When items and also products are imported to a nation for handling and also the ended up or refined items re-exported, the Customs responsibility that has actually been paid at the time of the import of the items and also products can be withdrawed from the federal government. This is normally referred to as Duty disadvantage.

The Customs division will certainly provide a debt for the Duty disadvantage total up to business after establishing that the items that were imported have actually been exported and also have actually left the nation.

All of the items and also products imported might have been exported or it might just belong to the amount. In this situation, the disadvantage can be asserted just on the exported part.

Duty disadvantage can likewise be asserted for an amount that has actually been damaged under the authority and also guidance of the appropriate federal government division.

Why is the Customs responsibility reimbursed?

The reasoning behind reimbursement of Customs responsibility is that in particular instances, the items that are imported are not eaten in the nation of import. Instead, it is made use of to boost an in your area made item or made use of as a component of such an item, which is after that exported.

Duty disadvantage is a motivation given by the federal government to motivate production sectors in the nation. Manufacturing and also export are both tasks that produce profits for the federal government.

The items that are imported are typically made use of in the manufacture of items or refined even more within the nation. The imported items or products that are to be re-exported at a later time ought to be plainly recognized and also quickly deducible to the exported items.

At the moment of import, they need to be stated and also noted to the fulfillment of the clearing up Customs police officer.

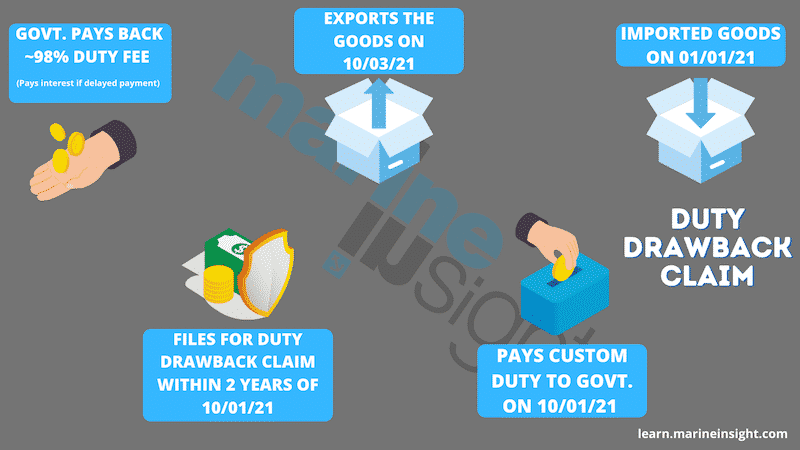

In India, Section 74 of the Customs Act of 1962 enables approximately 98% of Duty disadvantage. The disadvantage can be asserted on Customs responsibilities on imported items that are indicated for re-export within 2 years of settlement of such import responsibility.

This duration is computed from the day of settlement of import responsibility and also not from the day of importation.

In diplomatic immunities, after sending legitimate factors for any type of excessive hold-ups past 2 years to re-export the items, the federal government might permit Duty disadvantage. These items might be exported from the nation either in the made use of or extra state.

Certain items and also products if they are made use of after their entrance right into the nation are not qualified for Duty disadvantage. However, if they are exported consequently without being made use of, the disadvantage can be asserted from the Customs.

Examples of such items are particular sorts of clothing, un-exposed photo movies, x-ray, and so on

The price of disadvantage is determined by the federal government taking the period of usage, devaluation worth, and also various other appropriate elements right into factor to consider.

When Duty downsides are not reimbursed to the importer/exporter within a given duration, area 75A of the Indian Customs Act supplies passion to complaintants on these quantities through of hold-up.

In the United States, Duty disadvantage can be availed on imported duty-paid products that are made use of in the production and also handling of items that are re-exported.

The United States Customs and also Border Protection likewise enables Duty disadvantage on products that have actually not been made use of in any type of production however are consequently exported out of the United States in their extra state.

