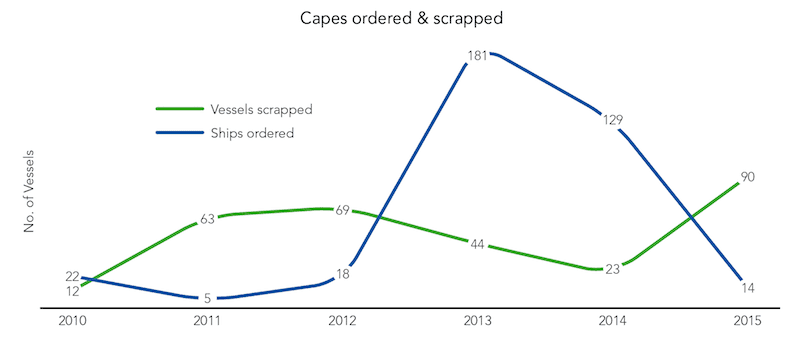

Fleet development is of explicit curiosity within the present local weather. It is universally acknowledged that one of many root causes of the trough is tonnage oversupply. In 2015 Capesize new orders fell by 89% year-on-year. Only 2.8m deadweight tons had been inked in comparison with 2014’s mammoth 26.8m. So fleet development is slowing, nevertheless till problems with oversupply are straight addressed then a restoration is off the playing cards. Owners’ survival will probably be determined by their price effectivity methods, the age of their fleets and the depth of their wallets. Current speak spans between chilly layup and scrapping.

It is estimated that chilly layup will price round $1500pd for the standard Capesize. If charges sit beneath $4500pd then that is the cheaper possibility. Rates are certainly at the moment beneath $4500 which is why chilly layups over the approaching months will likely turn out to be extra commonplace.

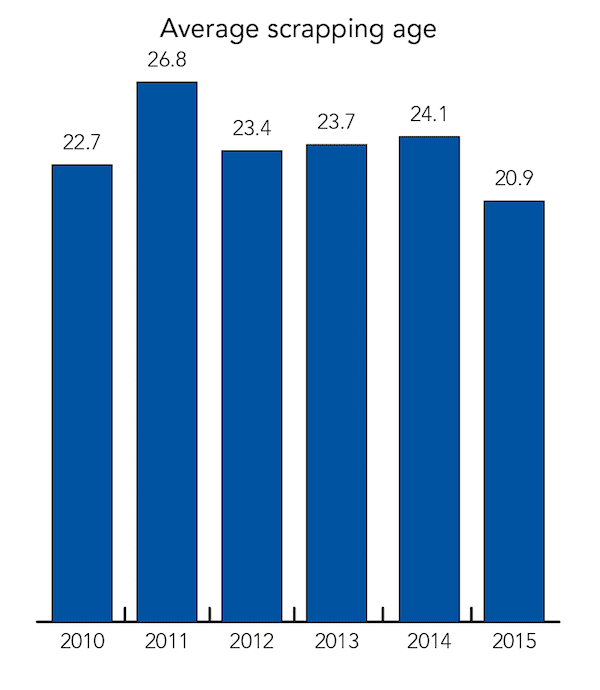

For youthful vessels out of constitution, layup is the lesser of two evils, the higher being demolition. In 2015 Capesize scrapping nearly tripled on ranges seen in 2014. A complete of 15.1m DWT was despatched for demolition. The common age of vessels being scrapped has fallen by round 25% – in 2015 it stood at 20.9 years in comparison with 2010 the place the common vessel was 27.7 years previous.

Much consideration has not too long ago been given to fifteen yr previous ships, changing into a brand new ‘pivot’ age for demolition. No capes youthful than 15 years have been scrapped to this point, nevertheless three 15 years previous capes had been scrapped in 2015. There are roughly 140 Capesize vessels nonetheless stay which might be older than 20 years, whereas 257 are 15 years previous or extra. With some house owners’ dwindling money reserves and a glut of tonnage provide, youthful scrapping could turn out to be the one possibility.

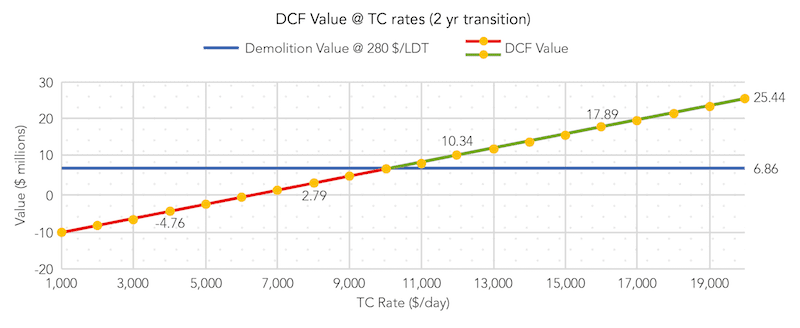

Scrapping, nevertheless, goes to be market pushed in addition to proprietor particular. The common scrap value truly elevated by round 15% yr on yr regardless of heavy ranges of recycling in 2015 (2015: 362 $/LDT in contrast with 2014: 316 $/LDT). At the time of writing, greatest subcontinent charges are roughly 280 $/LDT making a Cape of twenty-two,500 LDT value round $6.4m. Using the VesselsValue Discounted Cash Flow (DCF) module to match the scrap worth towards the long-term earnings worth of a 15 yr previous cape reveals some stark information. In order to realize a DCF worth equal to the demo worth, long-term charges with a 2-year restoration horizon must sit at $10,900pd. Below $8,000pd DCF worth begins to run into the detrimental suggesting that too meagre a restoration will drive house owners into the dust.

A generic 2001-built Capesize (15 years previous) assumed prime quality yard and 170,000 DWT has a present market worth of roughly $6.6m. This is alarmingly near the $6.4m quoted above for demo. On the 14th January the 172,500 DWT Koryu 2000 blt, NKK, offered for USD 6m, demonstrating what present circumstances are like. Some traders see the funding alternative, significantly in ‘upcycling’ as dry bulk turn out to be out of date. Not too lengthy after the Koryu, the Nisshin Trader (172,500 DWT, 2001 blt, Universal) offered for USD 6.25m for conversion right into a cellular energy station by Karadeniz delivery based mostly in Istanbul. It is unknown whether or not the brand new Chinese house owners of the Koryu will proceed to commerce the vessel however no buying and selling consumers had been discovered for the Nisshin Trader offering additional argument for scrap or extra inventive choices.

The sector has additionally seen exits and partial exits of enormous market gamers. With the Nord Energy, Norden make their exit from the Capesize sector planning to focus additional on their Panamax and Supramax portfolios. The deal occurred in uncommon circumstances following a swap for Bocimar’s Supramax, the CMB Maxime. Star Bulk additionally appear to be beating a hasty retreat having offloaded 8 Capes since December 2015 for a internet $295.3m. Current market exercise exhibits clearly that the following 2 years will ship a complete host of death-defying survival methods and maybe among the strange too.

Willial Bennett is a Valuation Analyst at VesselsValue.com, an on-line ship search, valuation and mapping service for Bulkers, Containerships, LNG, LPG, Tankers.