Much has been written about potential bottlenecks in retailer for numerous elements of the U.S. offshore wind trade, from vessels to monopiles. A brand new report revealed by the Business Network for Offshore Wind (BNOW) outlines the necessity for important funding in and growth of port infrastructure to assist the trade in its purpose of 30 gigawatts (GW) of offshore wind energy by 2030 and 110 GW by 2050.

The excellent news is that greater than 35 new offshore wind port tasks have gone into growth or started industrial operations within the U.S. during the last 5 years—nearly all of that are within the Northeast and Mid-Atlantic, in keeping with BNOW’s report, “Building a National Network of Offshore Wind Ports: A $36B Plan for Domestic Clean Energy Infrastructure”.

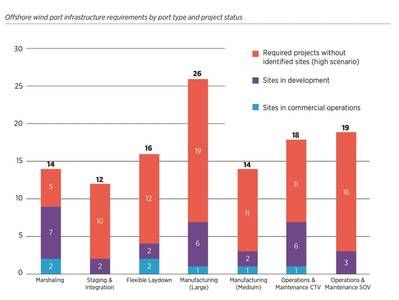

But that’s solely the tip of the iceberg. The report’s authors estimate that the U.S. wants a complete of 99 to 119 port growth websites throughout the East Coast, West Coast and the Gulf of Mexico to fulfill its 2030 purpose and lay the foundations for 2050. This means the U.S. is presently going through an offshore port infrastructure hole of 64 to 84 tasks.

The trade wants a community of port services to effectively manufacture, retailer, stage, set up and keep offshore wind generators. Port sorts embrace marshaling ports, staging & integration ports, versatile laydown ports, manufacturing ports, operations & upkeep ports.

BNOW estimates that the overall price to handle the nation’s offshore wind port infrastructure hole, assuming 2023 development costs and no financing prices, is between $22.5 billion and $27.2 billion. This development funding hole is roughly 3.4% to six.2% of the overall capital wanted for mission deployment by 2050.

After estimating the timing of tasks over the following decade, and accounting for development inflation, the higher certain of capital required to handle the offshore wind port infrastructure hole escalates from $27.2 billion ($ 2023) to $36 billion ($ Year of Expenditure (YoE)). According to BNOW’s report, the monetary prices related to growing these tasks is estimated to be an extra $7.2 billion ($ YoE) over 10 years.