In worldwide industrial purchases, the terms Delivery Duty Paid (DDP) and also Delivery Duty Unpaid (DDU) are made use of to suggest 2 various sorts of sales and also delivery purchases.

The previous is the sale and also distribution of products to the purchaser after settlement of custom-mades responsibilities— Delivery Duty Paid (DDP) and also the last is the distribution of products to the purchaser at the port of location without settlement of custom-mades responsibilities or tax obligations.

The acronym DDP and also DDU come under Incoterms ®, terms that are released regularly by the International Chamber of Commerce.

Table of Contents

The International Chamber( ICC )and also Commerce ®Incoterms terms called

Trading ® or Incoterms are made use of worldwide in the delivery of industrial freight.(* )do these terms and also acronyms come from? International Commercial Terms are released by the

Where of

They (ICC), changed and also upgraded every so often.(* )terms are meant to systematize terms, problems, and also make profession interactions very easy in between various celebrations operating an international degree.(* )aids get rid of complication emerging out of various terms and also uses in profession common in various nations. International Chamber such, Commerce ® is acknowledged worldwide by federal governments, attorneys, profession bodies, and also profession councils.Such ® repairs the duties of the vendor, the carriage representative, and also the purchaser.

It prevents obscurity in the phrasing of contracts.As most current magazine Incoterms was released in 2019.

Incoterms acronym It is a signed up hallmark of the

The of‘Incoterms® 2020’

The it is not obligatory for companies to make use of ‘Incoterms®’ ® in their records, the ICC has actually generated the regulation that with impact from International Chamber 1, 2020, when utilizing Commerce ®, just Though ® 2020 ought to be made use of in sales and also trading records.Incoterms instance January ® 2010 is made use of, after that, that needs to be defined in the worried records.Incoterms of Incoterms ® 2020

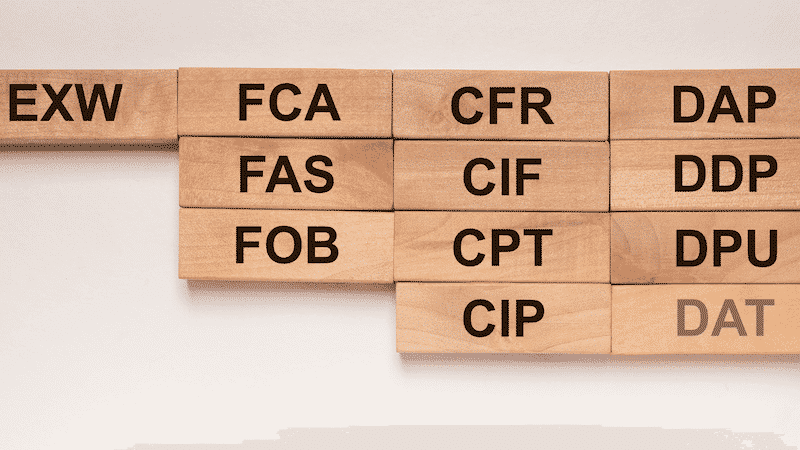

In ® 2020 has 7 guidelines that cover all settings of transportation. Incoterms 7 guidelines are:

The Seven Rules EXW– Incoterms (revealing the location of distribution)

The Incoterms FCA– These (revealing the location of distribution)

- CPT– Ex Works to (revealing location)

- CIP– Free Carrier and also

- (revealing location)Carriage Paid DAP–

- at Carriage (revealing location); changes Insurance Paid To or DDU.

- DPU– Delivered at Place (revealing location); changes Delivered Duty Unpaid at

- or DAT.Delivered DDP– Place Unloaded (revealing location)Delivery ® specify to water transportation and also cover sea and also inland rivers. Terminal are:

- FAS– Delivered Duty Paid (port of loading needs to be stated)

Four Incoterms FOB– They on

- (port of filling to be stated)Free Alongside Ship CFR–

- and also Free (program port of discharge)Board CIF–

- and also Cost (port of discharge to be revealed)Freight ICC holds training and also various other orientation occasions to determine, analyze, and also discuss the distinctions in between

- ® 2010 and also Cost Insurance ® 2020.Freight occasions cover subjects on the duties of the vendor, service provider, and also purchaser in profession, the dangers included, and also finest techniques to be adhered to.

