While problem locations remain to arise in the young united state overseas wind sector, experts at Intelatus Global Partners preserve a confident expectation for the sector in the long-term.

The service knowledge and also seeking advice from company stated in its most recent united state Offshore Wind Report that it sees long-lasting structures for the united state overseas wind market strengthening, referencing a number of favorable improvements such as the lately revealed public auction of 3 superficial water lease locations with at the very least 3.6 gigawatts (GW) of capability in the Gulf of Mexico at the end of the month, with 16 drivers prequalified to get involved. On top of the Louisiana and also Texas public auction task, government firms are progressing to prepare the foundation for the public auction of 3 superficial water Central Atlantic websites able to sustain 4.3-8.2 GW of capability early in 2024.

Up north, Maine has actually defined a 3 GW overseas wind mounted capability target by 2024, which is anticipated to call for drifting wind modern technology. As an outcome of Maine’s brand-new overseas wind objective, states have actually devoted and also have actually revealed procurement targets totaling up to over 105 GW. Delaware is additionally exploring developing an overseas wind purchase target.

However, in the temporary, price rising cost of living and also rate of interest worries remain to develop difficulties for drivers that have actually protected both leases and also state offtake honor, Intelatus stated.

Avangrid will certainly pay fines to 3 Massachusetts energies to terminate its Commonwealth Wind power acquisition contract (PPA), while SouthCoast Wind is additionally working out with the Massachusetts energies to terminate its PPA.

BP has actually verified that it and also Equinor are looking for to renegotiate PPA terms with New York firms for its northeast profile, that includes Empire Wind 1 & & 2 and also Beacon Wind.

In New Jersey, Orsted is encountering lawful difficulties over the state expense that was passed to sustain its Ocean Wind 1 growth. Another task in New Jersey, Atlantic Shores, is looking for the exact same therapy to make its task economically sensible.

Rhode Island picked not to choose the single quote in its current solicitation, Orsted’s Revolution Wind 2, as the task was viewed as also pricey in the existing market problems.

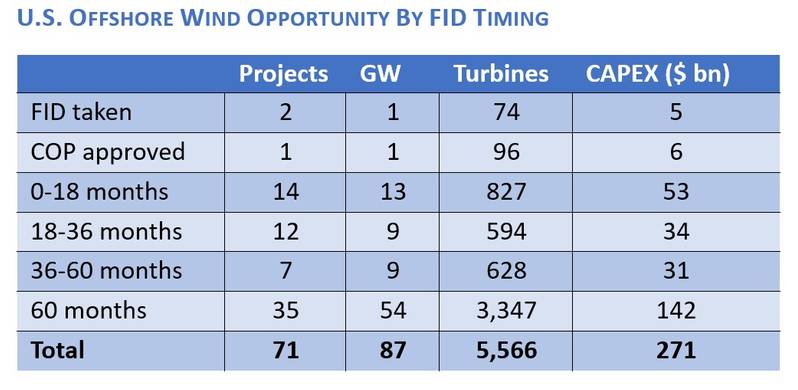

Despite the difficulties, Intelatus siad it preserves its projection for greater than 70 jobs that will certainly set up near to 87 GW of capability in this and also the following years and also an overall 110 GW by 2050.

“Forecasts for storm clouds in the short term have done little to dampen the positive long-term outlook for U.S. offshore wind,” stated Philip Lewis, supervisor of study atIntelatus Global Partners “The industry remains on track to meet its long-term targets despite recent negative trends.”

(Source: Intelatus Global Partners)

(Source: Intelatus Global Partners)

According to Intelatus, the 87 GW projection capability will certainly call for capital investment totaling up to around $271 billion to bring onstream, a persisting yearly procedures and also upkeep invest of $8.6 billion when supplied, and also near to $38 billion of deactivating expense at the end of industrial procedures.