The episode of battle in Eastern Ukraine has actually increased worries regarding the effect of additional assents on worldwide power markets, paired with the UK Prime Minister’s news today of “a massive package of economic sanctions” ahead. As much as the Shipping market is worried, until now, just one Shipping firm has actually been straight approved.

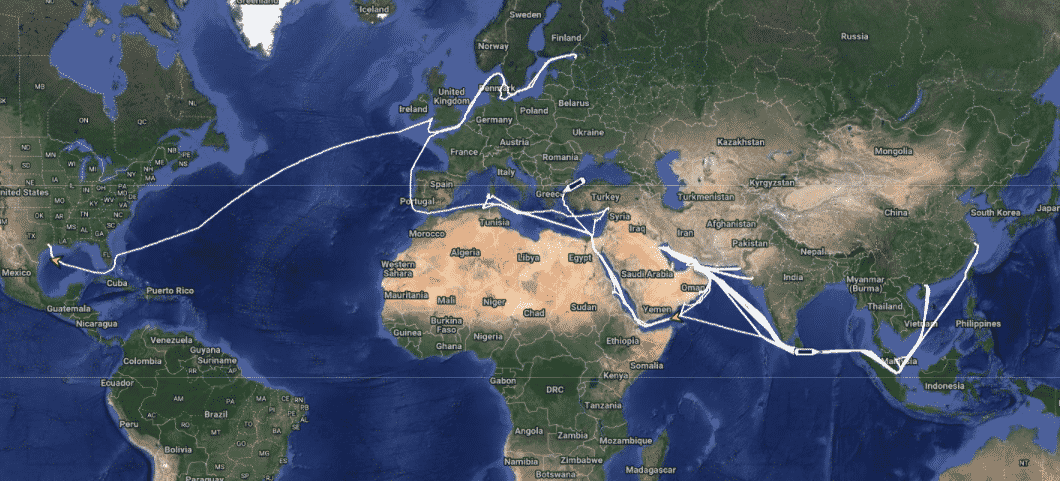

PSB Leasing has 5 ships: 2 Tankers, 2 Multipurpose ships as well as one RoRo (a “roll-on, roll-off” ferryboat for cars). At the very least among its Tankers was currently associated with approved Iran profession, although it has actually likewise called the United States, UK as well as EU in the last 2 years, as received Figure 1. However 5 ship of a worldwide fleet of over 78,000 will barely trigger a surge, not to mention any kind of kind of disturbance.

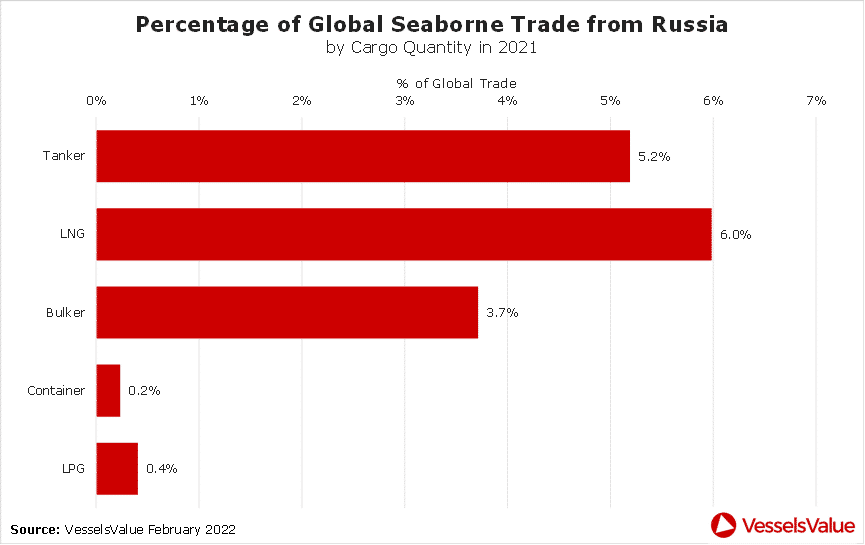

Almost every expert as well as information electrical outlet has actually kept in mind that assents on Russian oil as well as gas exports might protest the West’s very own passions, as costs are currently high, as well as this would certainly obtain substantial supply. As received Figure 2, in 2021, Russian exports represented 5.2% of worldwide seaborne profession on Tankers (oil as well as improved oil items), as well as 6.0% of worldwide seaborne profession on Liquified Natural Gas (LNG)Carriers Such substantial percentages are not easily exchangeable from various other resources.