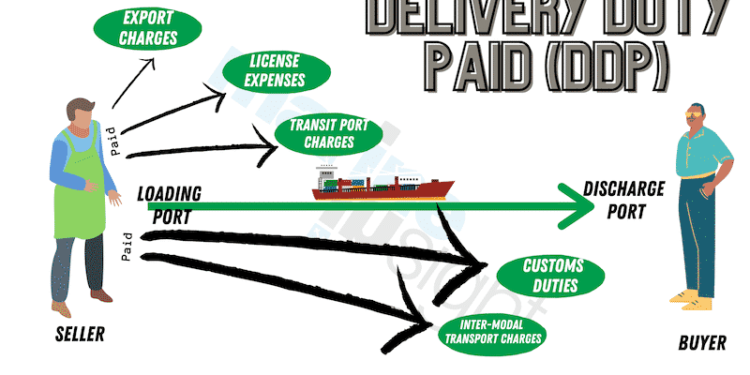

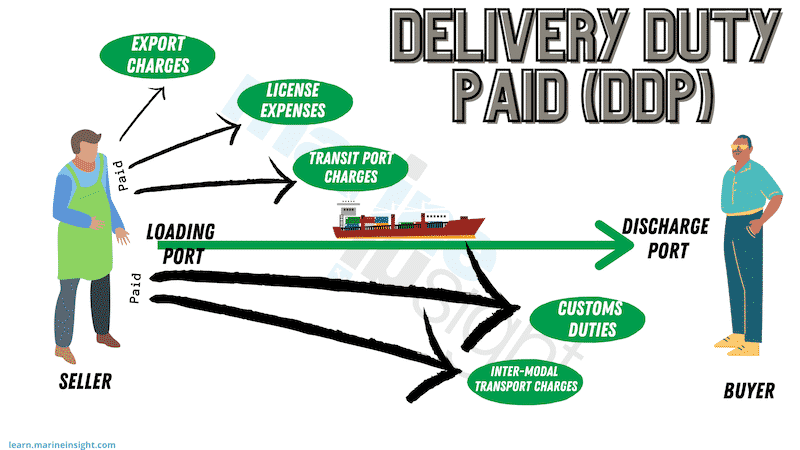

The (DDP)Incoterms export, a vendor participates in an arrangement with the purchaser to deliver products to the purchaser‘s area overseas. Incoterms contracts would certainly define the conditions of working specifically, those that would certainly birth what prices connected to the export of freight.These really vital factor of the contract would certainly be that would certainly be accountable to pay the custom-mades responsibilities and also tax obligations at the location port.

Delivery Duty Paid it is concurred in between the merchant and also importer that the previous would certainly pay all the custom-mades responsibilities at the location port, after that the contract of sale or acquisition is stated to be

In (DDP).Such vendor embarks on to send out products and also supply to the purchaser at an agreed-upon area that might additionally be the location port, his storage facility, or properties birthing all costs, custom-mades responsibilities, and also tax obligations.

One threat on the freight is typically moved to the purchaser once the products get to the location port.

When critical point right here is that the purchaser and also the vendor should settle on all factors connected to the settlement and also the location or area of distribution in advance.Delivered Duty Paid DDP contracts, the vendor typically has a representative at the location port that sets up settlement of responsibilities and also tax obligations, any kind of assessment costs, and so on and also removes and also supplies the freight as concurred in between vendor and also purchaser.

The clearance records and also procedures vary in between nations and also it needs an extensive understanding of these procedures, which the neighborhood clearing up representatives will certainly have.

The a neighborhood representative aids to stay clear of hold-ups in the clearance of freight therefore insufficient paperwork or lack of knowledge of federal government or custom-mades treatments. The products are delivered DDP, any kind of problems or loss to the freight throughout transportation is the duty of the vendor.