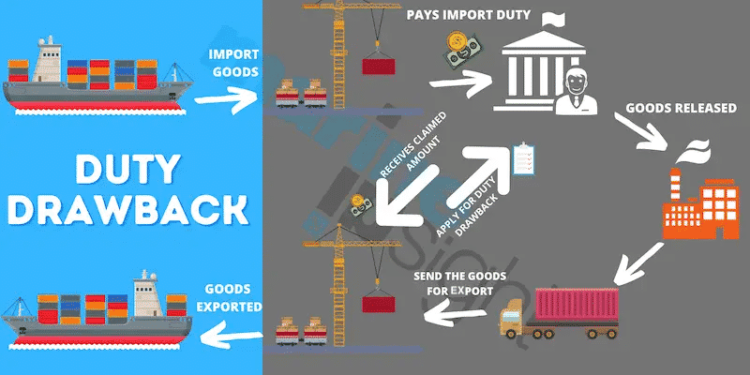

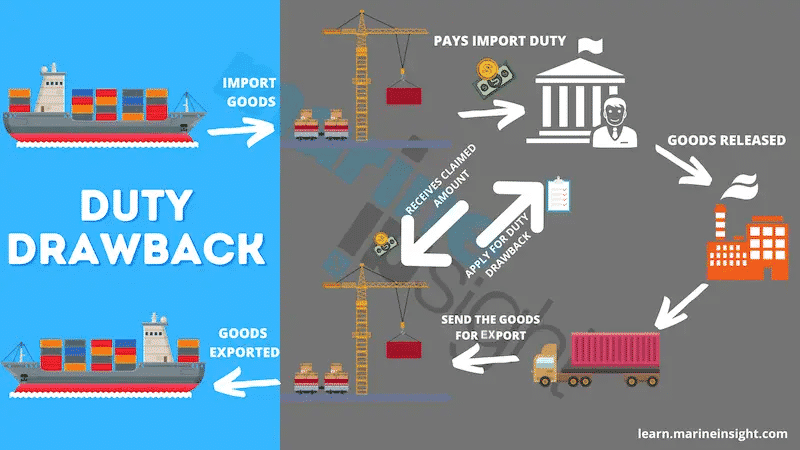

When items are imported right into the nation for handling, the importing service pays import responsibility to the federal government. These items and also relevant papers such as the expense of lading, and so on are recognized by the Customs authorities at the time of import.

Once the handling of items is finished, it is re-exported. Upon re-export, the responsibility paid on the re-exported part of the import can be withdrawed from the Customs by sending the appropriate types and also papers.

However, it should be remembered that the case on Duty disadvantage needs to be done within a given duration from the day of settlement of import responsibility.

In India, this case needs to be sent typically within 2 years. This duration can be expanded by offering adequate factors for the hold-up in re-export.

When items are marketed to a global client and also delivered to the client‘s international area, it is called export.

The concern that appear below is why enforce Customs responsibility in all on import of items and also products that are to be re-exported?

Certain federal governments have plans that enable total Customs Duty exception to motivate re-export. An Advance certificate for Duty- exception is needed to use such a system.

The Advance Duty- exception certificate is provided to companies for importing items that are literally consisted of in items that are indicated for export.

Machinery components, required extra components, and so on are some instances of things that can be imported via this system. However, the imported products need to be deducible to the exported items.

Arriving at Customs Duty Drawback Rates

How does any type of federal government choose the price of Customs Duty disadvantage? Are these prices based upon the amounts made use of in the manufacture?

Duty disadvantage prices are chosen the basis of numerous technological computations, quotes, the relevance of a details sector, and so on

It is offered on the amounts that are made use of in the manufacturing or manufacture of items and also products that are later on exported.

The major papers (duplicates) that are typically needed for entry to the Customs authorities for asserting Duty disadvantage are the following:

- Import Shipping expense— The major delivery record provided by the delivery representative.

- Bill of entrance— A file submitted by the importer to the Customs to make it possible for clearance of items.

- Import billing— Invoice of items revealing amount, summary, the price per item, complete worth, and so on

- Duty settlement invoice— Receipt for Customs responsibility paid.

- Export billing— Invoice of the merchant to the client situated in one more nation.

- Export packaging checklist— Packing checklist of freight revealing amount summary and also packaging of items.

- Export delivery expense— the major delivery record provided by the delivery representative prior to export.

Most federal governments nowadays have actually relocated to electronic documents and also information administration. Therefore, in such instances, these papers are to be submitted digitally via the EDI system (Electronic Data Interchange) likewise.

Is Duty disadvantage Used in Trade Protectionism?

At the beginning, allow us take a glance at what profession protectionism is everything about. It is a nation‘s profession plan focused on safeguarding residential sectors of the nation from international competitors.

There are numerous devices made use of to accomplish this purpose, the vital ones amongst these devices being import allocations, tolls, and also aids.

Duty disadvantage can likewise be viewed as among the elements that motivate residential manufacture and also profession.

Quotas

Quotas are established by the federal government to restrict imports of particular items and also products to the nation. When imports are limited the regional market will certainly flourish to satisfy the need for these items and also products.