The equilibrium of rewards might turn the various other method. But if Russia was to limit power exports to the West, it would certainly likewise stand to shed significant export earnings. As an apart, Russian exports likewise represented 3.7% of worldwide seaborne profession on Bulkers as well as their lack would certainly be apparent in markets such as grains, fertilizers, as well as coal.

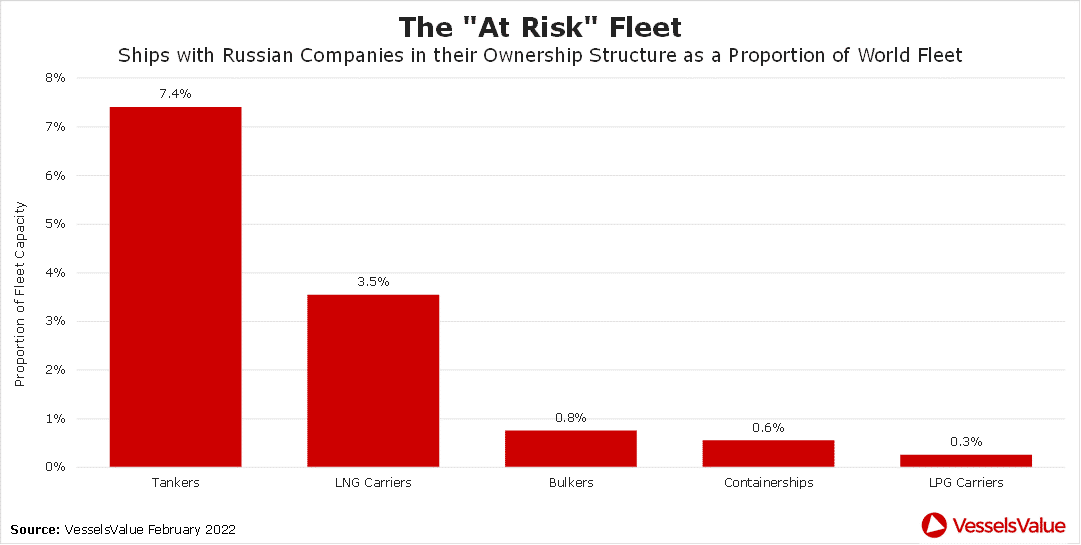

Given the feasible unfavorable rate effect of assents on oil as well as gas, the extra fascinating inquiry after that ends up being “If more Russian companies are sanctioned, how much of the world fleet is at risk?” Looking at possession frameworks of ships generates some beneficial understandings, as received Figure 3.

Potentially, 7.4% of the globe’s Tanker fleet would certainly go to danger, as would certainly 3.5% of the globe’s LNG Carrier fleet. With cripplingly weak exercise as well as products prices affecting both of those markets for the previous a number of months, in significant comparison to flourishing Dry Bulk Carrier as well as Containership markets, assents on Russian delivery business can eliminate some excess supply of ships from the freely open market without triggering as huge a higher motion in products prices.