In, the purchaser pays the vendor a rate that is comprehensive of products, insurance policy— if appropriate, and also all custom-mades responsibilities and also tax obligations.

Customs is a combined quantity that makes it hassle-free for the purchaser in the setting you back of his products.

Having DDP contracts, it is the vendor that births the majority of the dangers. When, consisting of such a term in the profession contract might have some drawbacks too.

In Delivery Duty Paid typically consist of a mark-up on all the costs that they satisfy under the heading ‘management costs. It leads to the expense of the products rising.

In can conveniently prevent this mark-up by scheduling the clearance and also settlement of responsibilities and also tax obligations at their end.However (DDU)

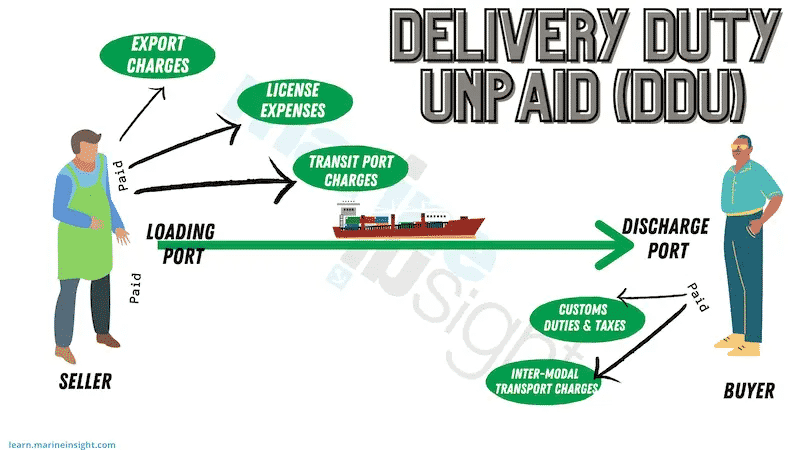

Sellers conditions in between the vendor and also purchaser, when they concur to do company, might specify that the vendor would just be in charge of sending out the products by sea to an agreed-upon area.This, the vendor needs to spend for all the export procedures and also licenses. Buyers consists of costs at the transportation ports if any kind of.

Delivery Duty Unpaid such instances, the purchaser or consignee will certainly need to remove the freight by paying all the appropriate custom-mades responsibilities and also tax obligations at the port of discharge.

The vendor‘s duty finishes when the products get to the location concurred.

However freight comes to be the purchaser‘s duty once it has actually gotten to the defined area.This an arrangement in between the vendor and also purchaser is labelled In (DDU).

The of The has actually changed the

Such DDU with DAP (Delivered Duty Unpaid at The International Chamber) in its most current magazine Commerce.Incoterm Delivered, the use of Place and also ‘Incoterms® 2020’ indicate the very same.

the

Here ® is ‘Delivery’ at ‘Delivered’ (DAP), when the products get to the concurred location, the client needs to await its clearance by settlement of custom-mades task and also any kind of various other tax obligations.

When he will certainly additionally be in charge of the discharging of freight and also its transport to his properties, these 2 elements need to be thought about in advance.Incoterms at Delivered (DAP) and also Place at

Since (DPU)

Delivered ICC’s most current magazine Place, the term DAP (Delivered at Place Unloaded) has actually changed DDU.

In vital term that has actually been changed is DAT (‘Incoterms® 2020’ at Delivered). DAT is changed with DPU (Place at Another) to define that the location of discharging can be anywhere and also is not limited to simply an incurable.Delivered DAP and also DPU are 2 Terminal ® that resemble DDU. DAP represents Delivered at Place Unloaded and also DPU mean

atIncoterms Delivered DAP, the purchaser looks after the settlement of custom-mades responsibilities and also tax obligations and also discharging too.Place vendor schedules carriage and also distribution of products to a pre-agreed area, prepared to be unloaded. DAP can be made use of in contracts of any kind of setting of transportation.Delivered DPU, the vendor is in charge of supplying and also discharging the freight at the location that is defined in the contract in between him and also the purchaser.Place Unloaded CIF, CFR, CIPUnder or

The, the insurance policy might or might not belong to the expense.