Tariffs

Tariffs are federal government tax obligations troubled particular sorts of imported items. When the prices of the toll are high it discourages importers to import these items. Lesser imports suggest even more chances for regional sectors to expand and also boost their manufacturing to satisfy the marketplace need.

Subsidies

Subsidies are motivations, financial assistance, or various other assistance offered by the federal government to a specific course of sectors. Subsidies provide such sectors a benefit over their rivals, specifically international rivals. It minimizes expenses to the manufacturers or producers which is after that shown in the reduced expense of items, providing an one-upmanship.

Duty Drawback and also Trade Protectionism

Among these, Duty disadvantage motivates residential production and also manufacturing that takes advantage of imported components or products.

Since the regional sector obtains the motivation to obtain a reimbursement of a component of the Customs responsibility they have actually paid on items and also products, they are motivated to create in your area and also to export. This has a favorable influence on a nation‘s equilibrium of profession.

As we can see in the instance offered at the end of this write-up when the Duty disadvantage percent repaired by the federal government is insufficient, it stops working to incentivize producers and also merchants, consequently falling short to satisfy its major purpose.

Balance of Trade and also Influencing Factors

Balance of profession is a financial term that passes numerous other names. Some of them are web exports, business equilibrium, and so on What is indicated by the equilibrium of profession?

In its most basic definition, it is the distinction in between a nation‘s exports and also imports, in economic worth, over a details duration. The equilibrium of profession is in some cases compared concrete items and also abstract solutions.

It is regular for the equilibrium of profession to turn in between a profession excess and also a profession deficiency. These momentary swings might rely on the profession cycle of the nation triggered by changes in the total economic worth of items and also solutions created throughout an offered duration likewise described as Gross Domestic Product or GDP.

When the economic worth of exports of a nation is greater than its imports, after that the nation is claimed to have a favorable profession equilibrium likewise described as a profession excess.

When it is vice versa i.e., a lot more items imported to the nation than its exports, the nation will certainly have an unfavorable profession equilibrium likewise described as a profession deficiency.

Various elements affect the equilibrium of profession of a country.

Availability of resources and also their expenses contrasted to the schedule and also expense of these products in the importing nation, expense of manufacturing in the exporting nation, variation in money exchange prices, tax obligation, tolls, profession obstacles, and also Duty downsides are several of them.

Duty Drawback Calculation

Company A is associated with the manufacture and also setting up of makers that aid in the cutting of rubies. Special components that set you back $900 per item is made use of in the manufacture of this equipment. These unique components are made by a firm in Germany.

When business A imports these maker components from Germany, they need to pay Customs responsibility at the price of 18.4% on the worth. When 1,000 items are imported, Customs responsibility will certainly concern $166,000. In this situation, the Customs responsibility will certainly concern $166 per item.

Company A finishes the manufacture and also setting up of 1,000 makers. Subsequently, they obtain export orders from Belgium for 600 makers. So below, Duty disadvantage can be availed from the federal government on 600 components that have actually currently been re-exported toBelgium The real Customs responsibility paid on 600 devices exercises to $99,600.

If the percent of Duty disadvantage repaired by the federal government is 2.2%, after that in the above situation, the business can send a case for $2,191. This exercises to $3.65 each.

As you can see below in this instance, unless the disadvantage percent is repaired realistically, it will certainly be viewed as insufficient to incentivize and also motivate the sector.

The Goods and also Services Tax (GST)

Before the rollout of the Goods and also Services Tax (GST) in 2017, the Central Excise responsibilities billed on items that are created within the nation can be asserted back.

The Central Excise responsibility referred to as Central Value Added Tax or CENVAT was a tax obligation on items that are created and also marketed within the nation.

Upon offering the needed papers to reveal evidence of the export of items, the federal government would certainly reimburse the quantity as recommended under Section 75 of the Indian Customs Act of 1962.

The GST has actually changed a number of Central and also State indirect tax obligations. Currently, those merchants that have actually paid the Integrated Goods and also Services Tax (IGST) at the time of exporting their items can declare a reimbursement from the federal government.

The procedure for obtaining a reimbursement is basically the like asserting the Duty disadvantage other than that papers are submitted on the federal government GST portal called ICEGATE (Indian Customs Electronic Commerce Gateway).

Goods and also Services Tax has a number of advantages. It includes modern technology. All entries, filings, demands, and so on are done online utilizing the GST website.

While making the entire procedure simpler it is likewise thought about corruption-free. It decreases the worry of the merchant from needing to submit paper copies of papers. Goods and also Services Tax gets rid of the system of tax obligation on tax obligation, making it straight-forward and also understandable.