Where to Look in the Oil Market for Clues of a Demand Slowdown

By Ellen Milligan as well as Alex Longley (Bloomberg)–This is intended to be a year of bumper oil need, yet financial indication are blinking throughout the establishing countries that drive development.

Emerging markets are anticipated to add 1 million barrels a day of added oil need this year, regarding 3 quarters of complete international development, according to theInternational Energy Agency Many of those nations are additionally the centers of current financial tumult– China’s profession battle with the united state, money dilemmas in Turkey as well as Argentina, as well as the risk of transmission in Indonesia.

So if the international financial chaos proceeds, what are one of the most vital edges of the oil market to look for indications that need is taking actual a hit?

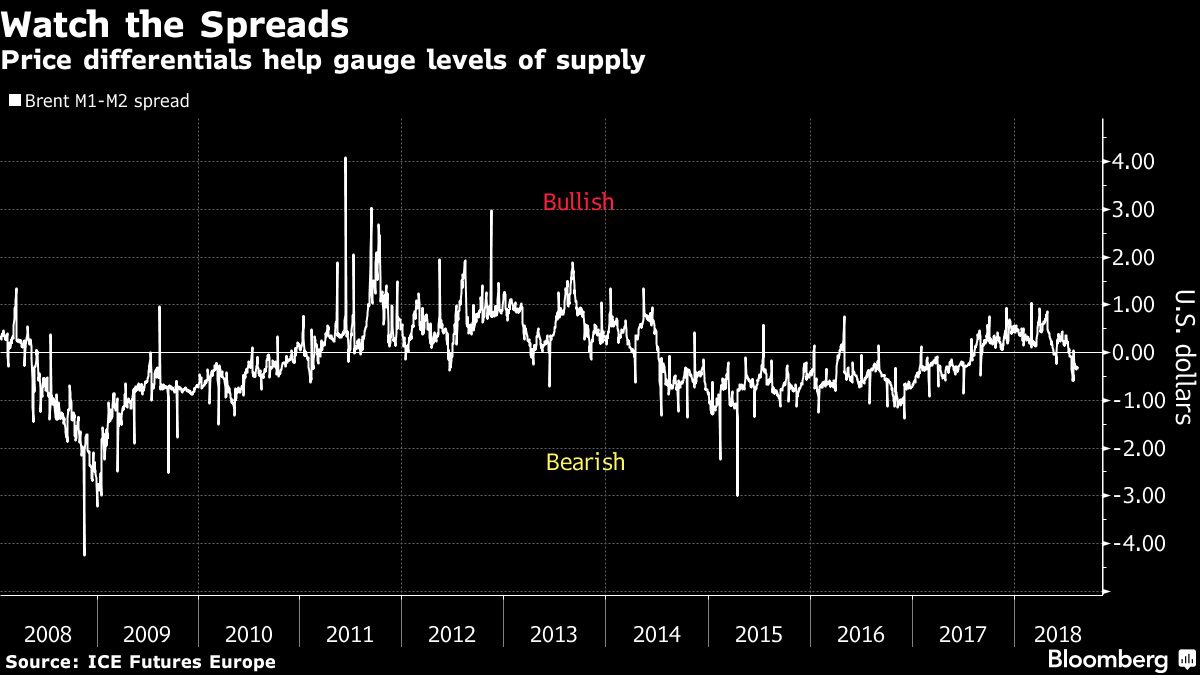

Crude Spreads

Among one of the most noticeable determines of market health and wellness are time-spreads– the voids in costs in between one futures agreement as well as the following. These differentials can offer clear signals regarding patterns in oil need, turning from favorable to unfavorable if the marketplace changes from being undersupplied to oversupplied.

Any stagnation in international need development must be grabbed right here, claims Bjarne Schieldrop, primary assets expert at SEB ABDOMINAL MUSCLE. “Crude oil prices and the crude curve structure are typically the indicator which picks up all the demand side factors and all the supply side factors into one number.”

Diesel Drivers

Diesel as well as gasoil are a lot more very closely linked to the globe’s economic climate than crude, with their usage focused in hefty market as well as business transportation. Demand for these items has a tendency to leap when international development is solid, as well as drop when it damages.

“Gasoil tends to be more closely aligned with global growth so watch the spreads there,” claimed Warren Patterson, elderly assets planner at ING Bank NV.

Right currently, the time-spreads for both crude as well as gasoil sold London have actually dipped right into bearish area, yet just in the short-term. Monthly differentials in New York futures reveal no actual indications of weak point.

Commodities Correlations

Cross- inspecting cost relocate the oil market with various other assets additionally uses a valuable overview on the state of the international economic climate. This week, base steels consisting of copper as well as zinc have actually additionally been sinking on problems regarding slowing down need development, overtaking the autumn in crude.

On days when unrefined costs are rolling in tandem with the whole assets facility, maybe “a sign of negative sentiment in financial markets including the oil market about the global economy,” claimed Jens Naervig Pedersen, elderly expert at Danske Bank A/S.

Follow the Money

As Turkey’s financial distress made headings today, the cost of crude in lira rose to a document high. That’s additionally real of numerous various other arising markets this year, with a weak Indian rupee as well as Russian ruble to call simply 2.

“Higher oil prices paired with a weakening domestic currency spells trouble for major emerging market oil demand growth countries like India, where consumers are already paying near record levels for retail petrol,” claimed Michael Tran, international power planner at RBC Capital Markets LLC.

Shipping Costs

If you would like to know just how much things is being moved the globe, delivery prices are as great an overview as any type of. Whether for oil vessels or mass ships, any type of depression in those pens would certainly use a solid signal of possible problem.

“It would send signals about shipping activity which correlates with goods trade, an important part of the global economy,” Pedersen claimed.

Further analysis Commodities Take Global Hit as Turkey, China Form Toxic Combo Threat of Contagion in Emerging Markets Deepens Commodity Risk What Raw Materials Can Tell Us About Trade War’s Bite: QuickTake

© 2018 Bloomberg L.P