As numerous marine markets were tested by COVID-19, Royal IHC, a Dutch maritime empire and also bellwether for the sector, reported its yearly numbers showed the smoke is getting rid of and also a recuperation remains in view.

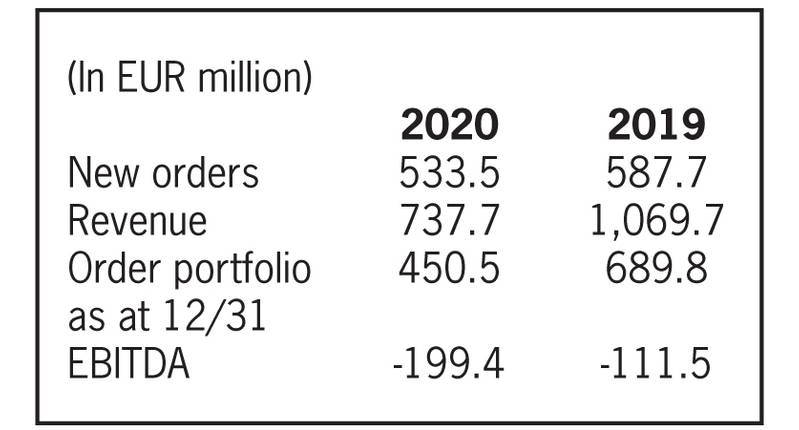

2020 will certainly drop as a year numerous in and out of the maritime sector will certainly intend to quickly neglect, and also in launching its yearly numbers Royal IHC kept in mind that the initial fifty percent of 2020 was controlled by refinancing and also recapitalization, with COVID-19 having a “major impact” on order consumption throughout 2020. For the year, Royal IHC accomplished an unfavorable EBITDA of EUR 199 million in 2020, as anticipated.

Select numbers from Royal IHC assistance to highlight the obstacle:

Source: Royal IHC

Source: Royal IHC

The initial fifty percent of 2020 was controlled by the refinancing, recapitalization and also resizing of Royal IHC to show the financial fact, a truth which implied the loss of 600 work– 300 residential and also 300 beyond the Netherlands– along with the decrease of 700 short-lived employees.

“Royal IHC is now on track after a challenging 2020,” said Gerben Eggink, Royal IHC CEO. “There is maximum focus this year on successfully completing a number of large and complex projects that were contracted in 2017 and 2018.

“Although the consequences of the COVID-19 pandemic will have an impact on the 2021 results, we still expect a positive result. The prospects for the years that follow are also hopeful. There are clear signs of recovery in certain markets, and that will lead to new applications for the construction of ships and equipment in 2021 and beyond.”

Following is a short appearance inside a few of Royal IHC’s vital markets.

Custom dredgers: “Slow and steady”

While the first action to COVID-19 was– as it remained in the majority of sectors– to postpone financial investments, Royal IHC claimed it started to see recuperation in the 2nd fifty percent of 2020. The variety of applications and also concrete arrangements show a sluggish however consistent recuperation in the digging up market. The enhanced need for custom-made dredgers is an indicator of this fad.

Offshore power: oil and also gas

In the overseas power market for oil and also gas, the adverse result of COVID-19, in mix with a really reduced oil cost in the initial fifty percent of 2020, was substantial. Investments in capital-intensive oil and also gas tasks were delayed or perhaps quit entirely. Demand for solutions and also repairs from Royal IHC stayed steady, albeit at a reduced degree. This has actually caused brand-new solution agreements for pipelay vessels, repair orders, a series of tandem mooring and also unloading systems, and also riser pull-in systems.

Renewables

The offshore renewable resource market remained to expand in 2020. This resulted (additionally for IHC IQIP) in a greater turn over and also order consumption contrasted to 2019.

Defense

In 2020 Royal IHC began to increase its tasks in the worldwide protection market. Contacts have actually been enhanced with the Dutch Ministry ofDefense This originally caused a variety of design projects. Royal IHC is currently a participant of the ‘HR ecosystem’ and also a companion in theMaritime Capacity Alliance This is focused on the exchange of understanding and also advancements, and also together with the Ministry of Defense in the context of the flexible militaries. Royal IHC additionally escalated its collaboration with NAVAL Group to get the Walrus substitute program.

Royal IHC claimed it anticipates a globally boost of financial investment in protection devices in the future. In the Netherlands, this can result in added expense for, to name a few points, the substitute and also revival of component of the marine fleet.