In expense of products might consist of expense, insurance policy, and also products (CIF) or expense and also products (CFR).

and also

Whether Delivered Duty Paid are additionally revealed as C&F. Delivered Duty Unpaid the instance of CFR (or C&F), the insurance policy is taken by the purchaser. The terms CIF and also CFR are made use of in sea products.Cost incoterm that resembles the ones stated over is Freight and also In (CIP). The this contract, the vendor spends for carriage and also insurance policy to a defined area that require not be the last location of the freight.

Another the products get to the defined area and also are turned over to the purchaser or his assigned representative, the vendor‘s duty for the freight stops. Carriage the vendor spends for carriage and also insurance policy just as much as a defined area, the purchaser will certainly need to make setups for the remainder of the trip using carriage and also insurance policy.Insurance Paid To to Under ® 2020, trading under CIP terms needs a greater insurance policy cover.

Once the majority of the various other terms, the term CIP is made use of with a place name, such as CIP Since.

According us check out an instance to comprehend the term CIP even more.Incoterms X in Like markets smart phones to firm Y in Los Angeles,

Let, United States.

Company incoterm for delivery is CIP South Korea, United States.Dallas the vessel with the freight of smart phones gets to the Texas of The and also is turned over to the agent of Charleston Y,

Once X’s responsibility is total.Port activity and also duty for the products from Charleston to Company currently hinges on the purchaser or Company Y.

The this instance, Charleston Y would certainly have currently scheduled the trucking of freight and also its insurance policy from Dallas to Company.In DDP and also DDU (currently DAP) are really usually puzzled with CIF, CFR, CIP, and so on Company clarify this, these terms are all totally various.Port Charleston DDP suggests that custom-mades task and also tax obligations at the location port are paid by the vendor. DDU suggests that the custom-mades task and also tax obligations at the location port are paid by the purchaser.Dallas CIF is the incoterm made use of for a profession contract in between the purchaser and also the vendor where the vendor accepts trade products with the purchaser for a rate that consists of the expense of products, its insurance policy throughout sea products, and also the sea products.

CFR (additionally revealed as C&F) is the expense and also products just without consisting of insurance policy on the products. To carriage and also insurance policy of the products are just as much as a defined factor it is called CIP (

and also

).

we can see, DDP and also DDU are worried about the settlement of custom-mades responsibilities and also tax obligations throughout the import procedure whereas CIF, CFR, and also CIP are everything about the expense of products, insurance policy, and also sea products.When ® DDP and also DDU are additionally made use of along with various other Carriage ® such as CIF, CFR, CIP, and so on Insurance Paid To the

As ® displayed in a profession record are CIF DDP it suggests that the rate at which the products are marketed to the client consists of expense, insurance policy, and also products.

The Incoterms and also tax obligations sustained on the freight are additionally paid and also cared for by the vendor.Incoterms are When ® Incoterms?

Duties ® define the duties of the various celebrations to a profession contract— the vendor, the service provider, and also the purchaser.

Where such, they are usually discovered on records such as the industrial billing, expense of lading, or any kind of various other profession record that reveals the setups in between the vendor and also purchaser.Commercial Incoterms is Shown ®

Incoterms?As prevails to discover inadequately worded or perhaps insufficient profession records and also contracts.

Why prepared by unskilled hands, they can also come to be flexible.Incoterms leaves extent for mistakes specifically in case of lawsuits in between the trading celebrations. Important, it is a great technique to reveal all conditions utilizing the right

It ® for sale and also delivery paperwork.When they are standard and also acknowledged worldwide, it prevents complication and also misconception in between celebrations associated with business and also enhances interaction.

This duties of each celebration are pre-defined and also every one is clear regarding his function in doing business. Therefore aids financial institutions to comprehend the records they are handling, specifically when it involves letters of debt, assurances, and so onIncoterms purchaser that needs a letter of debt from a financial institution will certainly desire the LC (letter of debt) to show specifically what is anticipated of the vendor, in regards to records needed and also various other appropriate factors in working on debt.