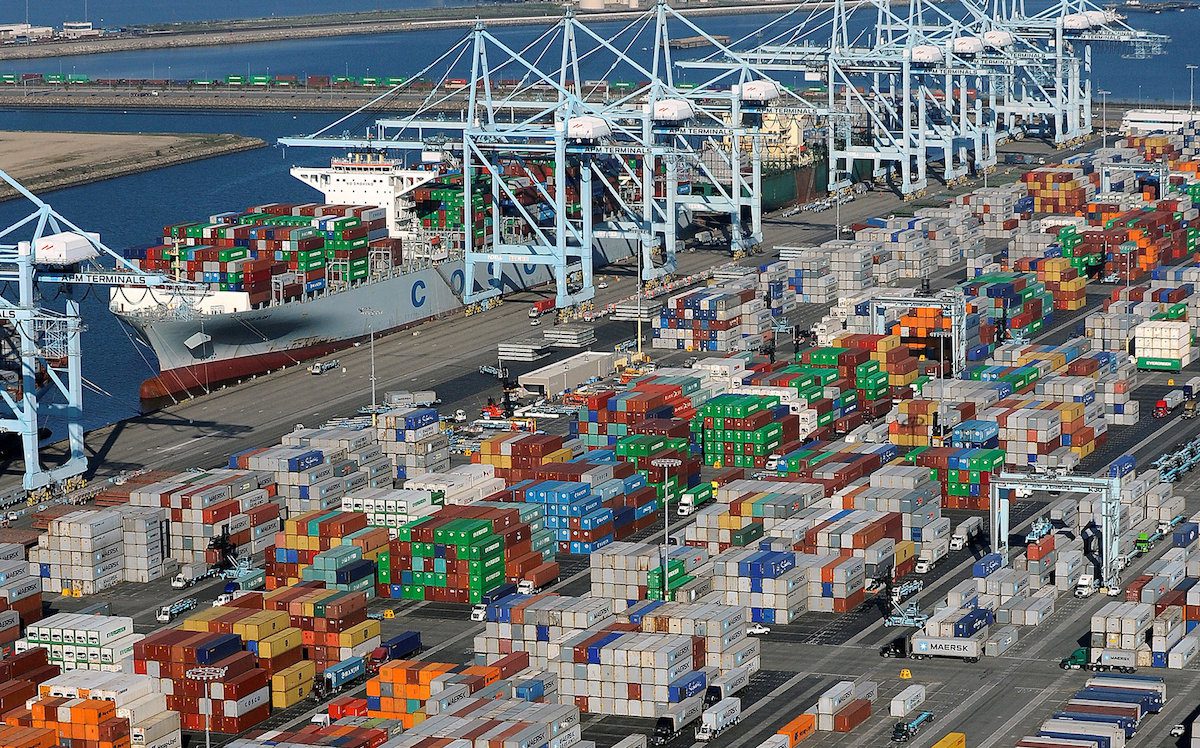

Global Trade Growth Is About to Slow, Morgan Stanley Says

By Luke Kawa (Bloomberg)– Signs are indicating an impending downturn in international profession development, according to Morgan Stanley.

Each part of the financial institution’s exclusive international profession leading sign– conserve for the united state buck– decreased in April to note back-to-back decreases for the index, which is made use of to anticipate genuine task with a one-month lead.

“Business sentiment, crude oil, commodity prices and Baltic Dry Index shipping rates all pulled the index lower,” claimed a group led by economic expertElga Bartsch “If [the] Morgan Stanley global trade leading indicator declines three times in a row, we will likely have established a new downtrend in global merchandise trade dynamics.”

Morgan Stanley prepares for a brief aberration in between its leading sign and also international profession quantities (gauged by the CPB World Trade Monitor), approximating that the latter will certainly still increase at concerning a 10 percent speed year-over-year forMay Going onward, nevertheless, unfavorable base impacts are most likely to magnify the headwinds of “less favorable trends in commodity prices, the U.S. dollar and shipping rates.”

In a paradoxical spin, Donald Trump’s political election success– adhering to a project with clear protectionist overtones amidst a hideaway in delivery task worldwide– accompanied a sharp velocity in international profession that executed to the very first quarter of 2017 and also past.

“As the strong trade data from Q1 rolls in think now clear ’deglobalization’ of last 2 ys a function of China’s slowdown and commodity shock,” Council on Foreign Relations elderly other Brad Setser claimed on Twitter.

Now, not just profession, yet one more crucial tenet of the international reflation thesis is positioned to discolor.

“Global growth has moved from boiling to merely simmering,” composed Credit Suisse Group AG experts led by James Sweeney in a May 2 note. “We estimate that global industrial production momentum (3m/3m annualized growth rate) has fallen from a 5 percent January peak to under 4 percent in April.”

Credit Suisse anticipates commercial manufacturing energy to remain to wind down, with the development price being up to 3 percent this summertime.

© 2017 Bloomberg L.P