Tongues are wagging in the overseas market, as one of the longest-running reports on the market has actually ultimately come to life.

united state overseas vessel proprietor Tidewater Marine has actually obtained Singapore’s Swire Pacific Offshore for USD 190 million, the firm’s largest powerplay given that its purchase of Gulf Mark Offshore back in 2018.

But why SPO, as well as why currently? In this write-up, VesselsValue’s Head of Offshore, Rob Day, looks for to respond to these inquiries as well as give discourse on why this long-time-coming offer makes good sense for both events.

A Force to be Reckoned With

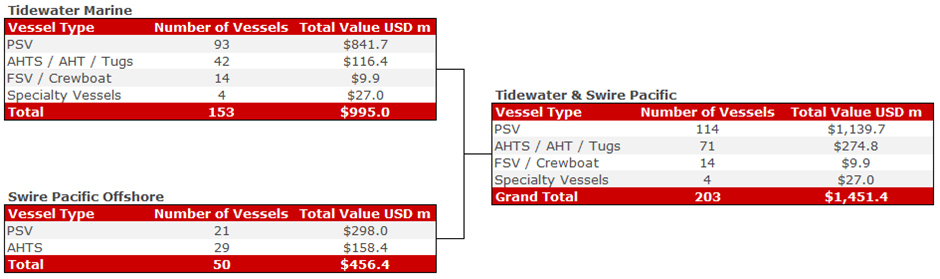

The purchase of SPO takes Tidewater to 203 vessels with a consolidated VV worth of USD 1.45 billion.

All information fix since 11/03/2022

Lock as well as Key Regional Fleet Integration

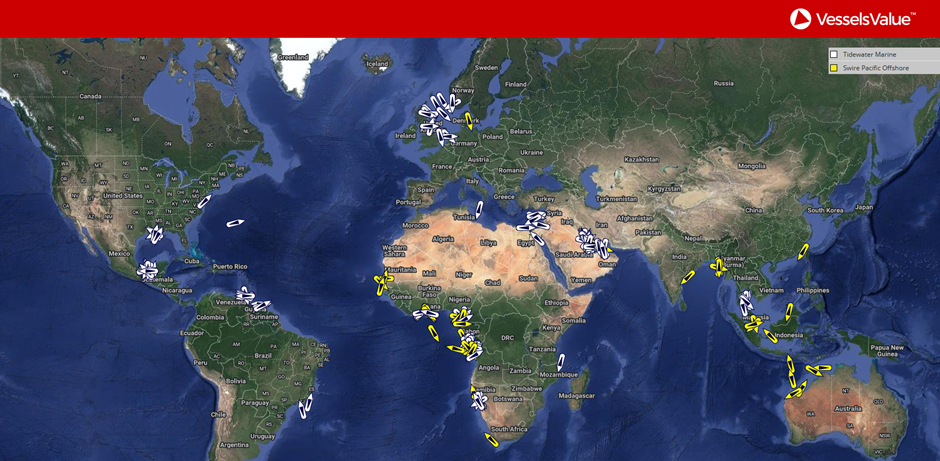

Tidewater’s primary locations of procedure are the North Sea, United States Gulf of Mexico, West Africa, Egypt, as well as theMiddle East SPO has a solid visibility in West Africa, Southeast Asia, as well asAustralia In recap, Tidewater ended up being a totally international gamer with a durable fleet generally locations of procedure.

Modern Versatile Fleet up for Grabs

The ordinary age of the Swire fleet (PSV as well as AHTS) is around ten years old. Swire violated the status over the last couple of years as well as remained to take distribution of their huge Japanese- developed PSVs. This was not a suitable scenario thinking about the overseas market problems. However, because of this, its fleet ordinary age was driven down.

By getting SPO, Tidewater additionally opened accessibility to 18 top notch huge PSVs (4,000 DWT +) with an ordinary age of 6.7 years of ages, as well as 10 huge AHTS (16,000 BHP +) vessels with an ordinary age of 8.4 years. Both the dimension as well as spec of vessels have actually experienced a firming in worth throughout late 2021 as well as very early 2022, as well as a considerable decrease in sale as well as acquisition prospects. Thus, the SPO purchase permits Tidewater to include properties swiftly as well as briefly to their fleet, as well as not end up being target to boosted proprietors’ asking rates and/or boosted purchasing competitors.

Out with the Old, In with the New

Since around 2018, Tidewater has actually been boldy offering its non-core tonnage to update its fleet. Based on VesselsValue transactional information, Tidewater has actually marketed around 60 vessels (mix of PSVs, AHT/AHTS, FSV) for additional trading as well as around 70 vessels for demolition.

This has actually permitted them to collect an approximated USD 140 million battle upper body (approximated c. USD 100 million for all pre-owned sales from 2018 as well as approximated around USD 40 million for all demolition sales from 2018). The purchase of SPO fills up deep space produced by minimizing their general fleet number, as well as having cash money can be found in over the last couple of years is constantly assists.

When the Going Gets Tough, The Tough Buy Their Competitors

It is obvious SPO hasn’t had the most convenient of declines as well as the firm has actually been experiencing for several years, with installing operating losses as well as melting via cash money (at a significantly greater price than the majority of huge overseas gamers on the market). Growing write-offs, the shutting down of the Swire Subsea department, as well as one of the most unusual, proclaiming really pricey alternatives of PSVs in the center of the recession. However, for a customer like Tidewater, this provides its very own collection of possibilities to order a deal (or at the very least a much more reasonable asking cost). The stating ‘one man’ s anguish is one more guy’s ton of money‘ occur, as well as a ripple effect of this is quiting your rivals getting SPO or their properties. Controlling the marketplace is vital to continue to be the leading gamer!

Jumping Back right into the Large Anchor Handling Market

Tidewater has a tiny direct exposure to the huge AHTS market, with 5 vessels in between 13,000 BHP as well as 16,000 BHP, most of which are operating inWest Africa The acquisition of SPO will certainly provide accessibility to Swire’s well-respected D course huge support trainers, modern-day, young, as well as high bollard pull. Again, the huge AHTS market has actually just recently seen a sharp firm, as well as there are minimal sale as well as acquisition prospects. On the hiring side, huge AHTS prices are firming, as well as they remain in high need from both the Renewables as well as Oil as well as Gas market.

Conclusion

With babble in the Offshore market of a recuperation in our middle, this purchase tops Tidewater to maximize any type of transforming market problems as well as truly established themselves aside from their rivals. It will certainly interest see just how various other huge OSV proprietors respond to this information as well as what techniques they implemented to take on the brand-new Tidewater/ SPO fleet in the long-term.

VesselsValue information since March 2022.

The write-up was initially released on VesselsValue.com.