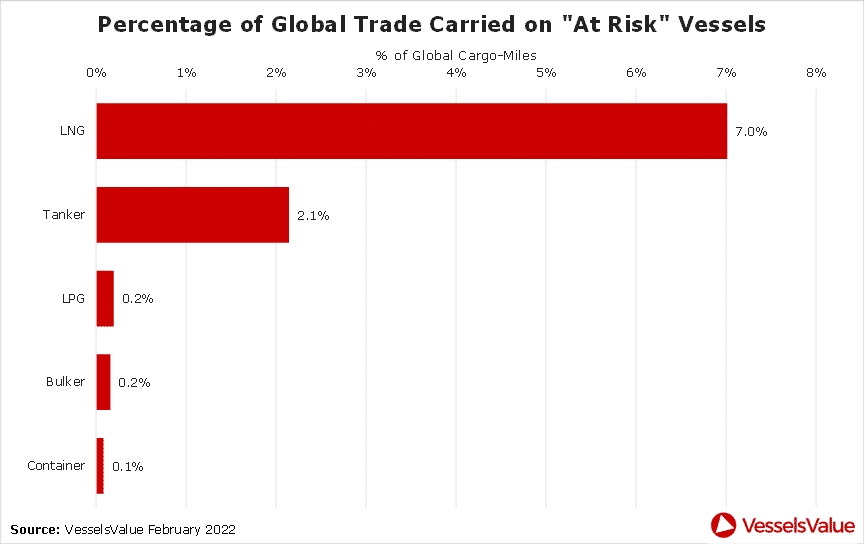

When taking a look at what this can suggest for family member market shares, the effect ends up being even more noticable for gas than oil, as received Figure 4. In 2021, “At Risk” LNG Carriers added 7.0% of complete CBM-miles, whereas “At Risk” Tankers added just 2.1% of complete ton-miles. This is a feature of the previous trading over longer ranges as well as the last over much shorter ranges. Sanctions on Russian Shipping business can for that reason possibly abandon a higher market share for non-sanctioned business in the LNG Carrier market than in the Tanker market.

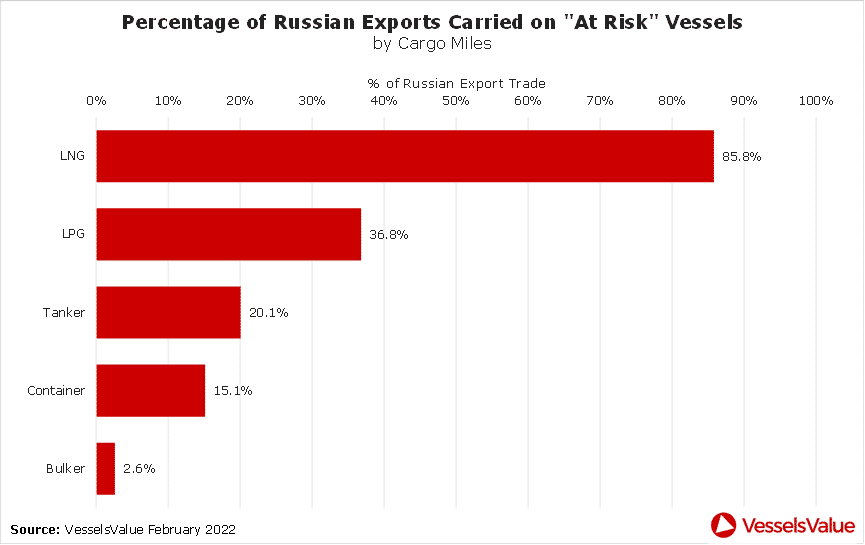

Market individuals will certainly likewise consider just how much Russian profession would certainly appear to unauthorized business under this situation. Figure 5 listed below programs “At Risk” LNG Carriers had 85.8% of CBM-miles rising from Russia in 2021, nearing full prominence. Moreover, “At Risk” LPG Carriers had 36.8% of Russian CBM-miles, although outright quantities are extremely little. A 20.1% market share of the big Russian profession for “At Risk” Tankers will certainly not go undetected by those in the oil market.

From taking a look at the information, one would certainly anticipate policymakers to take into consideration extremely thoroughly the influence on Western customers as well as homes prior to approving oil as well as gas. However, there can be extra extent to assent the ships as well as business that lug them, because of the lower influence on worldwide profession as well as exports.

|VesselsValue